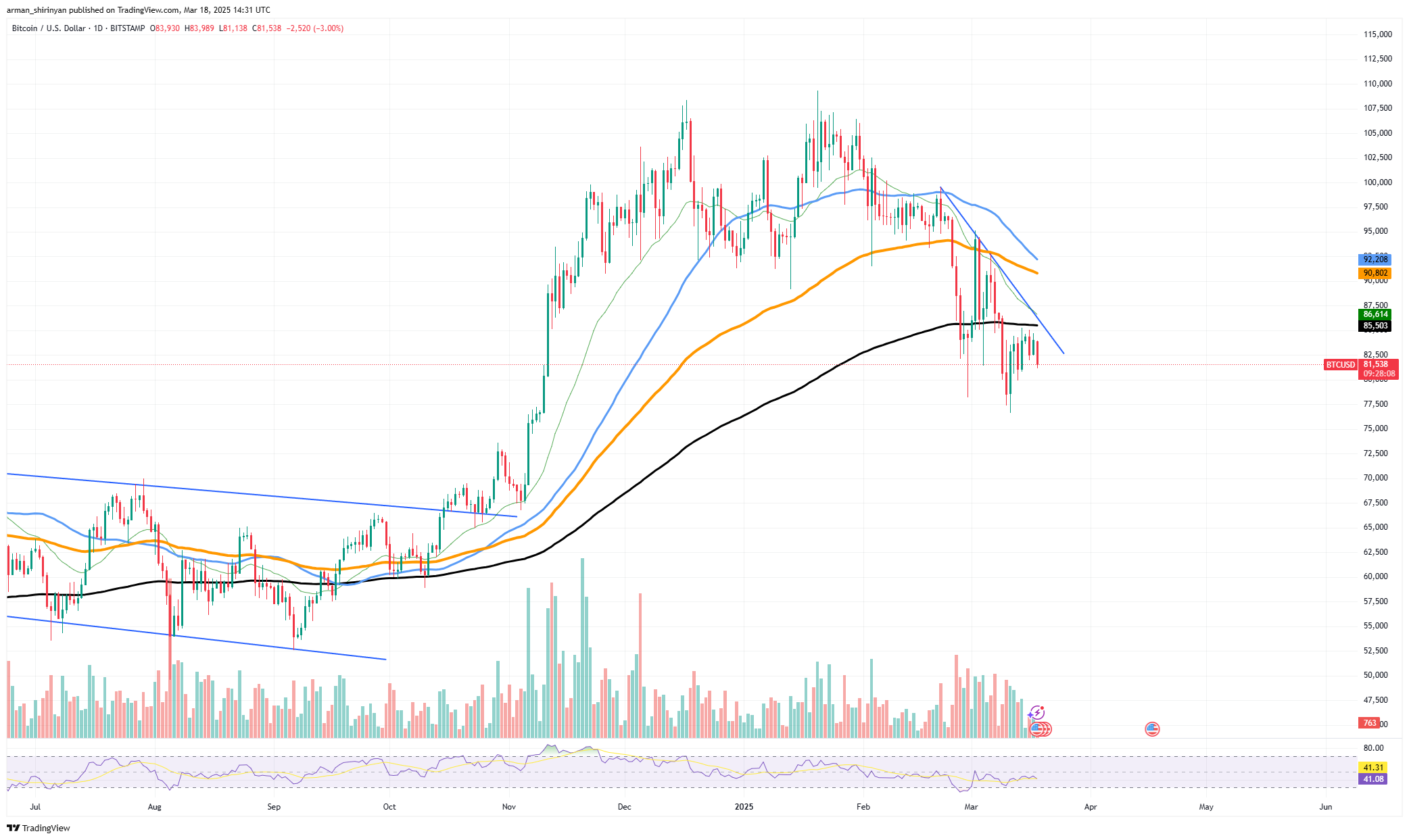

The worth of Bitcoin remains to be struggling as technical resistance ranges put growing stress on the asset. The 200-day Exponential Transferring Common, an important degree for development reversals, has as soon as once more rejected Bitcoin following a short restoration try. The lack to beat resistance prompts worries about further downward motion within the upcoming weeks.

The worth of Bitcoin is presently buying and selling at about $82,000 persevering with the downward development that started with its current highs. The asset is unable to get well its upward momentum because of the rejection on the 200 EMA, which signifies that bearish sentiment remains to be prevalent. Moreover, there was a constant drop in buying and selling quantity, indicating weak shopping for stress and leaving Bitcoin open to a different doable sell-off.

The market has gotten worse as Bitcoin has had hassle establishing a robust degree of assist. Since sellers are taking again management, as proven by the chart’s current decrease highs, Bitcoin might return to earlier assist areas. The following essential assist for Bitcoin, which might sign a extra profound correction section, could be within the $75,000 vary whether it is unable to carry the $80,000 mark.

The bigger cryptocurrency market has been turbulent as effectively, with main altcoins experiencing difficulties much like these of Bitcoin. Resulting from ongoing market pressures from regulatory points and macroeconomic uncertainties, investor sentiment remains to be cautious. The concept that Bitcoin won’t have sufficient momentum for a short-term restoration is additional supported by the Relative Energy Index (RSI), which remains to be in impartial territory however is starting to weaken.

The failure of Bitcoin to get well important resistance ranges raises the likelihood {that a} bearish cycle will proceed. Bitcoin might face extra downward stress quickly if there may be not a big change available in the market or a spike in shopping for quantity. As a result of a breakdown under this degree may result in a extra important decline, merchants ought to monitor the $80,000 assist degree.

Dogecoin in hassle

Because it tries to breach the essential resistance degree at $0.18, Dogecoin remains to be beneath downward stress. The asset has not been in a position to transfer previous this barrier despite a number of makes an attempt, suggesting that the market shouldn’t be robust sufficient to drive costs larger. This important rejection implies that DOGE remains to be prone to further declines.

One important impediment that has saved DOGE from reaching its prior highs is the $0.18 resistance. The worth of Dogecoin falls each time it will get near this degree resulting from elevated promoting stress. The market’s common weak point and the absence of considerable shopping for assist at present ranges are each mirrored within the incapability to beat resistance.

The growing affect of a dying cross, a bearish technical sample by which the short-term transferring common crosses under the long-term transferring common, is contributing to Dogecoin’s difficulties. The likelihood of a short-term restoration is diminished, indicating a protracted downward development. DOGE might expertise ongoing sell-offs and feeble reversal makes an attempt so long as this bearish formation is current.

The following necessary assist space is positioned round $0.16 if DOGE is unable to get well larger ranges. A break under this degree may result in further drops and probably a take a look at of the decrease assist zone round $0.14. Dogecoin traders proceed to be involved concerning the market’s incapacity to keep up bullish momentum.

Solana’s ascending triangle

After a protracted drop, Solana remains to be beneath loads of downward stress and is having hassle getting again on monitor. However its difficulties, a faint however probably encouraging sign — the event of a better low — has surfaced. By exhibiting that consumers are coming into the market at marginally larger ranges, this technical sample incessantly factors to a possible reversal and should set the stage for a extra regular restoration.

Solana’s outlook for the general market remains to be tough, although. Resulting from a dying cross on the charts, which occurred when the short-term transferring averages fell under the long-term averages, the asset has been trapped in a steady downward development. Such patterns sometimes point out protracted bearish situations, which makes it difficult for SOL to exit its present vary.

Technically, any doable restoration can be severely hampered by the resistance ranges of $143 and $169. Solana shouldn’t be prone to create any long-term bullish momentum till it clearly breaks above these ranges. Moreover, the decrease highs recorded throughout earlier restoration makes an attempt level to a steady battle in opposition to promoting stress. The overall temper of the market also needs to be taken under consideration.

It could be harder for already-weak belongings like Solana to make a comeback as your entire cryptocurrency market turns into unstable. SOL could be uncovered to further draw back dangers if Bitcoin and different important belongings don’t get well. Despite these worries, the next low signifies that consumers are considerably resilient. It’d take a look at its quick resistance ranges if Solana can keep above the $125 mark and decide up steam.

Then again, if assist shouldn’t be maintained, the downward development might proceed, leaving the asset susceptible to further losses. Because of the asset’s present important juncture, merchants and traders ought to preserve an in depth eye on Solana’s value motion within the days forward. In the end investor confidence and common market situations will decide whether or not this hidden value sign alerts an actual restoration or only a temporary lull in its bearish development.