Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

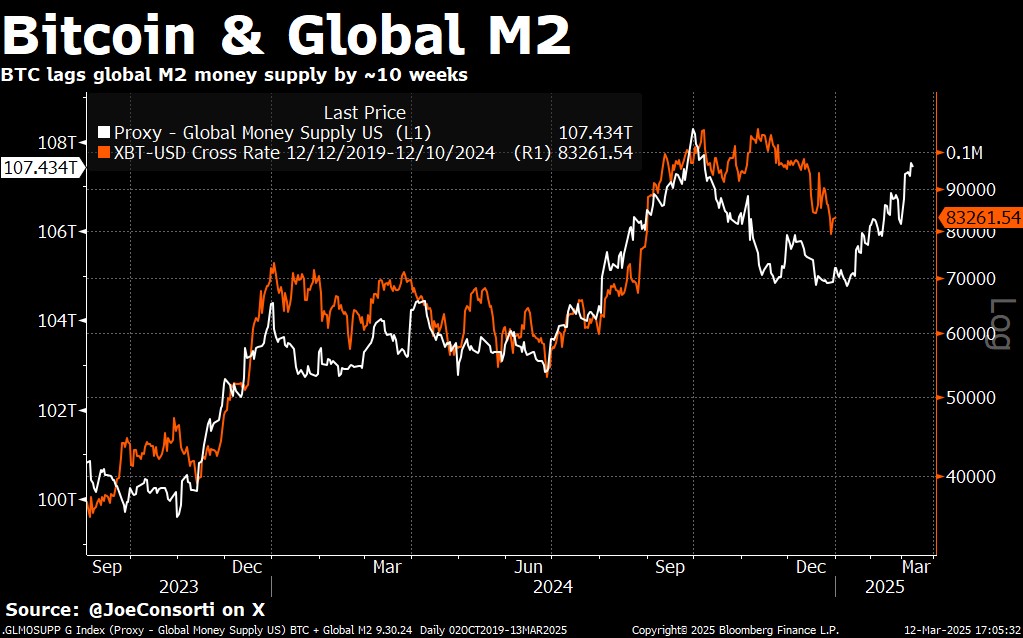

Bitcoin’s tight correlation with international M2 has returned to the highlight, suggesting that broader financial circumstances stay a key drive behind the cryptocurrency’s market trajectory. Current worth motion exhibits Bitcoin converging with M2’s downward drift—mirroring roughly a 70-day lag. This cyclical motion highlights Bitcoin’s ongoing responsiveness to fluctuations in liquidity, at the same time as different elementary elements, just like the newly introduced US Strategic Bitcoin Reserve (SBR), proceed to seize headlines.

International M2 Correlation And Bitcoin Market Inefficiency

In his newest analysis word, analyst Joe Consorti underscores that “Bitcoin’s directional correlation with international M2 has tightened once more,” indicating that worth stays closely swayed by cash provide developments. After just a few months of divergence—fueled partly by a powerful US greenback—Bitcoin fell to $78,000, coming inside $8,000 of M2’s projected path.

The worldwide M2 index has softened, partly reflecting the greenback’s strong efficiency. Regardless of that drag, Bitcoin seems to be following the final liquidity blueprint it has tracked all through this cycle, suggesting Bitcoin’s worth nonetheless hinges on main macro forces like central financial institution expansions and contractions. “Whereas this relationship isn’t a direct cause-and-effect mechanism, it continues to offer a helpful macro framework,” Consorti writes.

He added: “The takeaway? Bitcoin stays the last word financial asset in a world the place cash provide, stability sheet capability, and credit score are perpetually increasing. As international cash provide expands, bitcoin tends to observe it, at the very least directionally. However this cycle is seeing further variables that make M2 a much less dependable standalone indicator, such because the US greenback being traditionally robust, making a drag on international M2 denominated in USD, and extra correct measures of cash provide and liquidity coming onto the scene.”

Associated Studying

Though macro circumstances are exerting acquainted strain, the market’s response to the SBR announcement has been perplexing. After the US President Donald Trump formally declared plans to build up Bitcoin via a “budget-neutral” mechanism, the worth tumbled 8.5% in just below per week. Consorti described the sell-off as “an irrational response highlighting main inefficiencies in pricing Bitcoin’s geopolitical significance.”

Government Order 14233 mandates Treasury and Commerce officers to develop America’s BTC holdings—at the moment at 198,109 BTC—with out new taxpayer value or congressional oversight. This can be a stark distinction to earlier government-level adoptions, corresponding to El Salvador’s authorized tender transfer, which coincided with a surge in Bitcoin’s worth. Consorti attributes the disparity to short-term revenue taking and a “sell-the-news” mentality, including that “the magnitude of the selloff signifies an entire failure to cost within the long-term implications.”

Regardless of the SBR-related dip, Bitcoin’s technical alerts counsel a doable native backside forming. The cryptocurrency dipped to $77,000 earlier than bouncing again, filling a low-volume hole within the $76,000–$86,000 vary. Consumers seized on the retracement, creating two hammer candlesticks on the weekly chart.

Associated Studying

Hammer candlesticks usually level to a reversal, particularly after they seem at cycle-defining assist ranges. In keeping with Consorti, “Historic precedent means that Bitcoin varieties these patterns at cycle turning factors… The final time we noticed this precise worth construction was in the course of the tail finish of Bitcoin’s summer time 2024 consolidation, two months earlier than it surged from $57,000 to $108,000.”

A notable development amid these worth fluctuations is Bitcoin’s rising dominance, even in periods of market contraction. ETH/BTC lately sank to 0.0227—its lowest since Could 2020—indicating intensifying skepticism towards altcoins. In the meantime, institutional demand for Ethereum has likewise slumped, as evidenced by a 56.8% drop within the asset below administration (AUM) ratio for Ethereum vs. Bitcoin.

“This cycle belongs to Bitcoin, and all future cycles will solely additional cement this actuality,” Consorti asserts. He suggests altcoins are preventing an uphill battle as Bitcoin-centric narratives acquire international traction.

At press time, BTC traded at $82,875.

Featured picture created with DALL.E, chart from TradingView.com