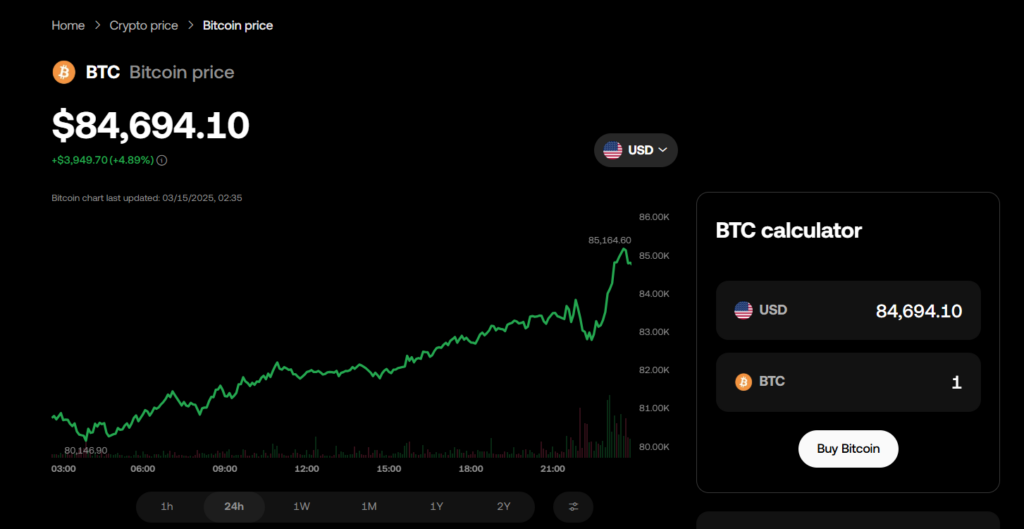

- Bitcoin surged previous $85,000 earlier than settling at $84,400, gaining 4.7% as threat urge for food returned to crypto and inventory markets.

- The S&P 500 and Nasdaq rallied alongside Bitcoin, whereas gold retreated under $3,000 after briefly hitting an all-time excessive.

- Merchants are watching Bitcoin’s 200-day transferring common at $83,767, with a detailed above it signaling potential market restoration.

After a sluggish week, sellers in threat markets are lastly hitting the pause button, giving crypto an opportunity to breathe—and bounce. On Friday, digital belongings surged alongside U.S. shares, flipping the script on current value stagnation.

Bitcoin made a run previous $85,000 throughout U.S. buying and selling hours, now holding at round $84,400, marking a 4.7% climb up to now 24 hours. The broader crypto market adopted go well with, with each asset within the CoinDesk 20 Index flashing inexperienced. Among the many largest gainers? Chainlink’s LINK, Solana’s SOL, and SUI, all making robust strikes upward.

Danger Urge for food Returns, Gold Takes a Backseat

Conventional markets additionally bought a jolt of vitality. The S&P 500 popped 1.7%, whereas the Nasdaq—a favourite for high-risk tech performs—jumped 2.3%. Apparently, gold, which had been stealing the present whereas Bitcoin stumbled in current weeks, dipped again under $3,000 after breaking that historic degree only a day earlier.

In response to Paul Howard, senior director at Wincent, this rally isn’t simply random noise. “Seeing markets bounce like that is possible a mixture of bettering sentiment in threat belongings—assume inflation, tariffs—and an indication that crypto is perhaps stabilizing after the current pullback,” he shared in a Telegram replace.

Including to that, the previous week has seen about $2.6 billion price of leveraged crypto positions get worn out, largely lengthy bets. With extra leverage flushed out, the market is perhaps on sturdier floor transferring ahead, Howard famous.

BTC Bulls and the 200-Day Transferring Common Battle

Bitcoin’s bounce additionally nudged it again above its 200-day transferring common, a significant trendline that merchants watch intently. Dropping under it for the primary time since final August’s correction had been a pink flag, however reclaiming it—at present sitting at $83,767—may imply bulls are regaining management.

okx.com

A robust shut above this degree would gasoline optimism that the worst of the dip is behind us. On the flip aspect, failing to carry it’d sign one other leg down.

Veteran cross-asset dealer Bob Loukas believes there’s extra room for this rally to stretch, at the least for now. “Seems like we’re nearing the tip of the panic section. Anticipating a couple of weeks of restoration earlier than the market takes one other onerous take a look at issues,” he shared earlier this week.

So, is the storm lastly passing, or are we in for extra turbulence? Solely time will inform, however for now, the crypto market appears to be catching its breath.