Michael Saylor’s Technique (previously MicroStrategy) added 130 Bitcoin (BTC) to its holdings between March 10 and March 16, spending roughly $10.7 million.

The typical BTC value for this buy was $82,981. This marks the corporate’s smallest Bitcoin buy since August 2024.

Why are MicroStrategy’s Bitcoin Purchases Turning into Smaller?

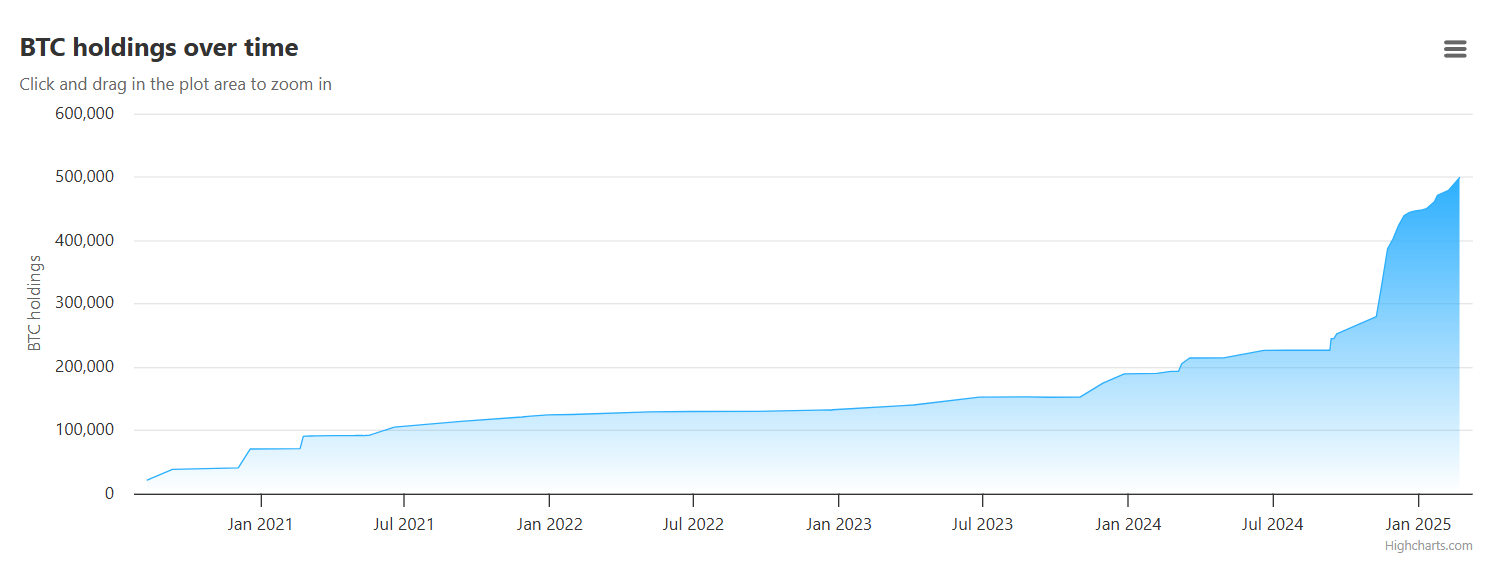

As of March 16, MicroStrategy holds 499,226 BTC, value round $33.1 billion. The corporate’s total common value per Bitcoin stands at roughly $66,000.

This newest acquisition comes simply weeks after MicroStrategy made its largest Bitcoin buy of 2025. In February, the corporate spent $2 billion on BTC at costs above $97,000.

Now, with Bitcoin buying and selling decrease, this smaller purchase raises questions concerning the agency’s technique.

“On-chain clues: Is Bitcoin gearing up for a significant reversal? Lively addresses peak, signaling potential bullish momentum forward,” Saylor posted on X (previously Twitter) at present.

One potential cause for the restricted buy is that MicroStrategy could also be ready for extra capital from its inventory choices.

Final month, the corporate raised $2 billion via a non-public providing of convertible senior notes. Most of these funds possible went towards its earlier acquisition. If further funding is required, the corporate could also be pacing its purchases.

MicroStrategy funds Bitcoin acquisitions via inventory gross sales and zero-interest convertible notes with out promoting off different belongings.

Whereas this strategy has labored to date, the agency’s capacity to lift capital relies on sustaining sturdy monetary stability. A pointy rise in liabilities relative to belongings may make future financing tougher.

Nevertheless, there’s a extra regarding cause why MicroStrategy may have made such a small Bitcoin buy at present.

Bitcoin is at the moment buying and selling just under $83,000, and a few analysts recommend the worth has not but bottomed. Arthur Hayes and different consultants predict BTC may drop to round $70,000 earlier than the subsequent upward transfer.

BeinCrypto analysts consider the market is experiencing a brief correction slightly than the top of the bullish section.

If MicroStrategy shares this view, it might be ready for an extra dip earlier than making a bigger funding.

Disclaimer

In adherence to the Belief Mission pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nevertheless, readers are suggested to confirm information independently and seek the advice of with an expert earlier than making any selections primarily based on this content material. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.