Cardano (ADA) has struggled over the previous week, dropping greater than 23% and remaining under $1 for over seven days. Regardless of this bearish strain, technical indicators recommend that the present downtrend could also be dropping energy.

ADX readings present that promoting momentum is fading, whereas whale addresses proceed to say no, signaling that enormous buyers have been offloading their holdings. Given these indicators, ADA worth might quickly check key resistance ranges at $0.64.

Cardano’s Present Downtrend Is Fading

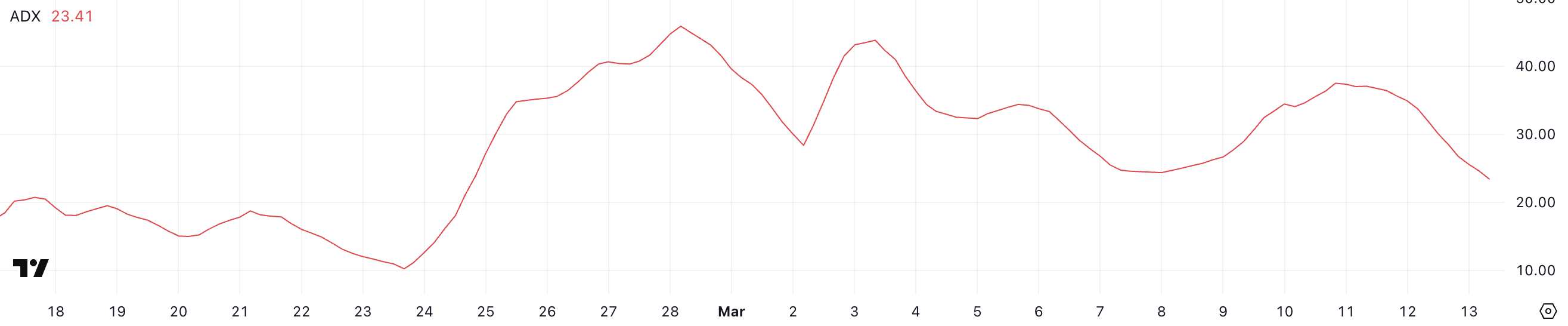

ADA’s Common Directional Index (ADX) has dropped to 23.4, declining from 34 yesterday and 37 two days in the past. ADX is a key indicator used to measure the energy of a development, no matter course, on a scale from 0 to 100.

Usually, readings above 25 point out a robust development, whereas values under 20 recommend weak or consolidating market circumstances. A falling ADX indicators that the present development is dropping energy, even when worth motion continues in the identical course.

With ADA’s ADX declining considerably, it means that the continuing downtrend could also be weakening.

Since Cardano stays in a downtrend, the ADX drop to 23.4 signifies that bearish momentum is slowing, although it has not totally disappeared.

If ADX continues to say no and falls under 20, it will recommend that promoting strain is fading, probably resulting in consolidation or a reversal. Nevertheless, for a real development shift, ADA would want shopping for quantity to extend alongside an increase in ADX, confirming renewed energy.

If the ADX stabilizes close to present ranges and turns upward once more, the downtrend might regain momentum, holding ADA underneath strain within the brief time period.

ADA Whales Are Steadily Dropping In The Final Few Days

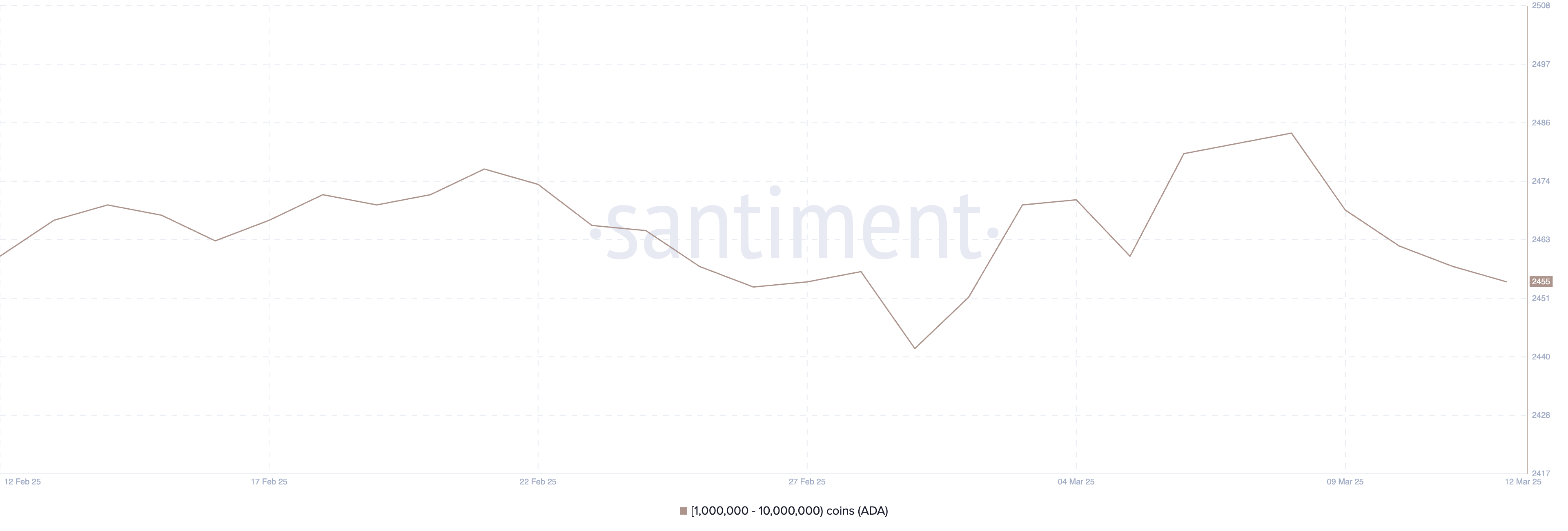

The variety of Cardano whale addresses – these holding between 1 million and 10 million ADA – has dropped to 2,455, down from 2,484 on March 8.

This regular decline suggests that enormous holders have been offloading their positions over the previous few days. Monitoring whale exercise is essential as a result of these high-value buyers usually affect market developments.

When whales accumulate, it indicators confidence within the asset and might result in worth will increase, whereas declining whale numbers recommend distribution, which may add promoting strain to the market.

With ADA whale addresses now at their lowest stage since March 2, this development might point out weakening confidence amongst giant holders regardless of Cardano being included within the US strategic crypto reserve.

If this sample continues, it could result in elevated volatility as smaller buyers soak up the promoting strain. A sustained drop in whale holdings might additionally recommend that ADA lacks sturdy purchase assist at present ranges, probably prolonging its downtrend.

Nevertheless, if whale numbers stabilize or start to rise once more, it might sign renewed accumulation, probably serving to ADA regain momentum.

Will Cardano Rise Again To $1 Quickly?

ADA’s EMA traces point out that Cardano is in a consolidation part. The short-term EMAs stay under the long-term ones, however their hole just isn’t important.

This implies that bearish momentum just isn’t dominant, and a shift in development might happen if shopping for strain will increase. If ADA can check the resistance at $0.75 and set up an uptrend, it might climb towards $0.81.

A stronger bullish breakout might push Cardano’s worth increased. The potential upside targets are $1.02 and even $1.17, if momentum continues to construct.

On the draw back, if promoting strain intensifies, ADA might check its key assist at $0.64.

Shedding this stage would weaken its construction and enhance the probability of additional declines, probably sending the worth all the way down to $0.58.

The comparatively shut EMA traces point out that Cardano is in a pivotal part, throughout which both a breakout or a breakdown might happen.

Disclaimer

Consistent with the Belief Mission tips, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. At all times conduct your personal analysis and seek the advice of with an expert earlier than making any monetary choices. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.