Decentralized perpetual change (DEX) Hyperliquid (HYPE) has reached a major milestone, surpassing $1 trillion in complete perpetual contract (perps) buying and selling quantity.

This achievement comes regardless of a broader market downturn, the place main sectors have posted losses. Whereas there was slight development right now, it stays minimal, highlighting the market’s challenges.

Hyperliquid Dominates Perps Market

In line with knowledge from DeFiLlama, Hyperliquid perps’ cumulative buying and selling quantity has surged to $1.1 trillion. This rise in exercise highlights its rising enchantment amongst merchants.

Moreover, as reported by Dune Analytics, weekly volumes have ranged between $40 billion and $50 billion. In truth, the platform now instructions over 60% of the market share amongst perps platforms, solidifying its place as a powerhouse in decentralized finance (DeFi).

Apart from its market dominance, Hyperliquid has made headlines for being central to a significant growth. As BeInCrypto reported, the platform gained widespread consideration after a whale dealer opened a 40x leverage BTC brief place value $423 million, triggering a “whale hunt.”

Nonetheless, the developments haven’t executed a lot for the platform’s native token, HYPE. As a substitute, it has been underperforming, sustaining a constant downtrend.

Over the previous day, it has depreciated by 3.4%. At press time, it traded at $12.9, marking lows not seen since December 2024. Furthermore, the platform has confronted elevated scrutiny following issues about potential cash laundering.

Analyst Forecasts: Will HYPE Attain $100?

Regardless of these struggles, an analyst predicted that HYPE might attain $50-$100, citing its standing because the main crypto DEX and its high-throughput Layer 1 blockchain.

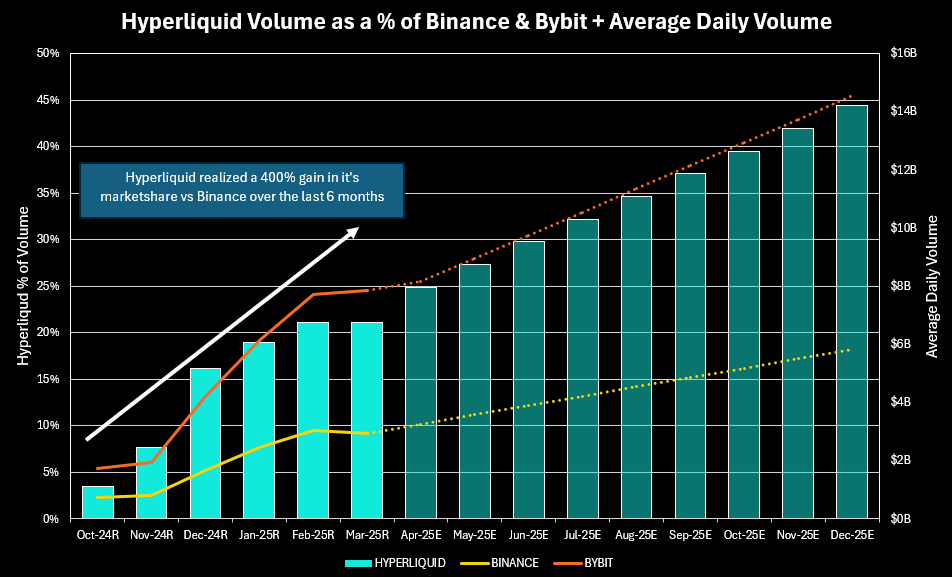

Within the newest X (previously Twitter), he highlighted Hyperliquid’s spectacular development. The platform averages $6.7 billion in each day quantity, a major improve from $1.1 billion in October. This surge has elevated its market share relative to Binance, leaping from 2% to 9% in simply six months.

“If Hyperliquid can keep only a fraction of its development fee, we might see it attain ~20% of Binance’s volumes by the top of the 12 months,” the put up learn.

In line with the analyst, this growth might considerably increase the HYPE token’s valuation.

“If Hyperliquid is ready to attain 20% of Binance’s quantity, I feel we might simply see $40-50 HYPE with the uptick in earnings and a slight a number of growth,” he stated.

He additionally highlighted a number of elements that would gas Hyperliquid’s continued success. The current addition of native spot Bitcoin (BTC) buying and selling, coin margin performance, and the potential of launching a delta-neutral stablecoin are seen as main catalysts for future development.

One other key growth is the evolution of Hyperliquid’s Layer 1 blockchain ecosystem. The platform has attracted over 50 initiatives and holds over $2.3 billion in USDC and BTC deposits.

The analyst added that Hyperliquid has a robust potential to ascertain itself because the third most used blockchain, following Ethereum (ETH) and Solana (SOL), throughout the subsequent few years.

“Given ETH and SOL are value $230 billion and $75 billion, respectively what does that make Hyperliquid’s potential L1 valuation? Even at 15-25% of ETH or SOL, that provides one other $10-50 to the token worth. $50 for the perps/spot/stablecoin product + one other $50 for the L1 and $100 HYPE appears potential,” he predicted.

Disclaimer

In adherence to the Belief Challenge tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nevertheless, readers are suggested to confirm info independently and seek the advice of with an expert earlier than making any selections based mostly on this content material. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.