Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

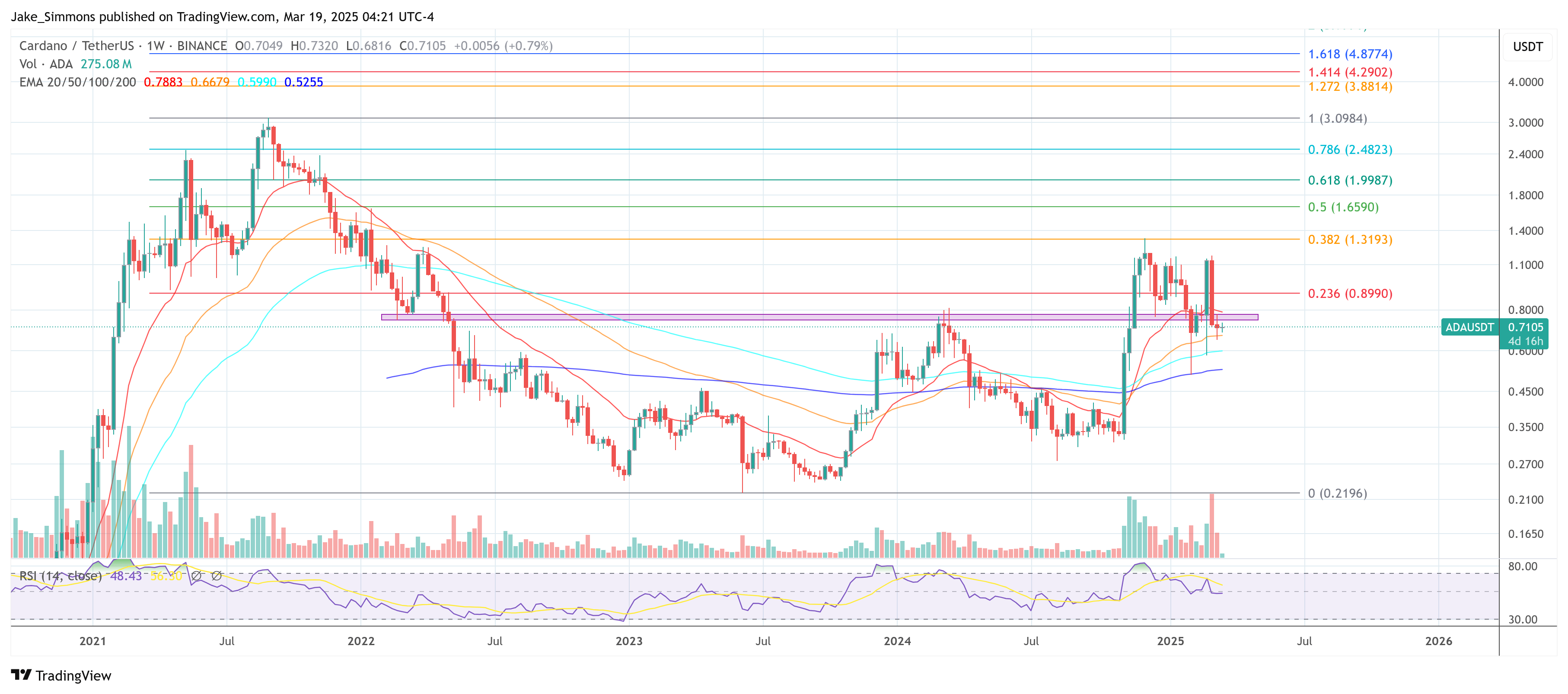

Regardless of excessive optimism amongst Cardano (ADA) supporters, a have a look at the weekly chart (ADA/USDT) suggests the exuberance could also be untimely. Whereas bullish sentiment has grown in tandem with current regulatory nods, ADA’s value motion stays underneath crucial resistance, flashing cautionary indicators comparable to a bearish engulfing sample.

Cardano: Rising Hype Vs. Bearish Technicals

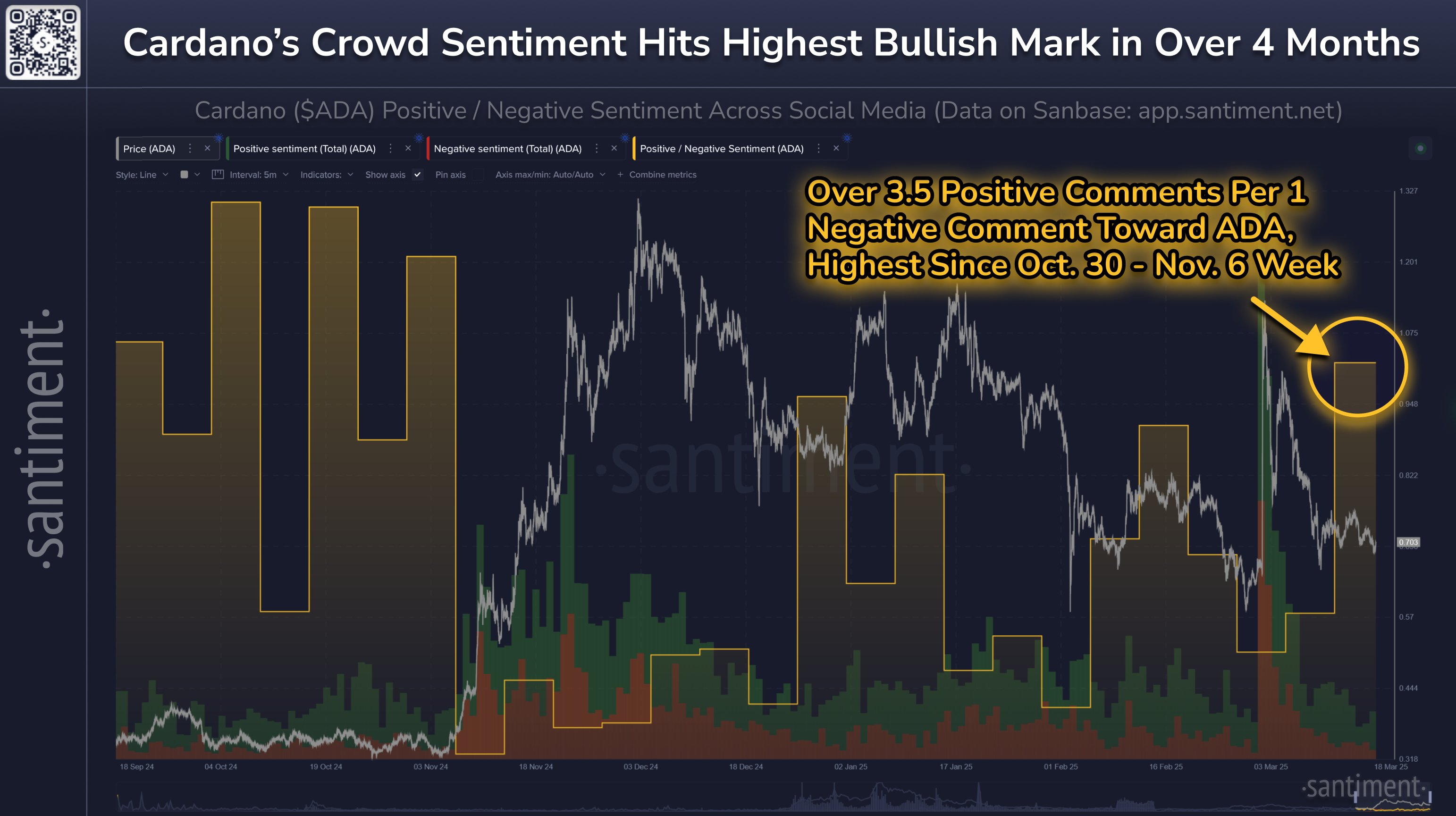

On-chain analytics agency Santiment notes right now a definite rise in social media optimism for Cardano on X: “Particular altcoins like Cardano are seeing excessive constructive sentiment on social media. Aided by the truth that the SEC categorized ADA’s use case as ‘sensible contracts for presidency providers,’ the altcoin’s group has pushed up bullishness to its highest charge in over 4 months.”

Associated Studying

Santiment additional highlights that Cardano’s crowd sentiment has hit the best bullish mark in over 4 months. “Over 3.5 constructive feedback per 1 detrimental remark towards ADA, highest since Oct. 30 – Nov. 6 week,” Santiment notes.

Nonetheless, this social media euphoria hasn’t translated in a bullish value motion but. At present buying and selling round $0.71, ADA has as soon as once more pulled again after ADA was introduced to be included within the Strategic Crypto Stockpile by US President Donald Trump. Of explicit concern to technical merchants is the bearish engulfing candle that shaped after the announcement and the next retreat. This sample occurred three weeks in the past when the big pink candle fully encompassed the prior inexperienced candle’s value vary, probably indicating a shift in momentum again towards the bears.

Since then, ADA retraced additional. On the transferring averages entrance, Cardano stays sandwiched beneath the 20-week EMA at $0.7883, which itself is trending downward. Beneath present costs, the 50-week EMA at $0.6679, the 100-week EMA at $0.59, and the 200-week EMA at $0.5255 might act as layered assist. If ADA fails to safe a foothold above $0.74-$0.78, these EMAs turn into more and more related for gauging further draw back danger.

Associated Studying

Tracing Fibonacci retracements from the all-time excessive at $3.0984, the chart reveals further checkpoints above present resistance. The 0.236 Fib degree at $0.8990 stands as essentially the most essential boundary if bulls can clear $0.78. Past that, $1.3193 (0.382 Fib), $1.6590 (0.5 Fib), and $1.9987 (0.618 Fib) characterize extra distant aims tied to broader restoration situations.

Nonetheless, the bearish engulfing formation underscores the fact that momentum not too long ago swung again to sellers’ favor. Sometimes, such a sample suggests elevated downward stress, a minimum of within the brief to medium time period, until a swift upside transfer reverses the underlying pattern. This appears to play out for the time being. The Relative Energy Index (RSI) close to 48 confirms this lingering indecision.

At present, the broader altcoin market at the moment seems closely influenced by declining Bitcoin dominance and overarching macroeconomic circumstances. All eyes are on right now’s FOMC assembly and the up to date dot plot, which shall be pivotal for danger property. Any indication of quantitative tightening (QT) easing or dovish indicators might function a catalyst for renewed energy throughout the altcoin sector.

Featured picture from Shutterstock, chart from TradingView.com