Consumer exercise on the Ethereum community has continued to say no, signaling weakening demand for the Layer-1 (L1) blockchain.

On Sunday, day by day lively addresses and new pockets creations fell to their lowest ranges of the 12 months, highlighting a steep drop in on-chain engagement.

Ethereum Community Exercise Crashes to YTD Lows as Inflation Dangers Develop

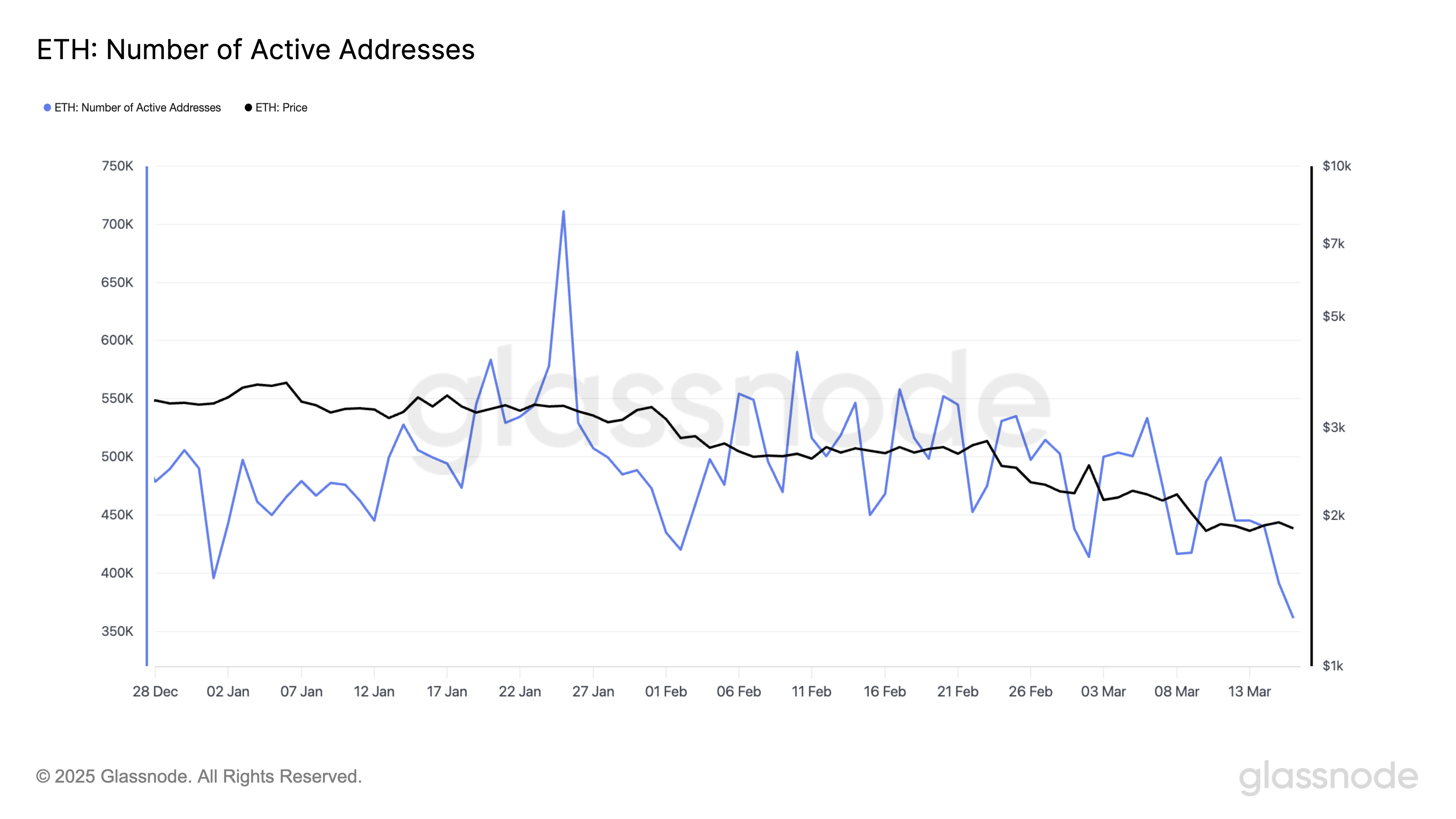

In accordance with Glassnode, the day by day depend of lively addresses concerned in ETH transactions plunged to a year-to-date low of 361,078 on Sunday.

This drop alerts declining person engagement and diminished on-chain exercise. It usually results in decrease transaction charges, lowering the quantity of ETH burned and making the asset extra inflationary.

If the pattern persists, it may decrease investor confidence, cut back the community’s adoption, and enhance the downward strain on ETH’s value.

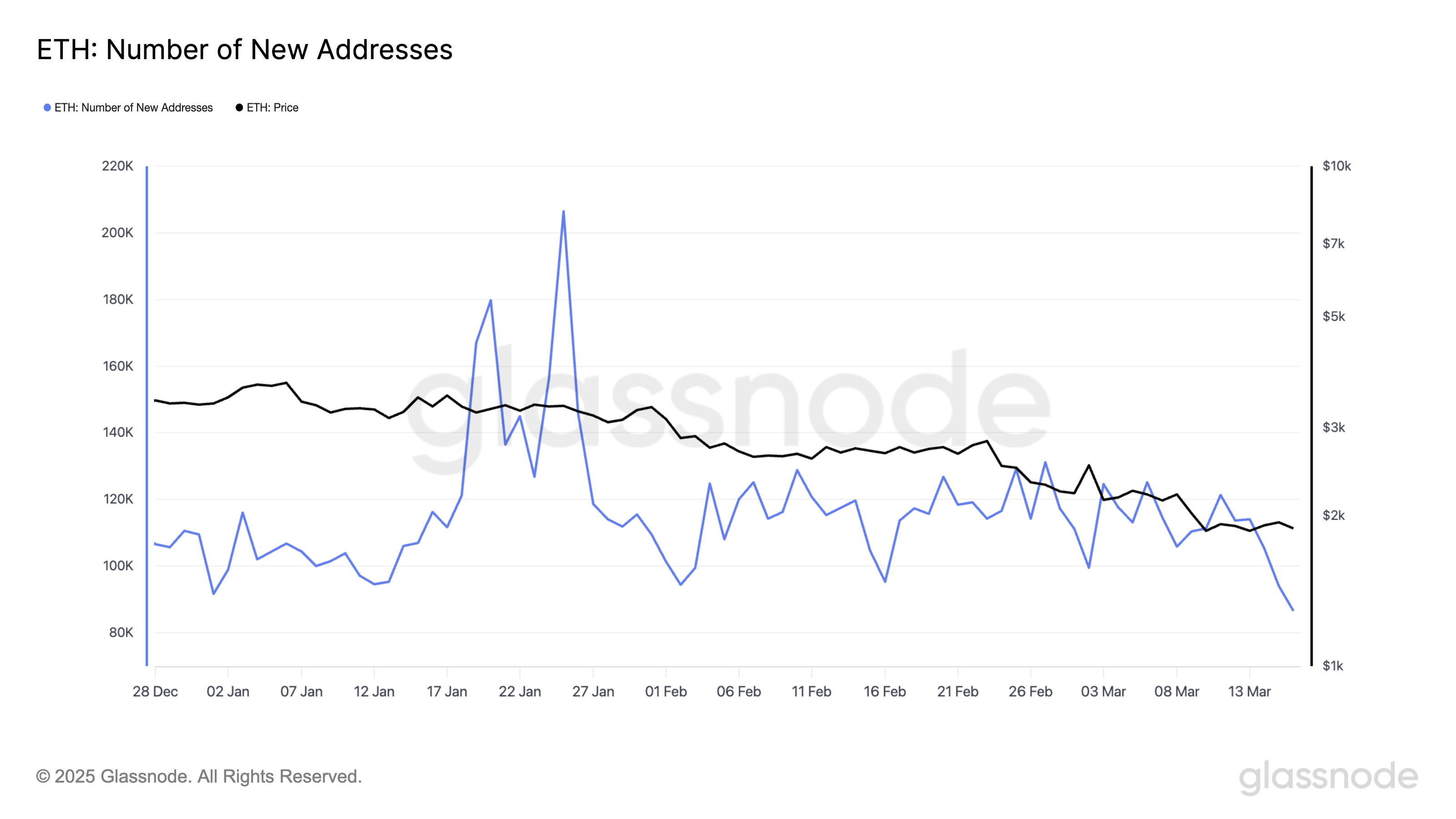

Additional, new demand for the Ethereum community has additionally waned. Per Glassnode, the depend of recent wallets created to commerce ETH totaled 86,539 addresses on Sunday, marking its lowest day by day depend for the reason that starting of the 12 months.

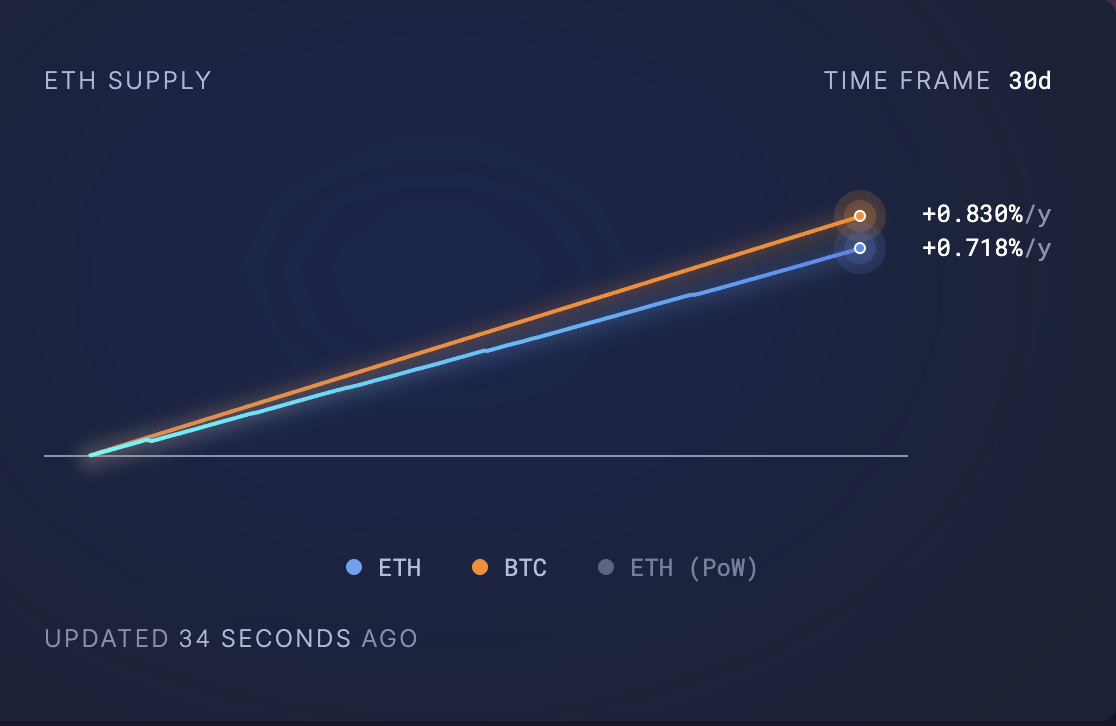

This decline in community participation has intensified ETH’s inflationary pressures, with the whole circulating provide surpassing 120 million ETH. Prior to now 30 days, 71,172 ETH valued above $135 million at present market costs have been added to the coin’s circulating provide.

With fewer transactions and interactions occurring on-chain, the shortage of demand to soak up the rising provide has elevated the downward strain on ETH’s value.

ETH Nears Oversold Ranges as Demand Wanes—What’s Subsequent for the Altcoin?

The decline in exercise on the Ethereum community has impacted the demand for the altcoin in current weeks, resulting in a value drop. ETH at the moment trades at $1,898, noting a 30% value fall over the previous month.

The downward pattern noticed in ETH’s Relative Power Index (RSI) on the day by day chart captures the weakening shopping for strain amongst market individuals. At press time, this momentum indicator is at 34.70.

The RSI indicator measures an asset’s oversold and overbought market circumstances. It ranges between 0 and 100, with values above 70 indicating that the asset is overbought and due for a decline. Conversely, values underneath 30 point out that the asset is oversold and will witness a rebound.

At 34.70, ETH’s RSI signifies important promoting strain. It suggests that there’s room for extra value declines earlier than the coin turns into oversold and witnesses a optimistic correction.

If this value dip continues, ETH dangers plummeting to $1,758.

However, if demand rallies, ETH’s value may break above $1,924 and climb towards $2,224.

Disclaimer

According to the Belief Venture pointers, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. At all times conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.