|

Argentina finalizes guidelines for digital asset suppliers

Argentina’s securities regulator has finalized guidelines for digital asset service suppliers (VASPs), which cowl common codes of conduct and custody necessities for cryptocurrency exchanges and different platforms facilitating digital asset transactions.

The laws have been revealed on March 13 by the Nationwide Securities Fee, also called the CNV, underneath Common Decision No. 1058.

In accordance with a translated model of the announcement, the laws impose “obligations relating to registration, cybersecurity, asset custody, cash laundering prevention, and threat disclosure” on VASPs working within the nation.

The acknowledged purpose of the principles is to ensure “transparency, stability, and person safety within the crypto ecosystem,” the announcement stated.

Argentine tax lawyer Diego Fraga stated the ultimate tips embody obligatory separation of firm and consumer funds, annual audits and month-to-month reporting with the CNV.

US Rep. Byron Donalds to introduce invoice codifying Trump’s Bitcoin reserve

A brand new invoice set to be launched in Congress goals to formalize President Donald Trump’s govt order establishing a US Strategic Bitcoin Reserve, a transfer that would additional combine Bitcoin into the nation’s monetary technique.

Trump signed an govt order on March 7 to make use of Bitcoin seized in authorities legal circumstances to ascertain a nationwide reserve.

The laws, launched by US Consultant Byron Donalds, seeks to make sure the Bitcoin reserve turns into a everlasting fixture, stopping future administrations from dismantling it by govt motion.

“For years, the Democrats waged struggle on crypto,” Donalds, a Florida Republican, stated in an announcement to Bloomberg. “Now could be the time for Congressional Republicans to decisively finish this struggle.”

FTX liquidated $1.5B in 3AC belongings 2 weeks earlier than hedge fund’s collapse

Newly revealed court docket paperwork present that FTX secretly liquidated $1.53 billion in Three Arrows Capital (3AC) belongings simply two weeks earlier than the hedge fund collapsed in 2022. The disclosure challenged earlier narratives that 3AC’s downfall was solely market-driven.

As soon as valued at over $10 billion, 3AC collapsed in mid-2022 after a sequence of leveraged directional trades turned bitter. The hedge fund had borrowed from over 20 giant establishments earlier than the Might 2022 crypto crash, which noticed Bitcoin fall to $16,000.

Nevertheless, not too long ago found proof exhibits that the FTX trade liquidated $1.53 billion price of 3AC’s belongings simply two weeks forward of the hedge fund’s collapse.

3AC “requested a chapter court docket to let it improve its declare in opposition to FTX from $120 million to $1.53 billion,” in line with Mbottjer, the pseudonymous co-founder of FTX Creditor, a gaggle FTX collectors and chapter declare consumers.

SEC delays choice on XRP, Solana, Litecoin, Dogecoin ETFs

The US Securities and Change Fee has delayed its choice to approve a number of XRP, Solana, Litecoin and Dogecoin exchange-traded funds.

In a slew of filings on March 11, the company stated it has “designated an extended interval”to determine on the proposed rule modifications that may permit the ETFs to proceed.

Among the many affected ETFs are Grayscale’s XRP and Cboe BZX Change’s spot Solana ETF filings, with the selections on them pushed till Might.

Russia utilizing Bitcoin, USDt for oil trades with China and India: Report

Russian firms have been utilizing cryptocurrencies like Bitcoin and USDt to facilitate commerce with China and India amid worldwide sanctions, in line with a Reuters report.

Russian oil firms have used crypto belongings together with Bitcoin and Tether’s USDt for worldwide commerce, Reuters reported on March 14, citing 4 sources with direct data of the matter.

One Russian oil dealer reportedly conducts tens of thousands and thousands of {dollars} price of month-to-month transactions utilizing digital belongings, in line with a supply who spoke on situation of anonymity because of a non-disclosure settlement.

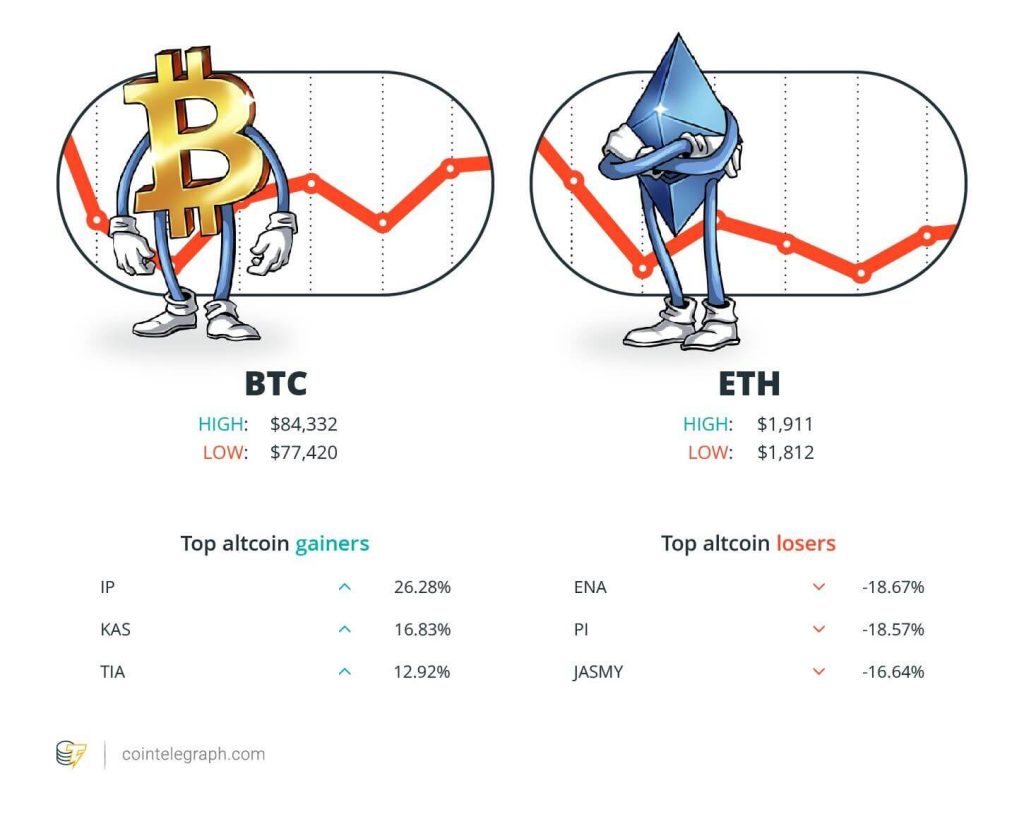

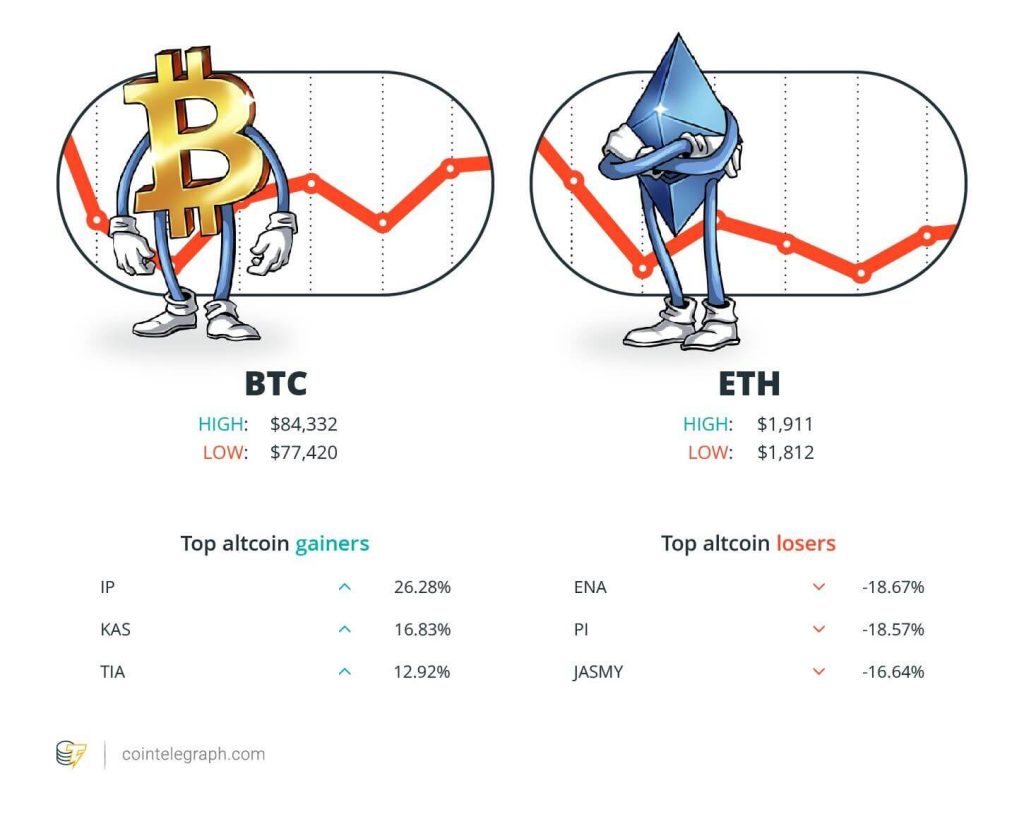

Winners and Losers

On the finish of the week, Bitcoin (BTC) is at $84,322, Ether (ETH) at $1,911 and XRP at $2.39. The entire market cap is at $2.74 trillion, in line with CoinMarketCap.

Among the many greatest 100 cryptocurrencies, the highest three altcoin gainers of the week are Story (IP) at 26.28%, Kaspa (KAS) at 16.83% and Celestia (TIA) at 12.92%.

The highest three altcoin losers of the week are Ethena (ENA) at 18.67%, Pi (PI) at 18.57% and JasmyCoin (JASMY) at 16.64%. For more information on crypto costs, ensure that to learn Cointelegraph’s market evaluation.

Most Memorable Quotations

“As a very long time Solana builder, the rationale I stepped down is as a result of I’m far too trusting for a way parasitic the memecoin house is.”

Ben Chow, co-founder of Meteora

“No felon would thoughts a pardon, particularly being the one one in US historical past who was ever sentenced to jail for a single BSA [Bank Secrecy Act] cost.”

Changpeng “CZ” Zhao, former CEO of Binance

“With stablecoins underneath the federal government’s management, the end result is identical, with the false veneer of decentralization added as a bonus.”

Jean Rausis, co-founder of Smardex

“The US administration is favorable towards cryptocurrencies and particularly dollar-denominated stablecoins, which can increase sure issues in Europe.”

Pierre Gramegna, managing director of European Stability Mechanism

“With Bitcoin dipping under $80,000, roughly 70% of all promoting got here from traders who purchased inside the final three months.”

Markus Thielen, CEO of 10x Analysis

“If Trump’s administration gives clearer laws on stablecoins, ETFs and institutional adoption, altcoins might regain momentum.”

Alvin Kan, chief working officer at Bitget

High Prediction of The Week

Will Ethereum worth backside at $1.6K?

Ethereum’s native token, Ether, dropped under $2,000 on March 10, and the altcoin has struggled to regain a place above the psychological degree.

Whereas Bitcoin and XRP exhibited minor recoveries over the previous 24 hours, Ether costs did not show bullish momentum within the charts.

Learn additionally

Options

Satoshi Nakamoto saves the world in an NFT-enabled comedian e book sequence

Options

2023 is a make-or-break 12 months for blockchain gaming: Play-to-own

The altcoin plummeted to a multi-year low of $1,752 on March 11. Nevertheless, onchain information and technical evaluation point out that the value might drop a further 15% within the coming weeks.

The present worth deviation under $2,000 carried onchain implications for the altcoin. In accordance with Glassnode, a knowledge analytics platform, ETH dropped under its realized worth of $2,054 for the primary time since February 2023.

High FUD of The Week

Bitcoin obvious demand reaches lowest level in 2025 — CryptoQuant

Obvious demand for Bitcoin has hit the bottom degree in 2025, dropping down into adverse territory, as merchants and traders take a cautious method to risk-on belongings because of macroeconomic uncertainty.

In accordance with CryptoQuant’s Bitcoin Obvious Demand metric, demand for Bitcoin has dropped all the way down to a adverse 142 on March 13.

Learn additionally

Options

Brokers of Affect: He Who Controls The Blockchain, Controls The Cryptoverse

Options

Actual AI & crypto use circumstances, No. 4: Combat AI fakes with blockchain

Bitcoin’s obvious demand has been optimistic since September 2024, peaking round December 2024 earlier than starting the gradual descent again down.

Nevertheless, demand ranges stayed optimistic till the start of March 2025 and have continued to say no since that time.

Crypto founders report deluge of North Korean pretend Zoom hacking makes an attempt

At the least three crypto founders have reported foiling an try from alleged North Korean hackers to steal delicate information by pretend Zoom calls over the previous few days.

Nick Bax, a member of the white hat hacker group the Safety Alliance, stated in a March 11 X publish the strategy utilized by North Korean scammers had seen thousands and thousands of {dollars} stolen from suspecting victims.

Usually, the scammers will contact a goal with a gathering provide or partnership, however as soon as the decision begins, they ship a message feigning audio points whereas a inventory video of a bored enterprise capitalist is on the display screen; they then ship a hyperlink to a brand new name, in line with Bax.

Lazarus Group sends 400 ETH to Twister Money, deploys new malware

North Korean-affiliated hacking collective the Lazarus Group has been shifting crypto belongings utilizing mixers following a string of high-profile hacks.

On March 13, blockchain safety agency CertiK alerted its X followers that it had detected a deposit of 400 ETH price round $750,000 to the Twister Money mixing service.

“The fund traces to the Lazarus group’s exercise on the Bitcoin community,” it famous.

The North Korean hacking group was chargeable for the huge Bybit trade hack that resulted within the theft of $1.4 billion price of crypto belongings on Feb. 21.

High Journal Tales of The Week

Crypto followers are obsessive about longevity and biohacking: Right here’s why

The reality concerning the hyperlinks between the crypto and longevity communities runs deeper and weirder than you may anticipate.

Vitalik on AI apocalypse, LA Instances both-sides KKK, LLM grooming: AI Eye

New proof of AI deception, LA Instances’ AI provides sympathetic view of KKK, Russians seed AI coaching information with propaganda.

Ridiculous ‘Chinese language Mint’ crypto rip-off, Japan dives into stablecoins: Asia Specific

Cebu airways in The Philippines integrates blockchain tech, Bithumb chair’s acquittal upheld, Japan’s stablecoin guess.

Subscribe

Probably the most participating reads in blockchain. Delivered as soon as a

week.

Ciaran Lyons

Ciaran Lyons is an Australian crypto journalist. He is additionally a standup comic and has been a radio and TV presenter on Triple J, SBS and The Undertaking.