|

Prime Tales of The Week

Donald Trump indicators govt order for Strategic Bitcoin Reserve

US President Donald Trump has signed an govt order that creates a “Strategic Bitcoin Reserve” and a “Digital Asset Stockpile,” each of which is able to initially use cryptocurrency forfeited in authorities felony circumstances.

“Just some minutes in the past, President Trump signed an Government Order to ascertain a Strategic Bitcoin Reserve,” White Home AI and crypto czar David Sacks stated in a March 7 submit on X.

“The Reserve shall be capitalized with Bitcoin owned by the federal authorities that was forfeited as a part of felony or civil asset forfeiture proceedings,” he added.

Moreover, a March 6 reality sheet from the White Home stated the order additionally establishes a “U.S. Digital Asset Stockpile,” which Sacks stated can be made up of cryptocurrencies apart from Bitcoin.

SBF despatched to solitary confinement over Tucker Carlson interview: Report

Former FTX CEO Sam “SBF” Bankman-Fried has reportedly been despatched to solitary confinement after collaborating in an interview with right-wing political commentator Tucker Carlson, which was not accredited by jail authorities.

“This specific interview was not accredited,” a consultant for the US Bureau of Prisons instructed The New York Occasions on March 7.

In keeping with an individual briefed on the state of affairs, after Bankman-Fried’s interview with Carlson was revealed, he was despatched to solitary confinement at Brooklyn’s Metropolitan Detention Middle, the place he has been held since August 2023.

The Bureau of Prisons is claimed to have strict guidelines on who can talk with inmates and the way they’ll achieve this.

OCC lays out crypto banking after Trump vows to finish Operation Chokepoint 2.0

The US Workplace of the Comptroller of the Foreign money (OCC) has eased its stance on how banks can interact with crypto simply hours after US President Donald Trump vowed to finish the extended crackdown proscribing crypto corporations’ entry to banking companies.

“Crypto-asset custody, sure stablecoin actions, and participation in impartial node verification networks akin to distributed ledger are permissible for nationwide banks and federal financial savings associations,” the OCC stated in a March 7 assertion.

The OCC confirmed in a doc titled “Interpretive Letter 1183” that OCC-supervised monetary establishments now not want “supervisory nonobjection” to have interaction with crypto-related actions.

“Right this moment’s motion will scale back the burden on banks to have interaction in crypto-related actions and be sure that these financial institution actions are handled persistently by the OCC,” Appearing Comptroller of the Foreign money Rodney E. Hood stated.

FDIC resists transparency on Operation Chokepoint 2.0 — Coinbase CLO

Some US authorities companies proceed to disclaim transparency concerning their position in Operation Chokepoint 2.0, a interval through the Biden administration when crypto and tech founders had been allegedly denied banking companies, in keeping with Coinbase chief authorized officer Paul Grewal.

The collapse of crypto-friendly banks in early 2023 sparked the primary allegations of Operation Choke Level 2.0. Critics, together with enterprise capitalist Nic Carter, described it as a authorities effort to stress banks into slicing ties with cryptocurrency corporations.

Regardless of latest regulatory shifts, companies just like the Federal Deposit Insurance coverage Company (FDIC) proceed to “resist fundamental transparency” efforts, Grewal stated in a March 8 submit on X.

“They haven’t gotten the message,” he wrote.

US will use stablecoins to make sure greenback hegemony — Scott Bessent

United States Treasury Secretary Scott Bessent stated the US authorities will use stablecoins to make sure that the US greenback stays the world’s international reserve forex through the White Home Crypto Summit on March 7.

Bessent reiterated the Trump administration’s promise to finish the conflict on crypto and dedicated to rolling again earlier IRS steering and punitive regulatory measures. Bessent then turned his consideration to stablecoins and stated:

“We’re going to put plenty of thought into the stablecoin regime, and as President Trump has directed, we’re going to hold the US [dollar] the dominant reserve forex on this planet, and we are going to use stablecoins to do this.”

President Trump instructed the summit that he hopes lawmakers will get a complete stablecoin regulatory invoice to his desk earlier than the August congressional recess.

“I feel there’s greater than 50% likelihood we are going to see all-time highs earlier than the tip of June this yr.”

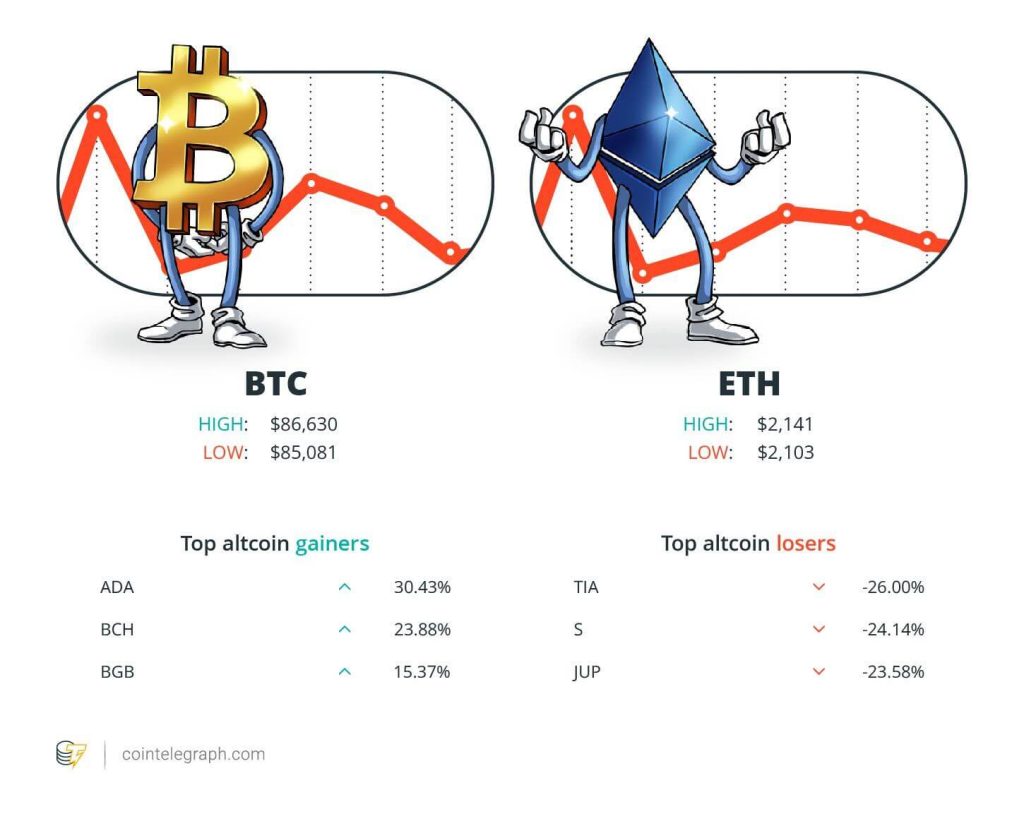

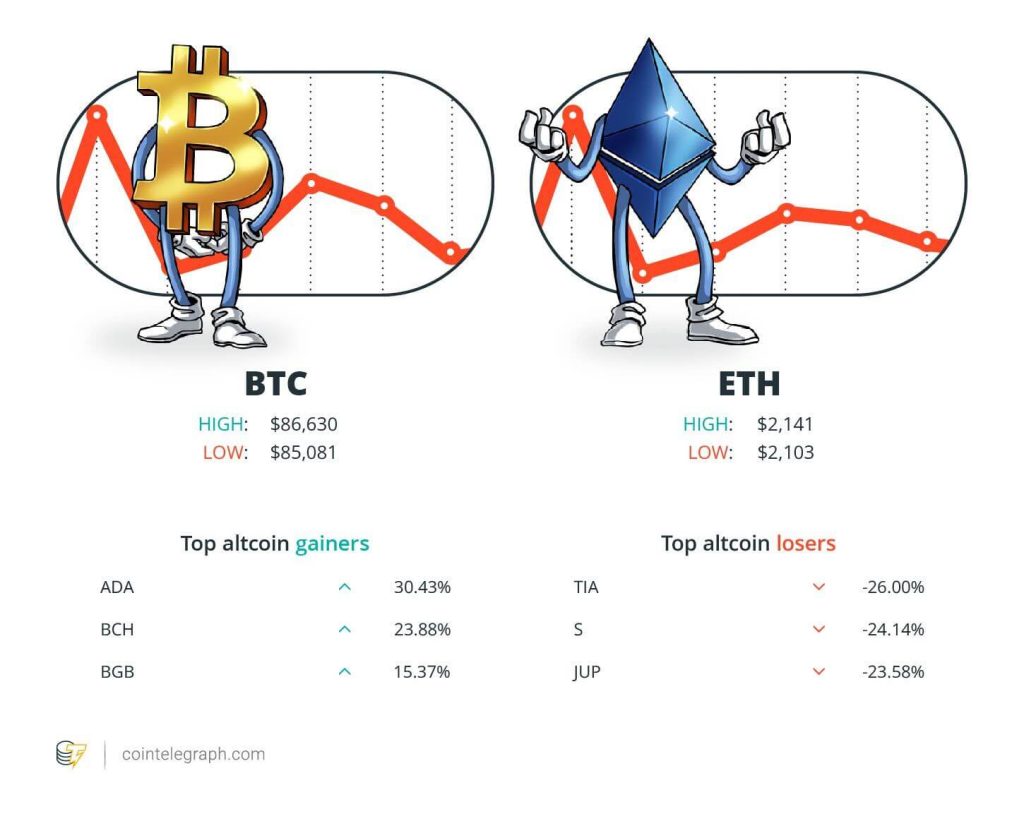

Winners and Losers

On the finish of the week, Bitcoin (BTC) is at $86,630 Ether (ETH) at $2,141 and XRP at $2.39. The overall market cap is at $2.85 trillion, in keeping with CoinMarketCap.

Among the many greatest 100 cryptocurrencies, the highest three altcoin gainers of the week are Cardano (ADA) at 30.43%, Bitcoin Money (BCH) at 23.88% and Bitget Token (BGB) at 15.37%.

The highest three altcoin losers of the week are Celestia (TIA) at 26.00%, Sonic (prev. FTM) (S) at 24.14% and Jupiter (JUP) at 23.58%. For more information on crypto costs, be certain to learn Cointelegraph’s market evaluation.

Most Memorable Quotations

“I feel there’s greater than 50% likelihood we are going to see all-time highs earlier than the tip of June this yr.”

Cory Klippsten, CEO of Swan Bitcoin

“The launch of TRUMP and MELANIA marked the highest for memecoins because it sucked liquidity and a spotlight out of all the opposite cryptocurrencies.”

Bobby Ong, co-founder of CoinGecko

“I don’t assume I used to be a felony.”

Sam Bankman-Fried, former CEO of FTX

“Just some minutes in the past, President Trump signed an Government Order to ascertain a Strategic Bitcoin Reserve.”

David Sacks, White Home AI and crypto czar

“We knew nothing about ADA being chosen for the reserve. It was information to me.”

Charles Hoskinson, Cardano founder

“If it didn’t cease when the world ostracized us and most ‘bitcoiners’ deserted us, it gained’t cease now, and it gained’t cease sooner or later.”

Nayib Bukele, president of El Salvador

Prime Prediction of The Week

Bitcoin has ‘greater than 50% likelihood’ of recent excessive by June: Cory Klippsten

The possibilities of Bitcoin surpassing its all-time excessive of $109,000 by June are favorable, however the market first wants time to soak up risky macroeconomic situations, says Swan Bitcoin CEO Cory Klippsten.

Learn additionally

Options

Ought to we ban ransomware funds? It’s a beautiful however harmful thought

Options

Tokenizing music royalties as NFTs might assist the subsequent Taylor Swift

“I feel there’s greater than 50% likelihood we are going to see all-time highs earlier than the tip of June this yr,” Klippsten instructed Cointelegraph.

Nevertheless, he stated that market individuals first must adapt to US President Donald Trump’s tariff threats and the uncertainty round inflation charges.

“The market must first digest tariffs, commerce conflict fears, and progress scare fears. Bitcoin buying and selling beneath $100,000 proper now appears like a pause, not an finish to the bull run,” he stated.

Prime FUD of The Week

Memecoins are doubtless lifeless for now, however they’ll be again: CoinGecko

Enthusiasm for memecoins seems to have cooled after a collection of unhealthy launches and rug pulls killing off investor curiosity, in keeping with CoinGecko founder Bobby Ong.

Metrics for token launchpad Pump.enjoyable instantly plummeted following the Libra (LIBRA) rug pull, Ong stated in a March 6 report, with newly created tokens and every day graduated tokens on the platform falling over 90% since their February peak.

Learn additionally

Options

Ethereum L2s shall be interoperable ‘inside months’: Full information

Options

Unstablecoins: Depegging, financial institution runs and different dangers loom

“The launch of TRUMP and MELANIA marked the highest for memecoins because it sucked liquidity and a spotlight out of all the opposite cryptocurrencies,” Ong stated.

US sanctions crypto addresses linked to Nemesis darknet market

US authorities have sanctioned the operator of a shuttered on-line darknet market, together with his crypto addresses, which just lately profited from Bitcoin worth fluctuations.

Iran-based Behrouz Parsarad established the darknet market Nemesis in 2021 and used it to facilitate the sale of medicine, false identification paperwork, skilled hacking sources, and a wide range of different illicit companies for cybercriminals, the US Workplace of Overseas Property Management stated in a March 4 assertion.

Underneath the sanctions, US residents are actually blocked from coping with Parsarad and any firms the place he owns greater than a 50% stake.

Solana sees $485M outflows in February as crypto capital flees to ‘security’

Solana noticed practically half a billion {dollars} in outflows final month as buyers shifted to what had been perceived to be safer digital property, reflecting rising uncertainty within the cryptocurrency market.

Solana was hit by over $485 million price of outflows over the previous 30 days, with investor capital primarily flowing to Ethereum, Arbitrum and the BNB Chain.

The capital exodus got here amid a wider flight to “security” amongst crypto market individuals, in keeping with a Binance Analysis report shared with Cointelegraph.

“General, there’s a broader flight in the direction of security in crypto markets, with Bitcoin dominance rising 1% prior to now month to 59.6%,” the report said.

Prime Journal Tales of The Week

SEC’s U-turn on crypto leaves key questions unanswered

Crypto is successful key authorized battles within the US and rising in significance on the worldwide stage — however the struggle for regulatory readability continues.

Meet lawyer Max Burwick — ‘The ambulance chaser of crypto’

The New York-based lawyer suing Pump.enjoyable and the creators of the Hawk Tuah memecoin says that if you’re within the public eye, “you’re certain to catch warmth.”

Thriller celeb memecoin rip-off manufacturing unit, HK agency dumps Bitcoin: Asia Categorical

Shenzhen memecoin manufacturing unit rumored to be behind celeb scams, Hong Kong agency sells most of its Bitcoin, Telegram rip-off crackdown, and extra.

Subscribe

Essentially the most partaking reads in blockchain. Delivered as soon as a

week.

Editorial Employees

Cointelegraph Journal writers and reporters contributed to this text.

Learn additionally

Hodler’s Digest

Saylor falls for faux Trump information, Kraken restructures, and extra: Hodler’s Digest, Oct. 27 – Nov. 2

Editorial Employees

8 min

November 2, 2024

MicroStrategy’s Michael Saylor falls for a submit about Donald Trump’s place on taxing crypto, Kraken declares “new day.” Hodler’s Digest

Learn extra

Hodler’s Digest

Telegram CEO can not go away France, OpenSea receives Wells discover, and extra: Hodler’s Digest, Aug. 25 – 31

Editorial Employees

8 min

August 31, 2024

Telegram CEO Pavel Durov has been positioned beneath judicial supervision after a court docket look, OpenSea receives Properly Discover: Hodler’s Digest

Learn extra