Onyxcoin (XCN) has maintained its downward trajectory, plummeting by 10% over the previous week as bearish sentiment grips the market.

With extra merchants turning away from the altcoin, its energetic tackle depend has seen a pointy fall, signaling a lack of curiosity within the asset and low community participation.

XCN Struggles as Quick Sellers Take Management

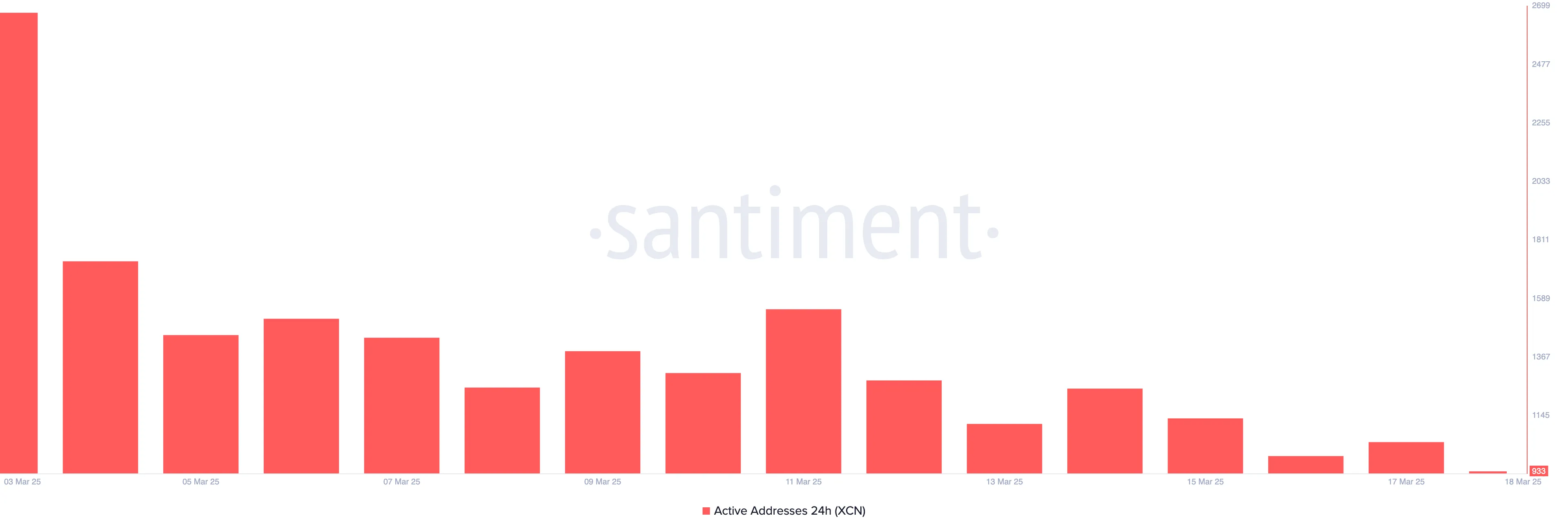

Since early March, Santiment’s knowledge has revealed an aggressive fall in XCN’s day by day energetic tackle depend.

In keeping with the on-chain knowledge supplier, on March 3, 2,673 distinctive addresses accomplished at the very least one transaction involving XCN. Since then, this determine has steadily declined, hitting a low of 1,044 on March 18.

This decline highlights waning community exercise on Onyxcoin and the decreased demand for its altcoin, reinforcing the bearish sentiment surrounding XCN.

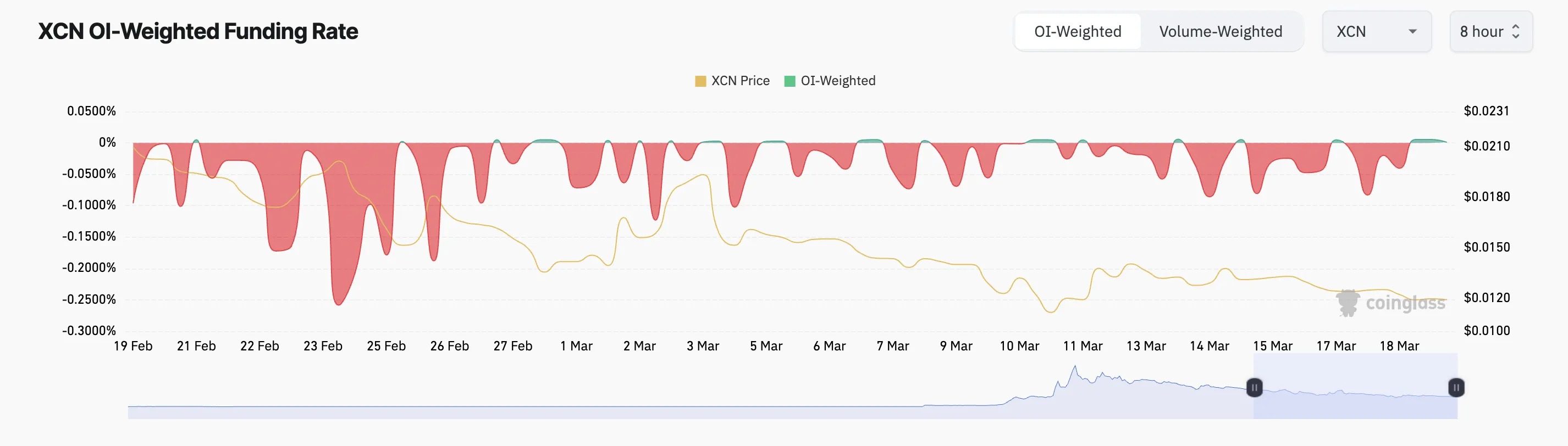

Furthermore, the month has been marked by a big rise within the demand for brief positions, as mirrored by the altcoin’s predominantly detrimental funding fee.

An asset’s funding fee is a periodic payment exchanged between its lengthy and brief merchants in perpetual futures contracts. When the funding fee is usually detrimental, brief sellers dominate the coin’s futures markets.

The rising demand for XCN shorts highlights the market’s bearish outlook. Sellers are sustaining management and limiting any potential short-term restoration.

XCN Faces Sturdy Promoting Strain

The token’s Chaikin Cash Movement (CMF) helps this bearish outlook. At press time, the momentum indicator is under zero at -0.19.

The CMF indicator measures fund flows into and out of an asset. When its worth is detrimental, promoting stress outpaces shopping for exercise. This means the chance of an extra value decline as demand stays weak. On this state of affairs, XCN’s value might slip to $0.0075.

Conversely, the token’s value might rocket towards $0.022 if consumers regain market management.

Disclaimer

According to the Belief Challenge pointers, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. All the time conduct your personal analysis and seek the advice of with an expert earlier than making any monetary choices. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.