Two Wall Road giants say the US now faces a larger threat of financial contraction amid a deteriorating macroeconomic backdrop.

JPMorgan Chase is elevating its recession forecast for the US financial system from 30% at the beginning of 2025 to 40% because of the uncertainty introduced by President Trump’s directives together with his commerce struggle towards China, Canada and Mexico, reviews the Wall Road Journal.

Says JPMorgan economists,

“We see a fabric threat that the US falls into recession this yr owing to excessive US insurance policies.”

Analysts at Goldman Sachs additionally imagine the chances of a US financial downturn are on the rise, elevating its 12-month recession chance forecast from 15% to twenty% as Trump continues to be “dedicated to its insurance policies even within the face of a lot worse knowledge.”

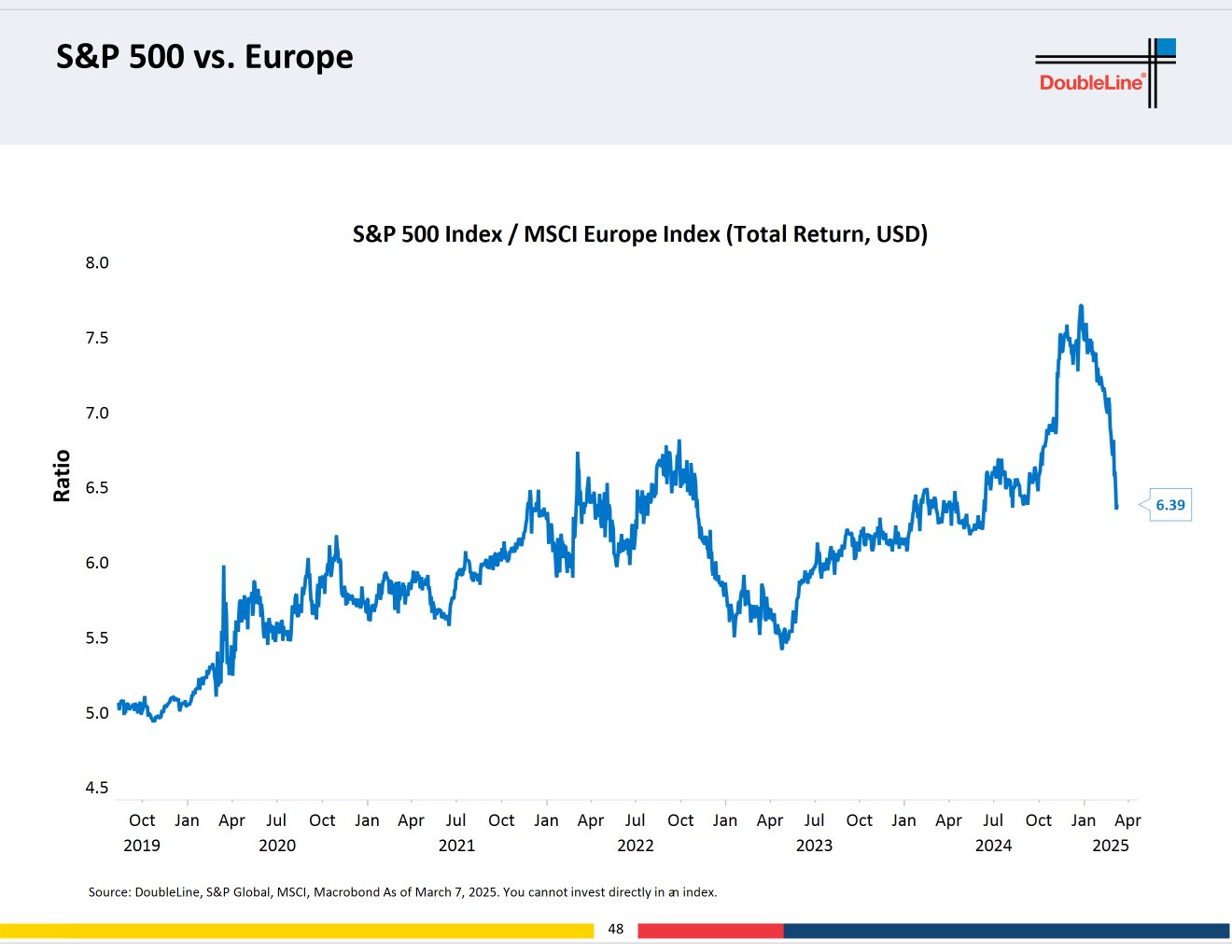

The information comes as billionaire “Bond King” Jeffrey Gundlach warns capital flight may hit US markets for years to come back. In a webcast presentation, the founder and CEO of funding agency DoubleLine Capital LP says Europe could drain capital from US markets because the area appears to be like to revive industrial manufacturing.

“Web funding into america: from about $3 trillion years in the past to greater than $20 trillion. That helps the US outperform ex-US markets.

With European international locations needing to re-industrialize, that might result in these flows to reverse. That would imply years, possibly many years, of European inventory outperformance vs. US shares.”

In line with Gundlach, we are actually seeing indicators that European equities are starting to outperform the S&P 500.

“US shares vs. Europe have dropped virtually to 2021 ranges.”

Comply with us on X, Fb and Telegram

Do not Miss a Beat – Subscribe to get electronic mail alerts delivered on to your inbox

Examine Worth Motion

Surf The Day by day Hodl Combine

Disclaimer: Opinions expressed at The Day by day Hodl aren’t funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your personal threat, and any losses chances are you’ll incur are your accountability. The Day by day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Day by day Hodl an funding advisor. Please notice that The Day by day Hodl participates in online marketing.

Generated Picture: Midjourney