The longer Bitcoin (BTC) retains quoting at elevated costs, the extra harm it brings, or at the very least that’s the perspective Peter Schiff stands by, making it clear that each dip, each second of market correction, is one step nearer to what he sees because the inevitable collapse of a monetary phantasm. For him, the autumn isn’t just coming; it’s needed. If which means some traders get caught on the flawed facet of buying and selling, so be it.

This newest assertion got here after Schiff was confronted on-line by a person who accused him of “kicking down” Bitcoin holders when the market turns crimson.

Schiff, by no means one to melt his stance, responded that his criticism shouldn’t be about people shedding cash however about exposing what he believes is a protracted bubble that retains pulling extra folks into monetary danger.

The way in which he sees it, Bitcoin isn’t just a speculative asset, it ia a harmful one, and the “burst of this bubble” shouldn’t be a matter of if, however when.

His renewed assaults on Bitcoin come at a time when he’s already in the midst of one other monetary battle, this one rather more private. His Panama-based Euro Pacific Financial institution, which confronted regulatory scrutiny and was finally shut down, stays a key level.

Points

Schiff says the U.S. Inside Income Service performed a serious position in its downfall, saying the financial institution’s closure was politically motivated reasonably than primarily based on actual authorized points. Whether or not his declare is true or not, it provides to the frustration of his ongoing monetary story.

In the meantime, Bitcoin itself shouldn’t be precisely exhibiting power. After failing to carry above its 200-day shifting common on the every day chart, it noticed a pointy worth reversal, dropping over 2% in simply 4 hours and hitting a low of $82,300 per BTC.

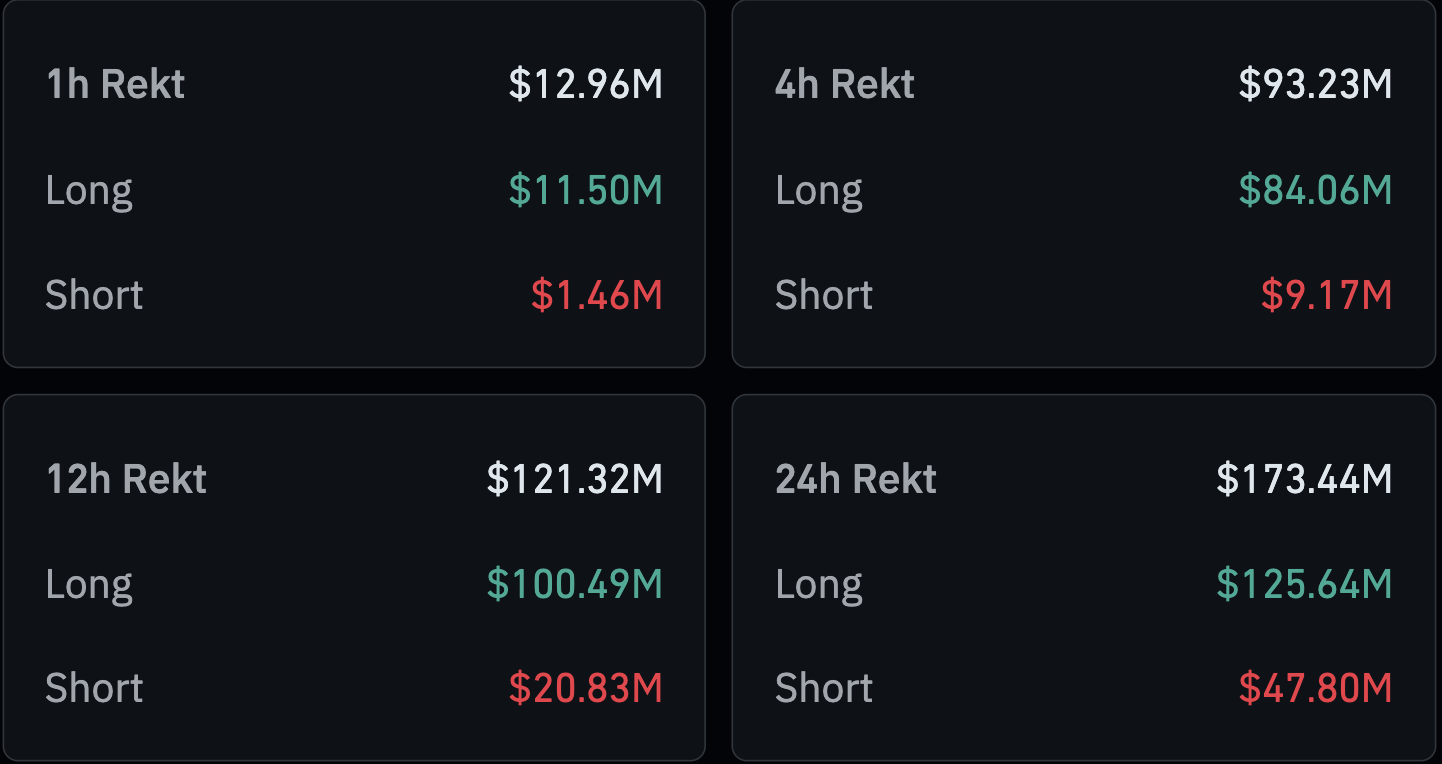

This prompted a wave of liquidations throughout the crypto market, resulting in a complete wipeout of positions value $93.2 million. Nearly all of this, $83.98 million, got here from lengthy positions. For individuals who had been relying on the value to maintain rising, this was a tricky transfer.