Nigeria not too long ago confronted one of the crucial extreme financial crises. Inflation surged to document highs in the direction of the top of 2024. Regardless of some degree of easing, residents nonetheless endure inflationary pressures.

In the meantime, the Nigerian authorities is accelerating efforts to manage cryptocurrency transactions. Prospects are that interventions may increase income for the nation.

Nigeria Faces Inflationary Pressures

Nigeria, Africa’s most populous nation and largest economic system, has lengthy struggled with financial instability. Sources point out its annual inflation charge soared to 24.48% in January 2025 earlier than dropping to 23.18% in February.

The 1.3% decline suggests the federal government’s financial tightening measures could also be beginning to take impact. Nonetheless, the nation’s naira foreign money has devalued considerably. It misplaced 230% of its worth in opposition to the US greenback over the previous yr.

“The drop within the inflation charge is especially because of the rebase of the Client Worth Index (CPI), not an precise discount in value ranges or inflationary strain,” highlighted one citizen.

It comes because the nation’s import-dependent economic system is extremely susceptible to exterior shocks. In opposition to this backdrop, President Bola Tinubu’s administration applied daring financial reforms to stabilize the economic system.

Amongst them are the elimination of decade-long gasoline subsidies and the unification of the nation’s a number of change charges. Nonetheless, these measures triggered unintended penalties, resembling skyrocketing gasoline costs and a extreme cost-of-living disaster.

The consequences of inflation are significantly devastating in conflict-ridden areas the place communities depend on subsistence farming for meals.

Crypto as a Hedge With New Laws on the Horizon

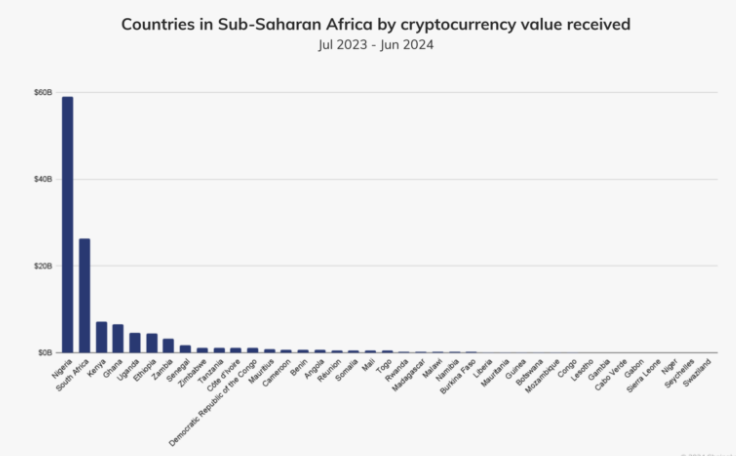

Amid the financial uncertainty, many Nigerians have turned to crypto as a hedge in opposition to inflation and foreign money depreciation. Blockchain analytics agency Chainalysis revealed that between July 2023 and June 2024, Nigerians traded roughly $59 billion in crypto property.

This surge in crypto adoption displays a rising mistrust within the conventional monetary system. It additionally suggests a want for extra secure and accessible monetary options.

Nigerian authorities are finalizing new laws in response to the rise in crypto adoption. They wish to combine digital asset transactions into the formal economic system.

The Nigerian SEC (Securities and Trade Fee) is drafting insurance policies to make sure all eligible transactions on regulated exchanges are integrated into the nation’s tax community.

A proposed invoice outlining taxation insurance policies for crypto transactions and different digital property is below legislative evaluate. The overall sentiment is that it’ll go inside the first quarter (Q1) of 2025.

In the meantime, the Central Financial institution of Nigeria (CBN) is stabilizing the foreign money and restoring investor confidence. Governor Olayemi Cardoso introduced that the financial institution had cleared $2.5 billion of the overseas change backlog, with one other $2.2 billion anticipated to be resolved quickly.

Nigeria’s President Tinubu has additionally ordered the discharge of meals reserves and establishing a commodity board to curb hoarding and stabilize costs.

Whereas Nigeria’s financial disaster leaves thousands and thousands struggling, the federal government’s intervention efforts involving crypto taxes and indicators of easing inflation counsel a possible turnaround. Nonetheless, a lot will depend on how successfully authorities implement their insurance policies and whether or not world financial situations stay favorable.

On the identical time, the nation’s cryptocurrency adoption presents each alternatives and challenges. If regulated correctly, digital property may present Nigerians with monetary options that assist them navigate financial instability.

However, hanging a steadiness between innovation and regulation will be certain that crypto stays a viable resolution slightly than a supply of recent monetary dangers.

“At the moment, Nigeria wants huge funding in each formal {and professional} training; that is important to extend our expert labor drive and be competent in at present’s world digital economic system.Particular consideration must be paid to areas in Blockchain, Digital Property, Web3,” one person shared on X.

Disclaimer

In adherence to the Belief Undertaking pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nonetheless, readers are suggested to confirm info independently and seek the advice of with knowledgeable earlier than making any selections primarily based on this content material. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.