Ethereum (ETH) has been struggling to keep up upward momentum regardless of repeated makes an attempt to recuperate. Current value actions present Ethereum buying and selling at $1,936, hovering simply above the crucial $1,862 assist.

Nonetheless, the shortage of volatility and declining market curiosity might push the worth down additional, probably reaching a 17-month low.

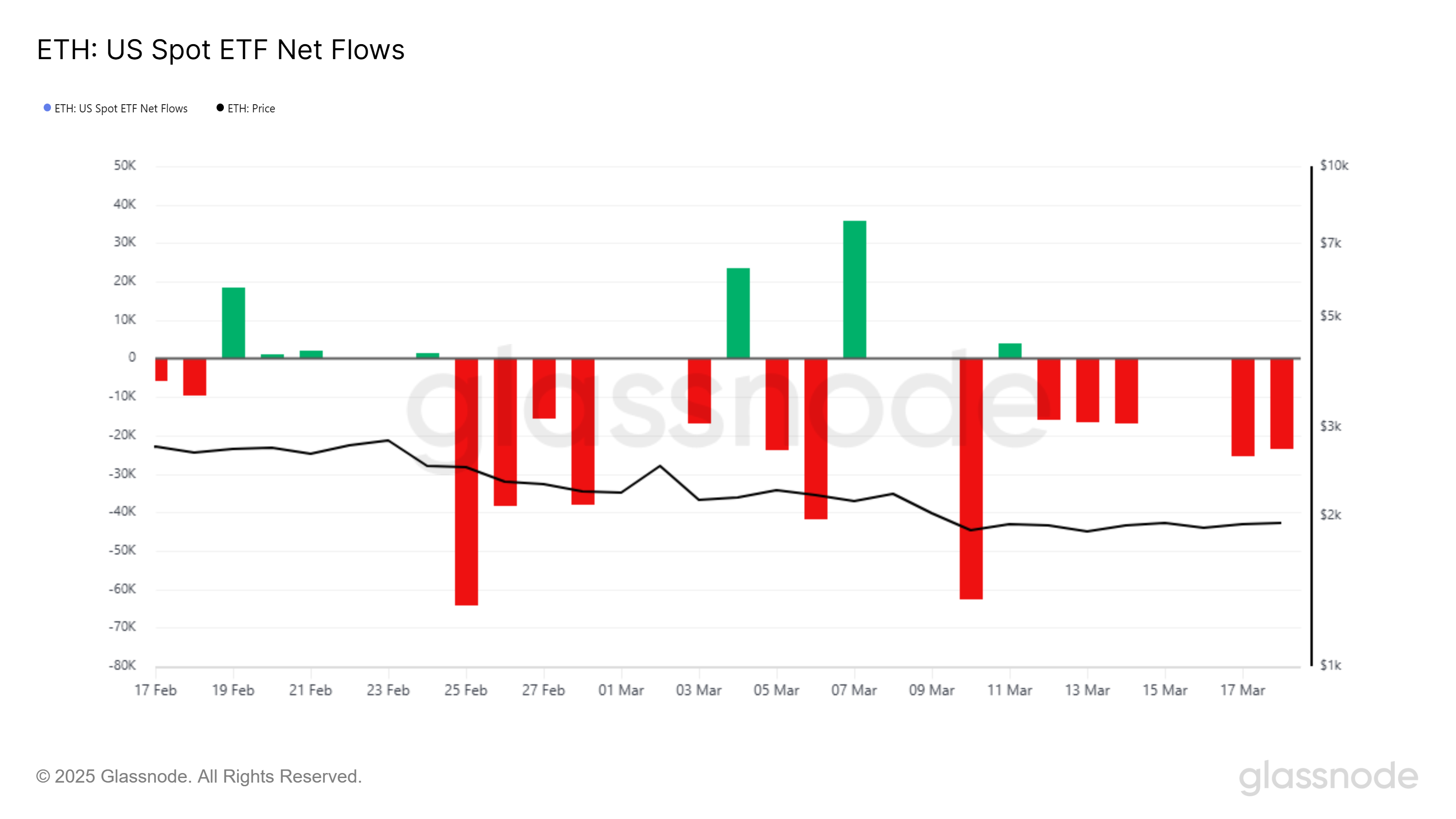

Ethereum ETFs Witness Outflows

Ethereum’s spot ETF has skilled important outflows over the previous month, highlighting declining curiosity within the cryptocurrency. Within the final 48 hours alone, practically 49,000 ETH had been withdrawn from the ETF, signaling that buyers could also be dropping confidence in Ethereum’s short-term prospects.

The sustained outflows replicate a broader market sentiment that has been bearish towards Ethereum. Whereas there have been some cases of inflows, they had been far outweighed by the outflows. Because of this, the market’s religion in Ethereum’s quick restoration stays low.

Technical indicators recommend that Ethereum’s value could also be in for additional challenges. The Bollinger Bands are nearing a squeeze, a sign that volatility is imminent. Traditionally, when the candlesticks seem above the baseline of the Bollinger Bands throughout such squeezes, the worth tends to dip quite than surge. This raises considerations that Ethereum could expertise a major value drop if the sample continues.

Moreover, Ethereum’s lack of ability to interrupt free from the downward pattern displays a scarcity of momentum. Regardless of earlier makes an attempt to recuperate, the technical indicators level to continued strain on the cryptocurrency. If this sample holds, Ethereum’s value might wrestle to keep up its present ranges and face additional declines.

ETH Value Is Holding On

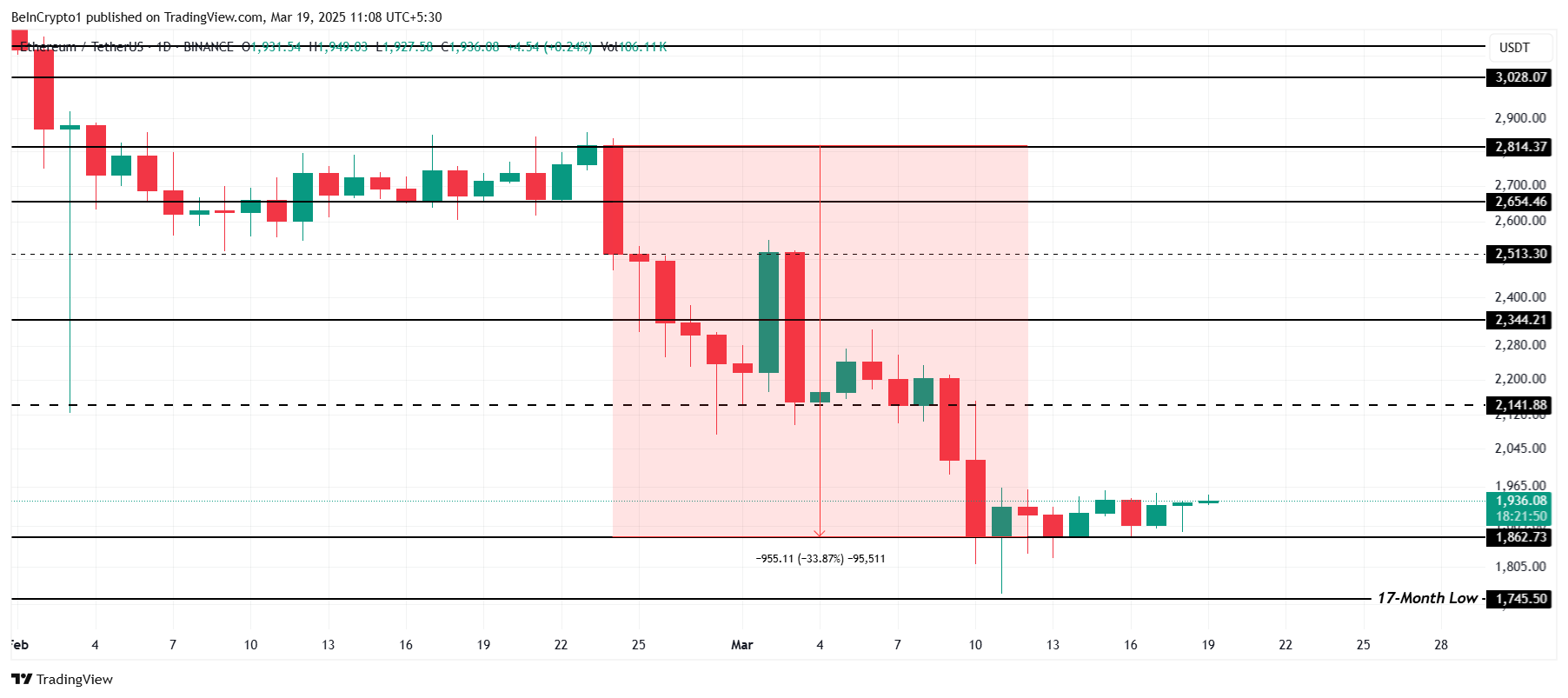

Ethereum has seen a 33% decline over the previous month, with its value dropping sharply towards the tip of February and early March. Presently buying and selling at $1,936, Ethereum is holding above the $1,862 assist stage.

Nonetheless, if the bearish pattern continues, Ethereum might break by way of this assist and fall to $1,745. Such a transfer would mark a 17-month low, additional testing market confidence.

If Ethereum continues to face promoting strain, additional declines might happen, presumably taking the worth right down to $1,500. The mix of weak ETF inflows and bearish technical indicators means that downward momentum is extra probably than a fast restoration.

Nonetheless, there may be nonetheless a possible for restoration if Ethereum capitalizes on the upcoming Pectra improve. Ought to the improve spark renewed curiosity from institutional buyers and improve ETF inflows, Ethereum’s value might rise again as much as $2,141, serving to to recuperate a number of the losses.

Disclaimer

In keeping with the Belief Challenge pointers, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. All the time conduct your personal analysis and seek the advice of with an expert earlier than making any monetary choices. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.