Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

CryptoQuant CEO Ki Younger Ju introduced right now that Bitcoin’s bull cycle “is over” and warned traders to brace for “6–12 months of bearish or sideways worth motion.” This improvement comes after the on-chain analytics veteran had beforehand urged warning however maintained a measured outlook in the marketplace as not too long ago as two weeks in the past.

Is The Bitcoin Bull Run Over?

In a put up shared right now through X, Ki acknowledged:“Bitcoin bull cycle is over, anticipating 6–12 months of bearish or sideways worth motion.”

Associated Studying

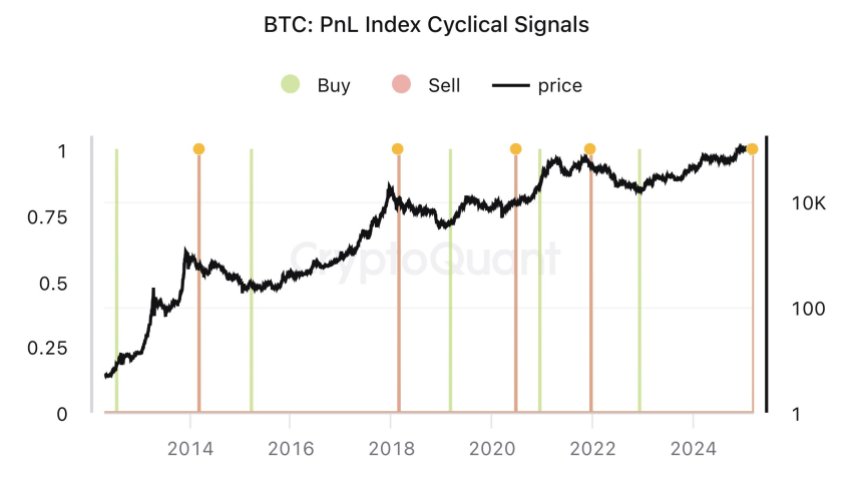

Together with the remark, the CEO highlighted the Bitcoin PnL Index Cyclical Alerts—an index that aggregates a number of on-chain metrics, similar to MVRV, SOPR, and NUPL, to pinpoint market tops, bottoms, and cyclical turning factors in Bitcoin’s worth. Based on Ki, this indicator has traditionally provided dependable purchase and promote indicators.

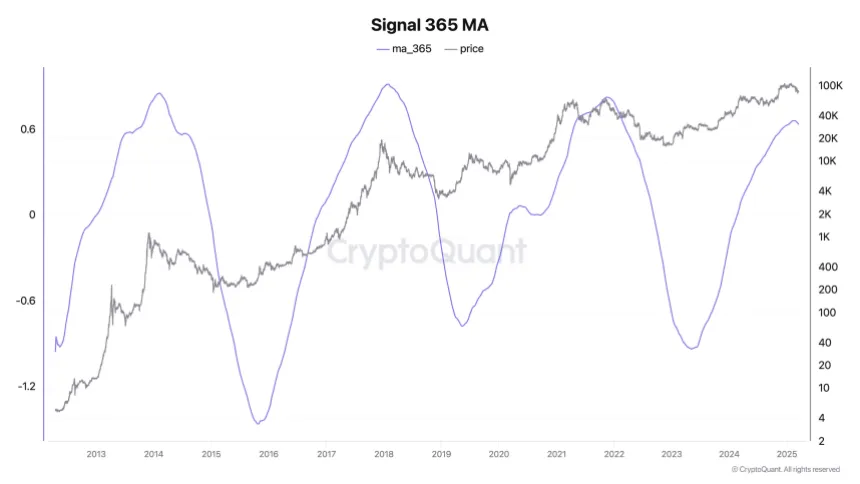

He additional defined how an automatic alert, beforehand despatched to his subscribers, mixed these metrics right into a 365-day shifting common. As soon as the development on this 1-year shifting common modifications, it usually indicators a big market inflection level. As proof, Ki additionally shared a chart: “This alert applies PCA to on-chain indicators like MVRV, SOPR, and NUPL to compute a 365-day shifting common. This sign identifies inflection factors the place the development of the 1-year shifting common modifications.”

Ki pointed to drying liquidity and recent promoting stress by “new whales” who, he mentioned, are unloading Bitcoin at decrease costs. Notably, he revealed that CryptoQuant customers who subscribed to his alerts obtained this sign earlier than right now’s public announcement. “With recent liquidity drying up, new whales are promoting Bitcoin at decrease costs. Cryptoquant customers who subscribed to my alerts obtained this sign a number of days in the past. I assume they’ve already adjusted their positions, so I’m posting this now.”

Associated Studying

This newest declaration contrasts remarks from simply 4 days in the past, on March 14, when Ki struck a extra cautious tone, stating: “Bitcoin demand appears caught, nevertheless it’s too early to name it a bear market.”

At the moment, he shared a chart of the Bitcoin Obvious Demand (30-day sum) indicator, which had turned barely destructive—an early sign that demand is likely to be really fizzling out. Though Ki identified that demand might nonetheless rebound (because it has in previous sideways phases), he acknowledged the opportunity of Bitcoin teetering on the sting of a bear market.

The pivot in sentiment is very notable given Ki’s stance from two weeks in the past. In that earlier put up, he opined that the “bull cycle continues to be intact,” crediting sturdy fundamentals and rising mining capability: “There’s no important on-chain exercise, and key indicators are impartial, suggesting the bull cycle continues to be intact. Fundamentals stay sturdy, with extra mining rigs coming on-line.”

Nevertheless, he additionally cautioned that the market might flip if sentiment didn’t enhance, notably in the USA. With right now’s announcement, the warning has evidently crystallized. Reflecting on the potential draw back situation, Ki mentioned on the time: “If the cycle ends right here, it’s an final result nobody needed—not previous whales, mining firms, TradFi, and even Trump. (FYI, the market doesn’t care about retail.)”

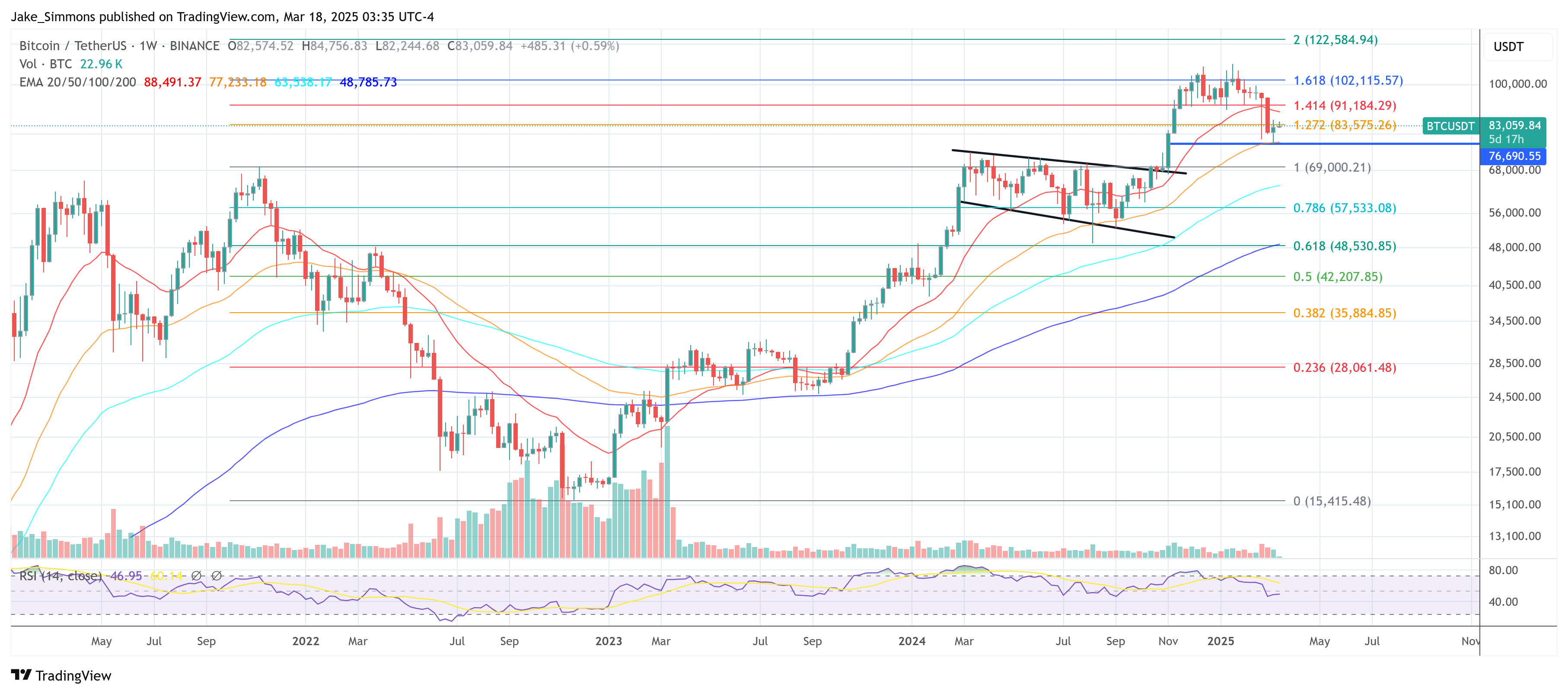

At press time, BTC traded at $83,059.

Featured picture created with DALL.E, chart from TradingView.com