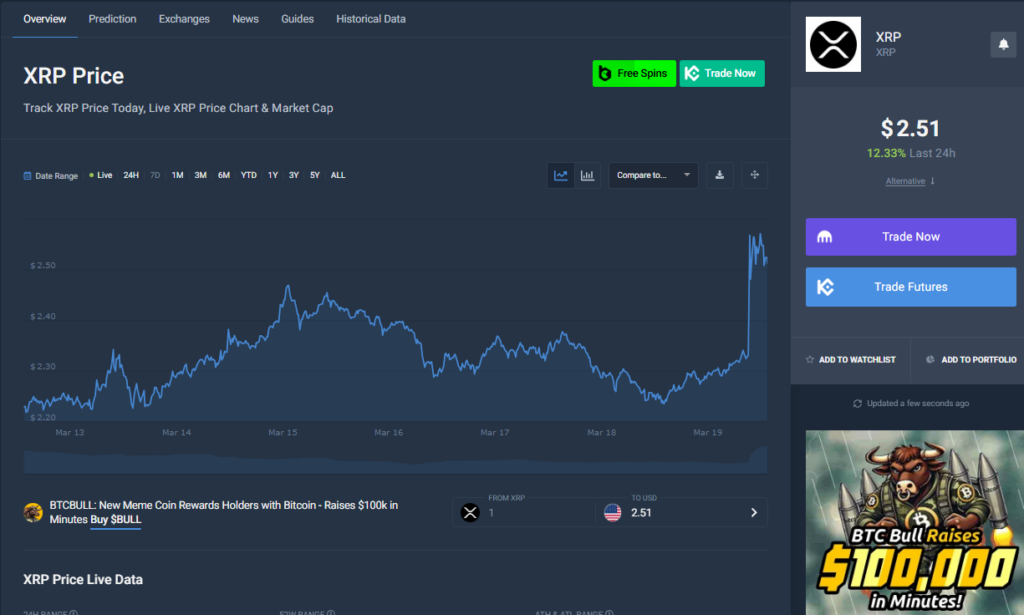

- XRP surged 11% to $2.52 after the SEC dropped its enchantment in opposition to Ripple.

- Ripple CEO Brad Garlinghouse slammed the SEC, calling the authorized battle a “dangerous religion” assault on crypto.

- XRP is up over 390% post-election, as regulatory uncertainty fades and momentum builds.

XRP skyrocketed after Ripple CEO Brad Garlinghouse revealed that the U.S. Securities and Change Fee (SEC) has deserted its enchantment in its long-running case in opposition to the funds firm.

The worth of XRP spiked almost 11%, hitting $2.52, following the announcement.

Garlinghouse Slams the SEC’s Authorized Battle

“It’s been nearly 4 years and three months because the SEC first sued us—an exhausting journey in some ways,” Garlinghouse mentioned on the Digital Property Summit in New York on Wednesday. “I’ve at all times believed we had been on the fitting facet of the regulation and, frankly, on the fitting facet of historical past.”

Taking a direct shot at regulators, he added: “The system simply feels damaged. We needed to struggle not only for Ripple however for your entire trade, whereas the SEC relentlessly attacked crypto. There have been no victims, no investor losses—only a dangerous religion marketing campaign in opposition to innovation.”

Ripple’s Authorized Battle: A Landmark Case

The authorized struggle started again in 2020, when the SEC sued Ripple for allegedly violating U.S. securities legal guidelines by promoting XRP with out registering it as a safety. Ripple secured a partial victory in 2023 when U.S. District Choose Analisa Torres dominated that XRP will not be a safety when bought on exchanges to retail buyers. Nevertheless, the ruling said that institutional gross sales had been thought of unregistered securities choices.

Now, the SEC’s withdrawal marks a big shift in regulatory stance—probably setting a precedent for future crypto circumstances.

The SEC Softens Its Crypto Stance

The choice to again off Ripple aligns with the SEC’s latest pivot away from strict enforcement actions within the crypto area. In simply the previous month, the company has:

- Ended its enforcement case in opposition to Coinbase.

- Closed investigations into Robinhood’s crypto unit, Uniswap, Gemini, and Consensys with no additional motion.

- Scaled again its crypto enforcement unit.

- Formally declared meme cash should not securities.

Moreover, the newly fashioned SEC crypto job pressure is launching roundtable discussions to outline the safety standing of digital property—a sign that the company could also be in search of a extra balanced regulatory method.

XRP’s Position and Market Influence

XRP was created in 2012 by Ripple’s founders and serves because the native token of the XRP Ledger, an open-source blockchain used for cross-border funds. With 95% of Ripple’s enterprise going down exterior the U.S., the SEC’s authorized assault had lengthy been seen as a roadblock to its enlargement.

Ripple stays the most important holder of XRP, and the token has seen an explosive rally post-election. Since then, XRP has surged over 390% and is up 20% this 12 months alone, making it one of many strongest performers within the crypto market.

With regulatory uncertainty fading and momentum constructing, may XRP lastly be prepared for a sustained breakout?