Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Dogecoin (DOGE) closed final week on a bullish word after testing vital technical ranges that would outline its subsequent directional transfer. The weekly chart on Binance (DOGE/USDT) reveals that DOGE is at the moment buying and selling simply above the numerous 0.786 Fibonacci retracement degree at $0.167. This retracement is drawn from the all-time low at $0.0805 to the height of $0.4844.

Dogecoin Reversal Confirmed?

A notable technical improvement is the interplay with a long-standing descending trendline, extending from the Might 2021 all-time excessive. DOGE just lately retested this trendline as assist after breaking above it in November 2024.

Final week’s candle printed a Hammer-like formation, characterised by a small actual physique close to the high quality and a considerably longer decrease shadow. Whereas the candle additionally shows a modest higher wick, the dominance of the decrease shadow indicators that patrons absorbed aggressive promote strain beneath the trendline and pushed the value again above the 0.786 Fibonacci degree – a robust bullish sign.

Associated Studying

Nevertheless, this week might be as necessary as final week. A weekly shut above $0.167 appears important to verify the momentum. In any other case, one other check of the multi-year trendline might grow to be a make-or-break second for the Dogecoin worth.

Notably, momentum indicators stay impartial to bearish. The weekly Relative Energy Index (RSI) closed round 39, reflecting subdued shopping for energy and highlighting that DOGE continues to be working beneath the impartial 50 mark.

The Exponential Shifting Averages (EMAs) are offering layered resistance above the present worth.

The 100-week EMA lies at $0.17284, positioned simply above DOGE’s present vary, whereas the 50-week EMA is positioned at $0.21427. The 20-week EMA, the extra rapid resistance throughout earlier rallies, now sits at $0.24805. Help is bolstered on the 200-week EMA round $0.13621, a degree that will possible function a final line of protection ought to DOGE crash beneath the multi-year trendline.

Associated Studying

Worth motion in current weeks additionally reveals DOGE breaking down from a bearish flag or channel formation, with the breakdown accelerating towards the confluence of the 0.786 Fibonacci degree and the descending trendline retest. Regardless of this, the market responded with robust shopping for curiosity within the highlighted purple assist zone.

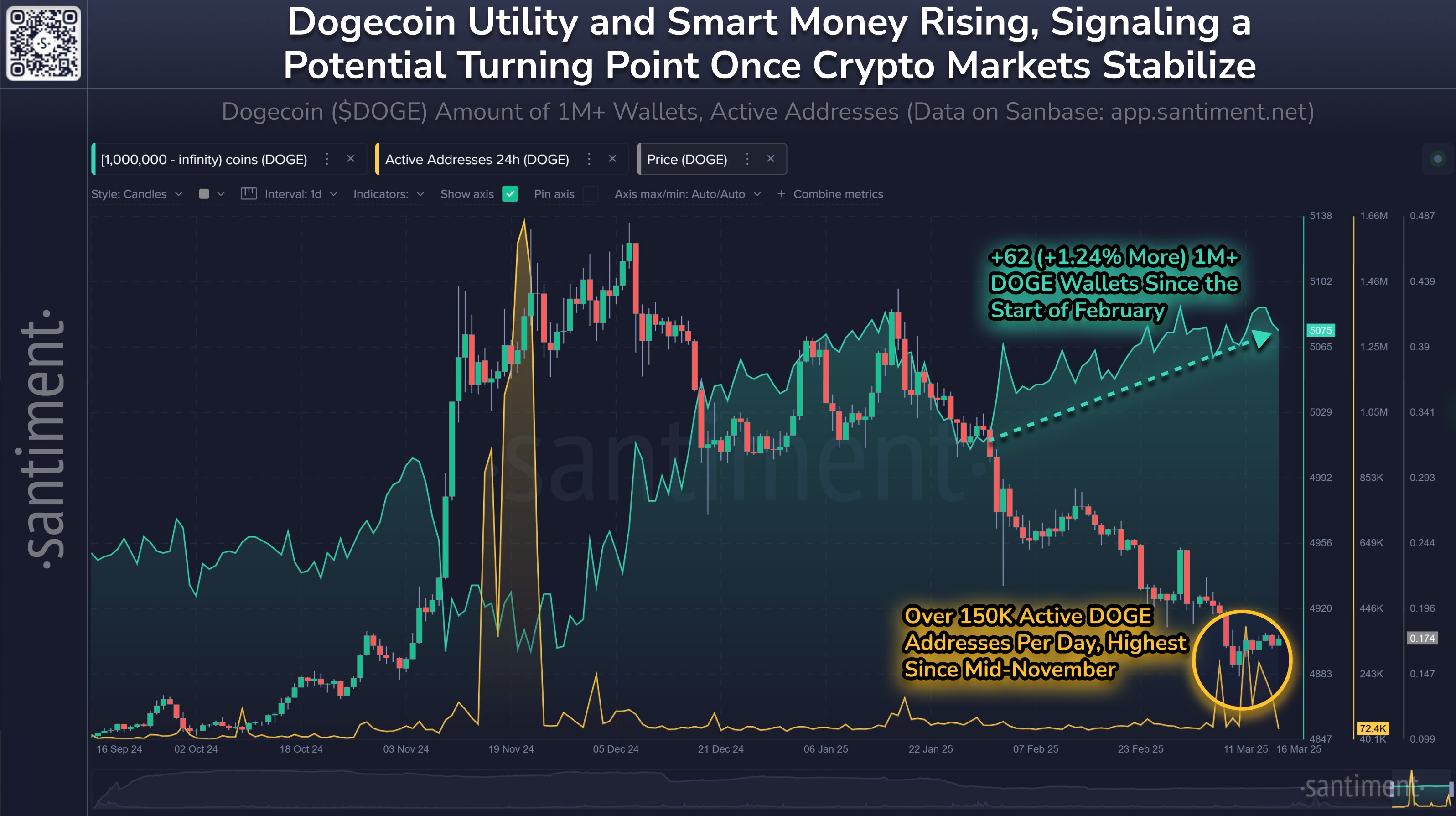

On-chain knowledge additional contextualizes the current worth motion. Analytics agency Santiment reported through X right this moment that Dogecoin, like most meme cash, has been closely impacted through the ongoing two-month market-wide retracement. Nevertheless, Santiment identified a bullish divergence on the community facet.

The agency states: “Dogecoin, like most meme cash, have been hammered through the 2-month crypto-wide retrace. Nevertheless, we suggest maintaining a tally of the rising degree of wallets holding not less than 1M $DOGE, which has recovered through the worth dump. Energetic addresses are additionally at 4-month highs.”

Including to this sentiment, crypto analyst Daan Crypto Trades commented through X: “DOGE just like PEPE however has already retaken the Election degree after sweeping it. I believe these are key ranges to maintain watching on a number of these alts. A sweep & retake indicators some quick time period aid and these ranges can provide a clear invalidation degree afterwards.”

This aligns with the technical statement that DOGE’s current worth motion might characterize a sweep of liquidity beneath a key degree, adopted by a restoration above assist — a typical short-term bullish reversal sample in crypto markets.

Featured picture created with DALL.E, chart from TradingView.com