|

Prime Tales of The Week

SEC dismisses lawsuit towards crypto change Coinbase

The US Securities and Alternate Fee has dismissed its lawsuit with crypto change Coinbase on Feb. 27, filings present, ending the case completely.

The SEC agreed to voluntarily dismiss all litigation tied to Coinbase and Coinbase International with prejudice, which included withdrawing from its preliminary June 2023 lawsuit and its request for an interlocutory enchantment with the US Courtroom of Appeals, a Feb. 27 court docket submitting reveals.

It comes after the 2 events introduced an settlement to finish the authorized dispute on Feb. 21.

Bitcoin sheds practically all Trump election features in plummet underneath $80K

Bitcoin has fallen underneath $80,000 for the primary time since November amid mounting macroeconomic uncertainty over US President Donald Trump’s proposed tariffs.

On Feb. 27, Bitcoin plummeted to $79,752, in response to TradingView knowledge. The two.65% worth decline over the previous hour led to $100.01 million in lengthy positions liquidated, per CoinGlass knowledge.

Bitcoin final traded at this degree on Nov. 11, simply days after Trump was elected US president, amid optimism that his pro-crypto insurance policies would lead a Bitcoin rally in 2025.

Over the previous couple of days, most crypto merchants eyed $82,000 as a possible backside for Bitcoin, however many are actually bracing for a transfer towards $70,000.

US decide tosses SEC fraud go well with towards Hex founder Richard Coronary heart

A district court docket decide has dismissed the US securities regulator’s lawsuit accusing Hex founder Richard Coronary heart of elevating over $1 billion by means of unregistered crypto choices and defrauding buyers of $12.1 million.

Coronary heart, whose actual identify is Richard Schueler, was additionally accused of spending these allegedly stolen funds on luxurious gadgets — together with the world’s largest black diamond.

Nevertheless, Choose Carol Bagley Amon mentioned these alleged misleading acts couldn’t be selected because the US Securities and Alternate Fee failed to ascertain that the US had jurisdiction over Coronary heart’s crypto actions — which she mentioned had been world in scope and never particularly focused at US buyers.

SEC once more delays Ether ETF choices on Cboe

The US Securities and Alternate Fee has as soon as once more prolonged its deadline for deciding whether or not or to not allow Cboe Alternate to record choices tied to Ether exchange-traded funds (ETFs).

The company has given itself till Could to make a remaining choice to approve or disapprove of Ether ETF choices buying and selling on the US change, in response to a Feb. 28 regulatory submitting.

Cboe initially requested to record Ether ETF choices in August 2024, however the SEC sought additional time to succeed in a choice in October.

The change is searching for to record choices on the Constancy Ethereum Fund. The fund is among the many extra common Ether ETFs, with round $1.3 billion in internet belongings, in response to knowledge from VettaFi.

FBI asks node operators, exchanges to dam transactions tied to Bybit hackers

The US Federal Bureau of Investigation has urged crypto node operators, exchanges and the personal sector to dam transactions from addresses used to launder funds from the $1.4 billion Bybit hack.

The FBI confirmed the outcomes of an earlier business investigation, stating that North Korea was answerable for the hack, which the US legislation enforcement company dubbed “TraderTraitor” in a Feb. 26 public service announcement.

The FBI famous in an April 2022 assertion that TraderTraitor is often referred to within the business because the Lazarus Group, APT38, BlueNoroff and Stardust Chollima.

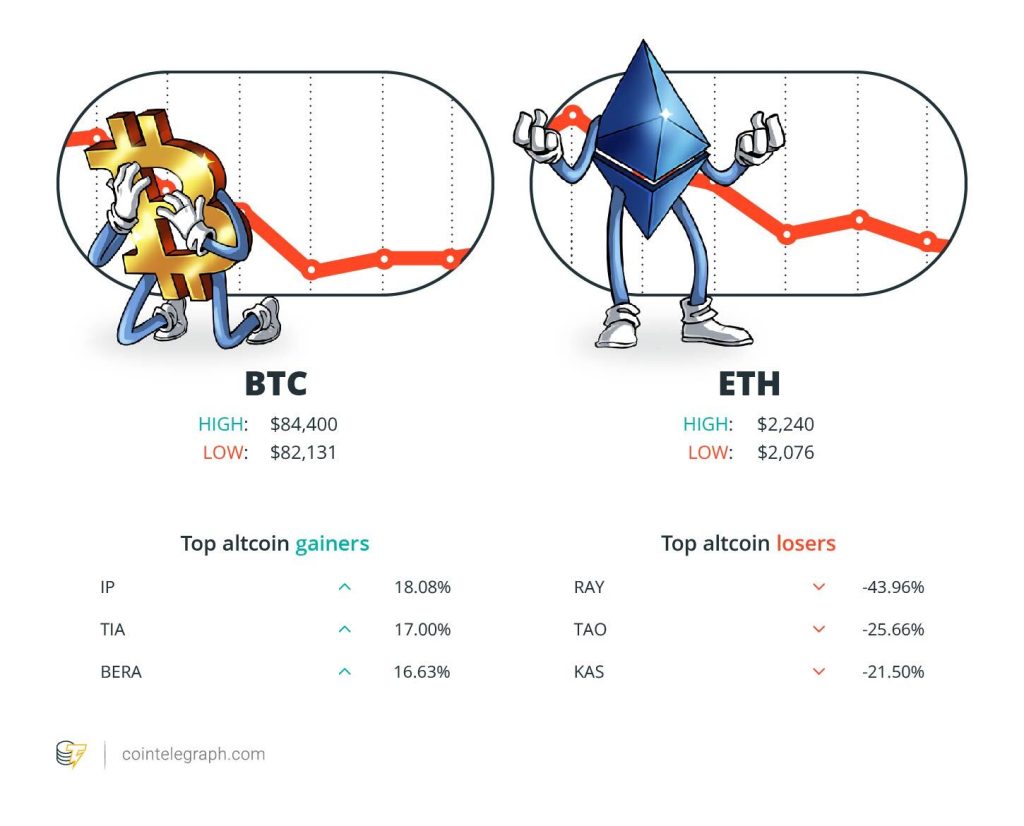

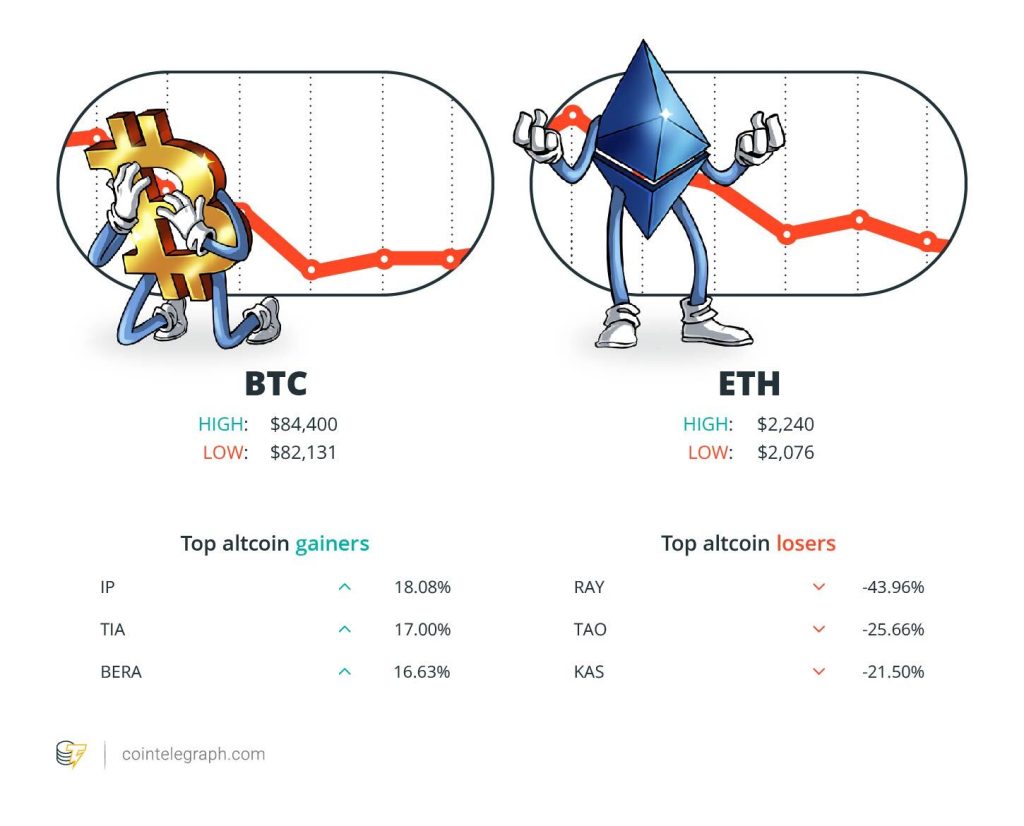

Winners and Losers

On the finish of the week, Bitcoin (BTC) is at $84,400 Ether (ETH) at $2,240 and XRP at $2.15. The full market cap is at $2.81 trillion, in response to CoinMarketCap.

Among the many greatest 100 cryptocurrencies, the highest three altcoin gainers of the week are Story (IP) at 18.08%, Celestia (TIA) at 17.00% and Berachain (BERA) at 16.63%.

The highest three altcoin losers of the week are Raydium (RAY) at 43.96%, Bittensor (TAO) at 25.66% and Kaspa (KAS) at 21.50%. For more information on crypto costs, be certain to learn Cointelegraph’s market evaluation.

Most Memorable Quotations

“It’s time for the Fee to rectify its strategy and develop crypto coverage in a extra clear method.”

Mark Uyeda, appearing chair of the US Securities and Alternate Fee

“If GameStop embarks on the LBE (Leveraged Bitcoin Fairness) technique… It’s going to bake the noodles of so many TradFi buyers and commentators who suppose each GME and Bitcoin are a joke.”

John Haar, managing director of Swan Bitcoin

“The magnitude of skullduggery that’s taking place in Washington D.C. is actually unbelievable. […] And it’s not over but.”

Caitlin Lengthy, founder and CEO of Custodia Financial institution

“We’ve numerous bearish ‘sentiment’ confluence. Which traditionally has been an excellent marker for a possible dip/reversal alternative.”

Charles Edwards, founding father of Capriole Investments

“Because the business turns into extra institutionalized, it ought to be safer.”

Geoffrey Kendrick, world head of digital asset analysis at Customary Chartered

“Crypto has been right here earlier than and bounced again even stronger.”

Richard Teng, CEO of Binance

Prediction of The Week

Bitcoin may hit $500K earlier than Trump leaves workplace — Customary Chartered

US President Donald Trump’s first month in workplace has been extremely unstable for threat belongings, however his administration will doubtless be a internet optimistic for Bitcoin in the long term, in response to Customary Chartered.

Learn additionally

Options

China’s Digital Yuan Is an Financial Cyberweapon, and the US Is Disarming

Options

‘Deflation’ is a dumb technique to strategy tokenomics… and different sacred cows

In a Feb. 27 interview with CNBC, Customary Chartered’s head of digital belongings analysis, Geoffrey Kendrick, mentioned he expects Bitcoin’s worth to succeed in $200,000 this yr earlier than surging to $500,000 previous to the conclusion of President Trump’s second time period. He cited rising institutional adoption and the potential for clearer rules as optimistic catalysts.

FUD of The Week

Virtuals Protocol income down 97% as AI agent demand fades

Virtuals Protocol, an AI agent platform enabling the creation and monetization of AI-driven digital entities on the blockchain, has seen its day by day buying and selling income plummet by 96.8% regardless of increasing from Coinbase’s Ethereum layer-2 community, Base, to Solana.

In line with Dune Analytics knowledge, the protocol recorded its highest day by day income of over $1 million on Jan. 2, however that determine had dropped to lower than $35,000 as of Feb. 27.

Income from the Base digital app has been significantly weak, with earnings remaining beneath $1,000 for 10 consecutive days, declining from its day by day peak of $859,000 on Oct. 27, 2024. In complete, Virtuals generated $28,492 on the Base community and $6,300 on Solana on Feb. 27.

Pi Community responds to Bybit CEO’s rip-off allegations

Pi Community has responded to an argument triggered by a submit from Bybit CEO Ben Zhou difficult the undertaking’s legitimacy and accusing it of being a rip-off.

On Feb. 20, an X account describing itself because the “unofficial technical crew” of Pi Community alleged that the undertaking had rejected an inventory provide from the crypto change and that Bybit was “dropping its place” available in the market.

Learn additionally

Options

North Korean crypto hacking: Separating truth from fiction

Options

AI didn’t kill the metaverse, it’ll construct it — Alien Worlds, Bittensor vs Eric Wall: AI Eye

Responding to the provocation, Zhou accused Pi Community of being a “rip-off,” citing a 2023 report from Chinese language authorities warning customers of a undertaking focusing on the aged. “Sure, I nonetheless suppose you’re a rip-off, and no, Bybit won’t record rip-off,” Zhou wrote.

Zhou additionally acknowledged that Bybit had by no means submitted an inventory request to Pi Community and challenged the undertaking to show its legitimacy by addressing earlier experiences that questioned its operations.

Bitcoin crash triggered by erosion of ETF money and carry commerce — Analyst

Since reaching all-time highs on Jan. 20, Bitcoin’s worth has been suppressed by hedge funds exploiting a low-risk yield commerce involving spot exchange-traded funds (ETFs) and CME futures, signaling as soon as once more that institutional adoption of crypto belongings isn’t a one-way avenue.

That is the final takeaway of analyst Kyle Chassé, who dissected the newest Bitcoin worth crash in a thread on the X social media platform.

“For months, hedge funds had been exploiting a low-risk yield commerce utilizing BTC spot ETFs & CME futures,” mentioned Chassé. Now, this money and carry commerce is “imploding,” he mentioned.

Prime Journal Tales of The Week

Elon Musk’s plan to run authorities on blockchain faces uphill battle

Overcoming bureaucratic inertia is certain to be troublesome — but when anybody’s up for the duty it could be the world’s richest man.

3AC-related OX.FUN denies insolvency rumors, Bybit goes to warfare: Asia Specific

OX.FUN’s token holdings spur insolvency rumors, Bybit launches restoration portal in ‘warfare’ towards North Korean hackers, and extra.

Researchers by accident flip ChatGPT evil, Grok ‘attractive mode’ horror: AI Eye

Researchers uncover one easy trick to show ChatGPT evil, and Grok’s chemical weapon instruction handbook is simply barely much less horrifying than ‘attractive mode.’

Subscribe

Probably the most participating reads in blockchain. Delivered as soon as a

week.

Ciaran Lyons

Ciaran Lyons is an Australian crypto journalist. He is additionally a standup comic and has been a radio and TV presenter on Triple J, SBS and The Undertaking.