After weeks of intense promoting strain, Bitcoin (BTC) has entered a consolidation part, buying and selling under the $85K mark and above $80K. Bulls now face a important check, as they need to push BTC above $90K to stop bears from driving costs decrease.

Bitcoin is at the moment down over 29% since reaching its all-time excessive (ATH) in January, sparking rising hypothesis a couple of potential bear market. Sentiment stays cautious, with merchants uncertain whether or not BTC has bottomed or if additional draw back is forward.

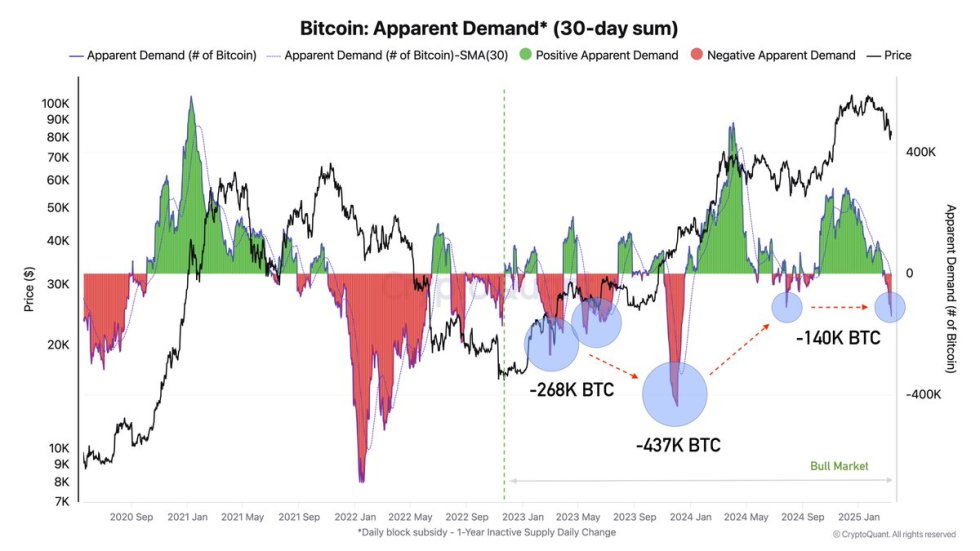

CryptoQuant information reveals that the present part of destructive demand suggests BTC distribution, a sample that has traditionally led to momentary corrections, has not at all times signaled a full pattern reversal. In accordance with the information, Bitcoin demand has declined by roughly -140K BTC, which is considerably decrease than earlier disaster outflows of -268K BTC and -437K BTC.

Whereas this localized promoting strain provides uncertainty, analysts recommend that the size of the present decline doesn’t threaten the broader bull market. The approaching days will likely be essential as Bitcoin should maintain its present vary and reclaim key resistance ranges to substantiate a restoration or threat additional losses if bears stay in management.

Bitcoin Bull Cycle Isn’t Over

The crypto and the US inventory markets are each struggling amid macroeconomic uncertainty and commerce battle fears, making a difficult surroundings for traders. Bitcoin (BTC) is now down practically 20% for the reason that begin of the month, and the bearish pattern seems prone to proceed as sentiment stays weak.

Regardless of this destructive short-term outlook, market fundamentals stay sturdy. Institutional adoption continues to develop, and US President Donald Trump’s plans to create a strategic Bitcoin reserve may very well be a serious catalyst for future value motion. Many analysts argue that whereas present situations are bearish, they don’t essentially sign the tip of the bull market.

Prime analyst Axel Adler helps this view, sharing insights on X suggesting that BTC’s decline is a part of a traditional market cycle reasonably than the beginning of a protracted downturn. In accordance with Adler, the present part of destructive demand signifies BTC distribution, a pattern that has traditionally led to momentary corrections however has not at all times signaled a full pattern reversal. Demand has dropped by roughly -140K BTC, considerably lower than earlier disaster outflows of -268K BTC and -437K BTC.

Adler additionally notes that regardless of the present localized promoting strain, this decline doesn’t threaten the broader bull market. As an alternative, it seems to be a short-term profit-taking occasion following Bitcoin’s all-time excessive (~$109K) and a response to macroeconomic components.

Including to market uncertainty, the Federal Reserve continues to take care of tight financial coverage, whereas inflation information has exceeded expectations, prompting markets to regulate their fee forecasts. This has elevated strain on threat belongings, together with BTC, resulting in additional volatility and cautious investor sentiment.

Value Struggles Beneath Key Transferring Averages – Bulls Struggle To Reclaim $85K

Bitcoin is at the moment buying and selling at $84,300, struggling to regain momentum after weeks of promoting strain. The worth is now under the 200-day exponential transferring common (EMA) at $85,500 however stays barely above the 200-day transferring common (MA) round $84,000. Bulls should maintain this assist and reclaim the $85K stage to stop additional draw back.

For a confirmed restoration rally, BTC wants to interrupt via $85K and push above $90K as quickly as potential. Reclaiming these ranges would sign renewed bullish momentum, probably reversing the present downtrend and resulting in a retest of upper resistance zones.

Nevertheless, if BTC fails to reclaim the 200-day MA and EMA, it might face stronger promoting strain, resulting in a potential drop under the $80K stage. Shedding this key psychological assist would possible set off panic promoting, forcing BTC into decrease demand zones and increasing the present bearish part.

With market situations nonetheless unsure, bulls should act shortly to push BTC above resistance and forestall additional draw back dangers. The subsequent few buying and selling classes will likely be essential in figuring out Bitcoin’s short-term course.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our crew of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.