Onyxcoin has taken a big hit, plunging 15% over the previous week amid broader market volatility. At press time, the altcoin exchanges fingers at $0.0132, noting a 1% worth dip amid the final market rally.

Whereas different property try to get well, XCN stays trapped in a powerful bearish cycle, with technical indicators pointing to the opportunity of additional losses.

XCN Bears Dominate as Value Trades Below Main Resistance Zones

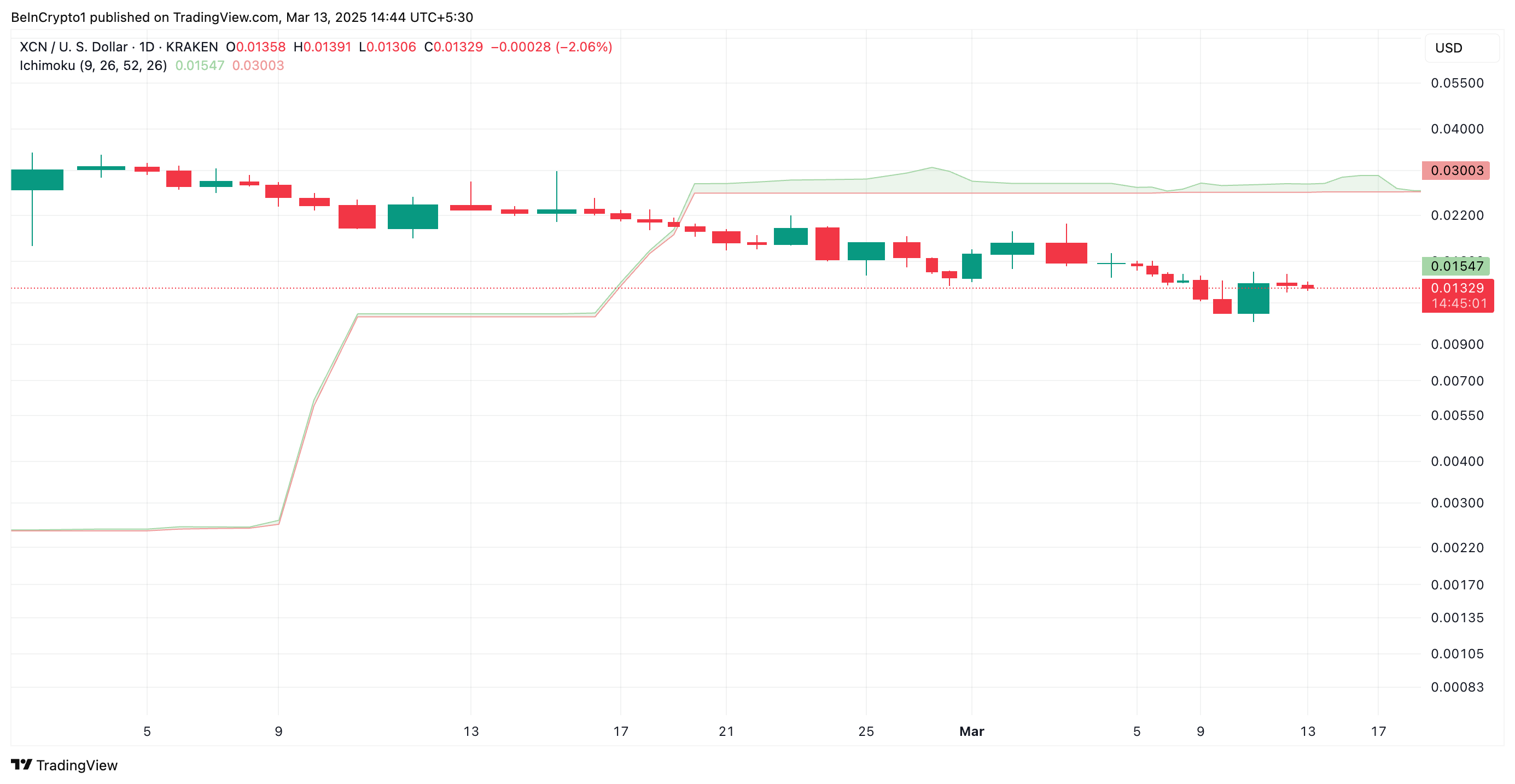

Readings from the XCN/USD one-day chart present the altcoin buying and selling under its 20-day exponential shifting common (EMA). This types resistance above its worth at $0.0137.

The 20-day EMA measures an asset’s common buying and selling worth over the previous 20 days, giving extra weight to current costs for a smoother pattern evaluation.

When the worth falls under this key shifting common, it alerts weakening momentum and a downtrend as sellers acquire management. This means that XCN may face additional losses except sturdy shopping for stress reverses the decline.

Moreover, the altcoin trades considerably under the Main Spans A and B of its Ichimoku Cloud, supporting this bearish outlook.

This indicator measures the momentum of an asset’s market developments and identifies potential help/resistance ranges. When the worth falls under this cloud, the asset in query is witnessing a downtrend. On this situation, the cloud additionally acts as a dynamic resistance zone, reinforcing the downtrend.

For XCN, its Ichimoku Cloud types dynamic resistance above its worth at $0.0154 and $0.0300, highlighting the sturdy downward stress on the coin’s worth.

XCN Bears in Management – Breakout or Breakdown Subsequent?

XCN’s worth has remained inside a descending parallel channel that has saved its worth in decline since January 25. With strengthening promoting exercise, the altcoin could keep on this bearish sample and lengthen its decline.

If this occurs, XCN’s worth may plunge to $0.0117.

Nonetheless, if shopping for stress positive aspects momentum, XCN’s worth may rally previous the $0.0137 resistance of its 20-day EMA and try to cross $0.0154.

Disclaimer

According to the Belief Challenge pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. At all times conduct your individual analysis and seek the advice of with an expert earlier than making any monetary choices. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.