|

China’s crypto ban didn’t cease this ridiculous scheme

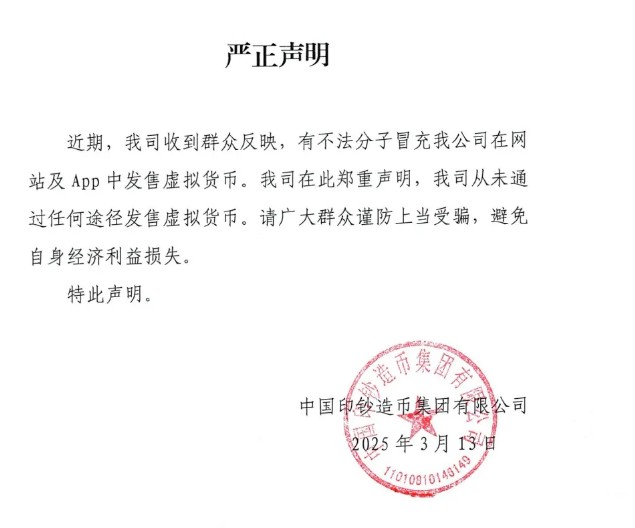

A brand new kind of crypto rip-off has surfaced in China, with fraudsters posing because the China Banknote Printing and Minting Company (CBPMC) to promote cryptocurrency by means of faux web sites and apps.

For these aware of China’s crypto laws, this scheme might sound ridiculous. The nation has banned a number of crypto-related actions, together with buying and selling and mining, and formally acknowledges solely its fiat forex, the renminbi, as authorized tender. The concept the very state-backed entity accountable for printing this fiat forex would launch a crypto solely provides to the oddity of the crime.

In response, CBPMC issued a public warning by means of its official WeChat channel, stating that it has by no means offered any digital forex by means of any platform. The corporate urged the general public to stay cautious and keep away from falling for fraudulent schemes.

Exterior of China, scammers hacked official X pages belonging to authorities officers and companies to advertise faux meme tokens. Additional complicating issues for unsuspecting victims, some presidents, together with US President Donald Trump, have not too long ago launched their very own memecoins, making this once-absurd thought appear extra believable.

CBPMC, which operates beneath the Individuals’s Financial institution of China (PBOC), is accountable for printing and minting the nation’s banknotes, cash, and safety paperwork. The PBOC has lengthy been one of the crucial vocal opponents of cryptocurrencies, as a substitute specializing in creating its personal central financial institution digital forex (CBDC), the digital yuan. It sees one of many key advantages of the CBDC is its potential to fight fraud, very like how centralized stablecoin issuers — reminiscent of Tether —can freeze wallets linked to illicit actions.

Nevertheless, the digital yuan has turn out to be an ingredient for scammers to play with. In February 2024, China’s Ministry of Business and Data Expertise warned a couple of faux digital yuan app that carefully resembled the official model, persevering with a development that began in 2021. A December 2024 report from native media discovered that these scams have turn out to be more and more subtle, with fraudsters impersonating banks and authorities officers to advertise counterfeit purposes and fraudulent funding schemes.

Japan’s wager on stablecoins might unlock $14 trillion in family financial savings

Japan is making important strides in stablecoin adoption, with Progmat rising as a key participant within the nation’s regulated digital asset ecosystem, in line with a brand new report by analysis and consulting agency Yuri Group.

The Japanese authorities views stablecoins as a possible catalyst to unlock the nation’s $14 trillion in family financial savings, Yuri Group stated in its report. As soon as a pioneer in cryptocurrency adoption, Japan’s enthusiasm has cooled resulting from previous safety breaches and market downturns. Nevertheless, with stablecoins providing larger monetary stability, the nation hopes to revive belief and drive broader digital asset adoption.

Progmat is backed by a consortium of main Japanese monetary establishments and expertise corporations. Its possession construction contains Mitsubishi UFJ (MUFG), Japan’s largest monetary establishment, which holds a 49% stake, and SBI PTS Holdings, a subsidiary of the SBI Group, which holds 5%, alongside different home leaders. SBI’s crypto arm, SBI VC Commerce, not too long ago introduced that it expects to be among the many first monetary platforms in Japan to supply cryptocurrency buying and selling in USDC.

A significant milestone for Progmat got here in February when Toyota introduced its first safety token bond on the platform. Progmat has additionally partnered with Wealth Realty Administration, which has dedicated to utilizing the platform for actual estate-backed digital securities — an asset class that accounts for 89% of Japan’s safety token market, in line with Yuri Group.

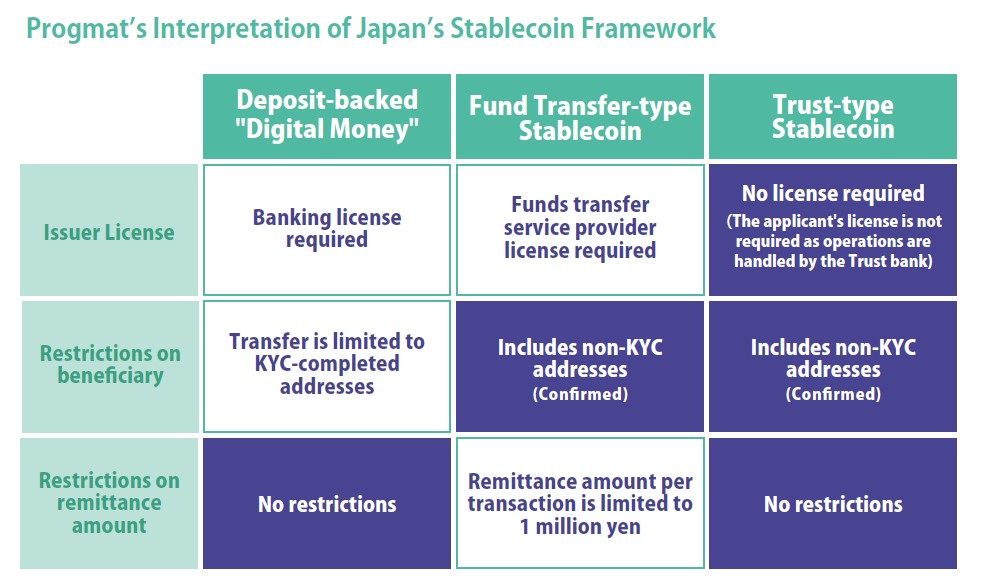

Progmat’s stablecoin framework is designed to align with Japan’s regulatory necessities, which mandate a 1:1 reserve backing for issued stablecoins. Not like decentralized options, newer stablecoin approaches emphasize collaboration between personal issuers and trusted banks, guaranteeing safe reserve holdings to attenuate buyer danger. This mannequin retains Japan’s largest monetary establishments on the middle of its digital finance transformation.

Whereas Japan was an early chief in stablecoin regulation, implementing its first guidelines in 2022, progress stalled, and no stablecoins had been commercially accessible till late 2024. Progmat now seeks to shut that hole, providing a regulated and safe platform in an business traditionally susceptible to hacks and fraud.

Learn additionally

Options

Justin Aversano makes a quantum leap for NFT images

Options

5 risks to beware when apeing into Solana memecoins

Former Bithumb chairman walks free

The South Korean Supreme Courtroom has upheld the acquittal of former South Korean crypto alternate Bithumb chairman Lee Jung-hoon, dismissing the prosecution’s attraction on fraud costs price roughly 110 billion Korean received ($75.5 million).

This resolution finalizes the rulings from each the primary trial and the appellate court docket, which had beforehand discovered him not responsible.

The Supreme Courtroom introduced the choice on March 13, affirming that there was inadequate proof to convict Lee. The case revolved round allegations that Lee misled BK Medical Group chairman Kim Byung-gun in 2018 by promising to checklist Bithumb’s digital asset, BXA, as a part of a proposed acquisition and joint administration deal.

Lee was indicted with out detention in July 2021 by the Seoul Central District Prosecutors’ Workplace, however courts in any respect ranges dominated in his favor, citing lack of conclusive proof. Lee stepped down from Bithumb previous to his authorized proceedings. In December 2022, Bithumb’s largest shareholder govt, Park Mo, was discovered lifeless after he acquired allegations of embezzlement and manipulation of inventory costs.

Learn additionally

Options

5 actual use instances for ineffective memecoins

Options

DeFi abandons Ponzi farms for ‘actual yield’

Cebu Pacific takes off on Algorand

Cebu Pacific Air, the Philippines’ largest airline by passenger quantity, is ready to combine blockchain expertise into its operations by means of a partnership with TravelX, a blockchain platform constructed on Algorand.

TravelX focuses on blockchain options for the airline business, providing companies reminiscent of NFT-based airline tickets and blockchain-powered seat administration programs. The corporate has already partnered with a number of low-cost carriers, together with Argentina’s Flybondi and Mexico’s Viva and Volaris.

As a number one low-cost provider, Cebu Pacific dominates home air journey within the Philippines, an archipelago nation of over 7,000 islands. Its new partnership with TravelX is ready to launch in Q2 2025 and can deal with post-booking income administration, in line with the Algorand Basis.

Cebu Pacific’s passenger quantity exceeded pre-pandemic ranges in 2024, flying 24.5 million passengers that 12 months, which leads the nation, in line with the Civil Aeronautics Board.

Subscribe

Probably the most participating reads in blockchain. Delivered as soon as a

week.

Yohan Yun

Yohan Yun is a multimedia journalist overlaying blockchain since 2017. He has contributed to crypto media outlet Forkast as an editor and has coated Asian tech tales as an assistant reporter for Bloomberg BNA and Forbes. He spends his free time cooking, and experimenting with new recipes.