|

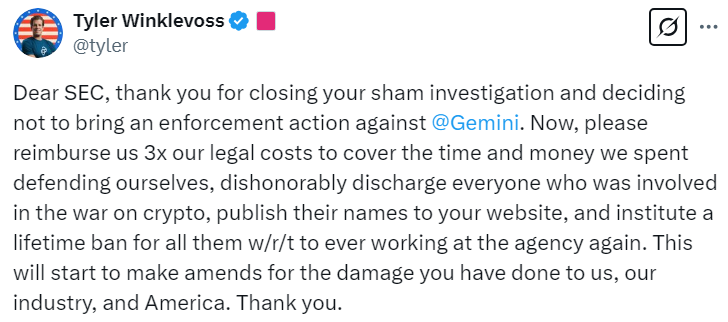

The USA Securities and Alternate Fee is quickly shifting its stance on cryptocurrency, dropping circumstances and investigations towards main corporations like Coinbase, OpenSea, Uniswap and Robinhood, amongst others.

President Donald Trump has additional cemented the legitimacy of the business along with his bulletins a couple of strategic Bitcoin and/or crypto reserve.

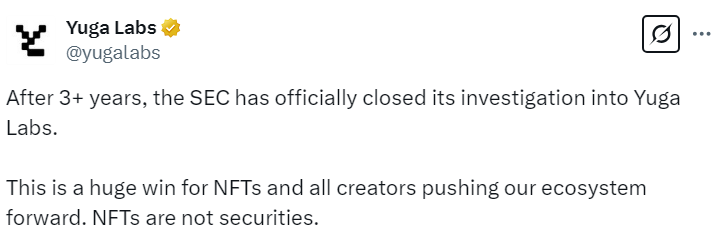

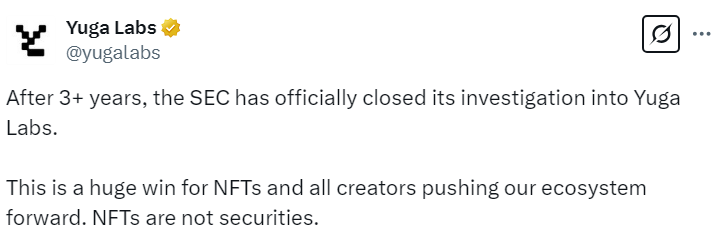

Whereas the business is celebrating these developments, there are many unresolved questions. Does the SEC dropping its investigations into OpenSea and YugaLabs actually imply that NFTs will not be securities? Yuriy Brisov of Digital & Analogue Companions says it’s not that clear minimize, pointing to the Ripple case for example of how an asset’s classification is determined by how it’s offered.

Journal spoke with a panel of authorized specialists to search out out extra in regards to the ramifications of those strikes: Brisov in Europe, co-chair of the Hong Kong Web3 Affiliation Joshua Chu from Asia and Charly Ho of Rikka from US. This dialogue has been edited for readability and size.

Does the SEC’s withdrawal of prices and investigations towards crypto corporations set a precedent for crypto legal guidelines for the longer term?

Ho: As a result of the SEC is the plaintiffs suing the defendants, which might be the Ripples, the Coinbases, the OpenSeas of the world, they will definitely drop these circumstances — although from the Ripple case, Choose [Analisa] Torres needed to be particularly concerned in order that one may be a little bit bit extra sophisticated to simply drop.

Whether or not that leaves the business in a little bit of a vacuum, in some respects, sure. However it’s additionally form of what the business requested for. The business requested to not be regulated by enforcement motion that was considerably — of their phrases, utilizing the previously present Chevron deference— arbitrary and capricious. So a variety of the responses from the Coinbases, the Ripples and OpenSeas of the world have related language asserting that the SEC was extending past its authorized jurisdiction and that it was principally appearing in an arbitrary and capricious method in violation of the Administrative Process Act.

It opens up: “The place will we go from right here?” What the business has requested for is moreclear regulatory guidancein the type of both a legislation handed by Congress or regulation and guidelines from the company itself. So with the creation of the brand new crypto activity drive, I consider that their mission is particularly to fill that void. So case legislation shouldn’t be the one strategy to get readability.

Brisov: The nice final result of those investigations isn’t all the time a lawsuit. It may additionally end in an SEC report clarifying regulatory classifications — simply as Ripple’s utility tokens had been deemed securities in sure gross sales, the SEC would possibly assert that NFTs and memecoins will also be securities beneath sure situations, whereas DeFi platforms could also be thought-about brokers or sellers beneath the Alternate Act of 1934.

Now, they simply dropped prices and the crypto neighborhood is saying that NFTs can’t be securities. And the Uniswap case suggests that every one DeFi platforms can’t be an trade or dealer vendor beneath the Alternate Act.

It’s the mistaken message that the market receives: that they will do no matter. I don’t help this strategy. It’s in all probability a great factor to let the brand new, revolutionary corporations develop. However somebody should, sometimes, examine them and ask some questions, difficulty stories, and make suggestions.

Below Gary Gensler, the SEC was overdoing it. For example, with Coinbase, they had been strictly following all of the KYC procedures. Coinbase truly invests lots into following all of the legal guidelines. So this battle with Coinbase, for me, was meaningless from the very starting. However with OpenSea, with Uniswap, I wouldn’t say that it was meaningless however the outcomes of those investigations, I can not name them passable at this level.

Provided that US crypto legal guidelines affect different international locations, are jurisdictions like Hong Kong, Singapore, and Dubai prone to see related abrupt modifications?

Chu: In locations like Hong Kong, Singapore, and Dubai, such drastic regulatory U-turns are much less doubtless. These jurisdictions have taken a extra measured and structured strategy to crypto regulation.

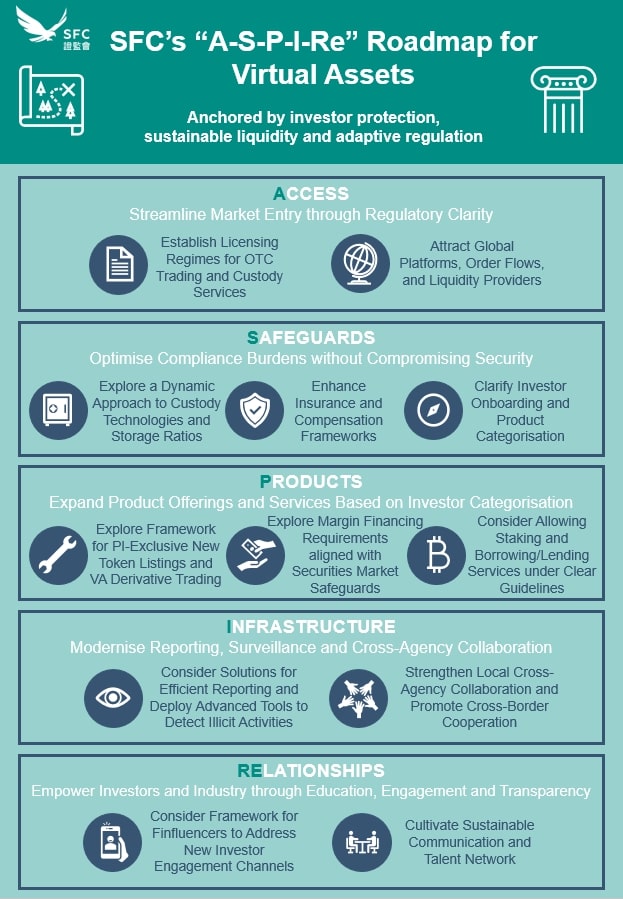

For instance, Hong Kong’s Securities and Futures Fee has been methodical in its strategy. When the SFC first launched its crypto regulatory framework, it excluded riskier merchandise like choices buying and selling. Solely after the preliminary framework had been in place for a while did the SFC announce it will discover permitting choices and leveraged buying and selling. This phased strategy ensures that riskier facets of the ecosystem are launched solely after members have been vetted and deemed sufficiently subtle.

This regular, incremental strategy contrasts sharply with the SEC’s abrupt shifts. It additionally highlights the significance of constructing a regulatory framework that evolves primarily based on expertise and judicial enter, somewhat than the private views of these in energy. In Hong Kong, Singapore, and Dubai, the main focus is on making a predictable and reliable setting for innovation, which is one thing the US may study from.

Can crypto corporations sue regulators in the event that they consider regulatory actions have harmed their enterprise?

Ho: Within the US, you possibly can sue anybody for something, even when you don’t have a meritorious declare.

Nothing stops you from launching a lawsuit. That is why, in my line of labor, what we do is we frequently have indemnification clauses that if a celebration had been to be sued because of the opposite social gathering’s actions, regardless if that go well with has advantage or not, that social gathering that’s sued nonetheless incurs authorized prices merely simply to make this go away or defend themselves. So the reply to the query is, they will completely sue. Whether or not or not they’re going to win is clearly an entire different factor.

Has the SEC’s strategy to NFTs and its choice to drop the OpenSea investigation created extra authorized uncertainty round crypto legal guidelines?

Brisov: Now, there’s a normal understanding for the market that NFTs can’t be securities. I don’t suppose that could be a excellent final result of this investigation as a result of NFTs clearly might be securities, and so they can create sure dangers relating to securities. Really, the truth that the SEC was investigating OpenSea may have created this understanding, as we now have with Ripple. Earlier than the Ripple case, we didn’t know find out how to strategy utility tokens. Now, we all know that there are two forms of tokens, these which might be offered on exchanges and people which might be offered to institutional traders. And the identical token might be both a safety or not.

Learn additionally

Options

WTF occurred in 1971 (and why the f**okay it issues a lot proper now)

Options

Banking The Unbanked? How I Taught A Complete Stranger In Kenya About Bitcoin

We may have the identical understanding relating to NFTs, that some NFTs are actually collectibles and so they’re not part of securities laws.

For example, we did a venture the place we provided securities within the type of NFT in an actual property venture, and we registered it within the US, and we used the Regulation D exemption from the securities legal guidelines. It was a really handy enterprise mannequin to supply securities within the type of NFT. And now, no person is aware of. We don’t have a straight reply.

With out authorized precedents, do present copyright legal guidelines nonetheless apply to blockchain-based content material akin to AI-generated NFTs or tokens?

Ho: Generally, copyright infringement in generative AI is rife proper now with numerous litigations. There have been few that truly resulted in a judgment. The Thomson Reuters case, a minimum of within the US, was one of many, if not the primary, circumstances the place there was an precise judgment from the courtroom that gave some readability.

The way in which that generative AI takes knowledge and trains on it, a variety of instances there are a number of sources of knowledge that you just get for coaching. One is to scrape the web. Information scraping generally is a violation of copyright as a result of despite the fact that one thing is public, it doesn’t imply that it’s not protected by my mental property. It doesn’t imply I don’t have a copyright. However it’s not so easy as a result of there are affirmative defenses in US legislation, particularly the Truthful Use doctrine.

On the output aspect, as a result of the AI principally takes all this coaching knowledge, learns from it and produces an output, that output itself could also be infringing as a result of it might be derived from one of many important rights of copyright (which) is to create spinoff works.

So if the AI is creating spinoff works of any individual else’s work product that they’ve a copyright in, basically that’s a violation of the unique copyright holder’s copyright. This will get actually, actually sophisticated as a result of there’s little or no case legislation proper now.

Chu: Not like conventional reserve belongings like gold (which has bodily tangibility) or oil (which has utility), Bitcoin’s worth is totally speculative, and its place as a reserve asset would make it a chief goal for adversarial nations. For instance, if quantum computing turns into a actuality, it may break Bitcoin’s cryptographic safety, rendering it nugatory in a single day. What occurs if adversarial nations like China or Russia develop quantum computing capabilities and resolve to focus on Bitcoin? The US may discover its reserves worn out, with no strategy to get better the misplaced worth.

Learn additionally

Options

William Shatner Tokenizes his Favourite Reminiscences on the WAX Blockchain

Options

Memecoins: Betrayal of crypto’s beliefs… or its true function?

From a strategic perspective, it’s laborious to justify Bitcoin as a reserve asset. Not like gold, which has been a retailer of worth for hundreds of years, or oil, which powers the worldwide economic system, Bitcoin’s worth is totally speculative and tied to market sentiment. If the US had been to pour assets right into a Bitcoin reserve, it will basically be betting on the continued demand for a digital asset that may very well be rendered out of date by technological developments or focused by adversarial nations. This can be a dangerous proposition, particularly in a world the place geopolitical tensions are already excessive and technological disruption is a continuing menace.

Trump pardoned Silk Street founder Ross Ulbricht, and a latest prisoner swap between the US and Russia additionally concerned a key crypto determine. What does this inform us about crypto’s rising significance?

Brisov: After Russia invaded Ukraine, they traded for arms vendor Viktor Bout. Now, Russia has BTC-e operator Alexander Vinnik, or as he’s referred to as, “Mr. Bitcoin.” It’s simply part of the pattern that we see now that nations are realizing that crypto is critical.

For example, Donald Trump, one in all his first actions was to pardon Ross Ulbricht, the man who created an internet site for illicit buying and selling, Silk Street.

That can also be an indication that the US wants crypto folks to help and develop the infrastructure. The second transfer was to cease the investigations towards crypto.

In Russia, as sanctions and SWIFT operations are much less out there to Russia, they’re transferring towards crypto, and now they want crypto guys who know find out how to infiltrate the authorized limitations to function globally with crypto.

The EU additionally, on a sure stage, acknowledges the seriousness of crypto and eventually enacted sanctions towards Guarantex, the largest Russian crypto trade.

It’s humorous, although, that the US Workplace of International Property Management included Guarantex on its checklist of sanctions in 2022. Nonetheless, the EU solely did it this February.

They had been simply ignoring the chance that crypto generally is a critical menace. We will now see that every one the worldwide regulators, no matter they do, whether or not creating legal guidelines or enacting sanctions, are beginning to contemplate crypto in all their actions.

Subscribe

Essentially the most participating reads in blockchain. Delivered as soon as a

week.

Yohan Yun

Yohan Yun is a multimedia journalist overlaying blockchain since 2017. He has contributed to crypto media outlet Forkast as an editor and has coated Asian tech tales as an assistant reporter for Bloomberg BNA and Forbes. He spends his free time cooking, and experimenting with new recipes.