The co-founders of the crypto analytics platform Glassnode imagine that for Bitcoin (BTC) to enter a powerful uptrend, key metrics have to align.

Jan Happel and Yann Allemann, who go by the deal with Negentropic, inform their 63,100 followers on the social media platform X that primarily based on historic priority, three components should line up for Bitcoin to take off on a sustained bull run.

The analysts embrace the Bitcoin Threat Sign as a key component, which gauges whether or not BTC is prone to a significant drawdown in value. Glassnode says it’s “primarily based on a set of proprietary indicators, together with bitcoin value knowledge, on-chain knowledge, and a number of different buying and selling metrics.”

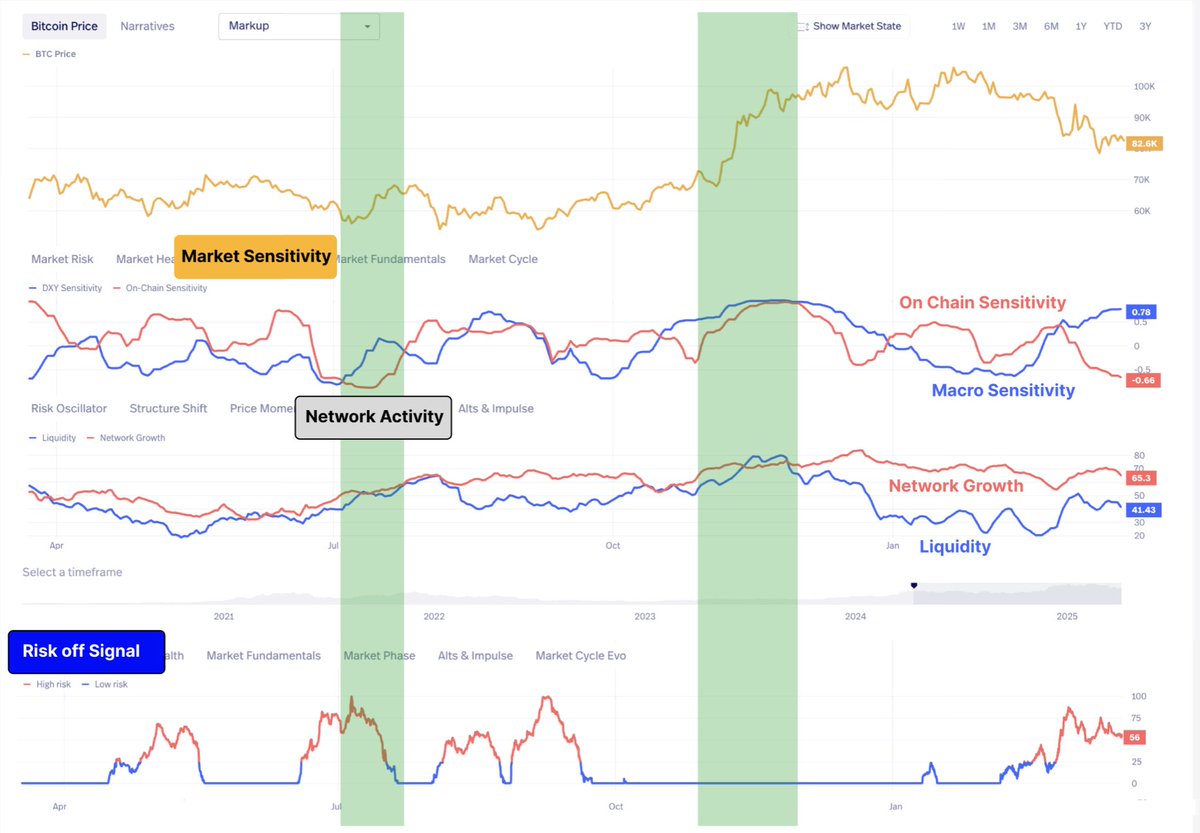

“For Bitcoin value to rally with conviction, we’d like an alignment of three components (inexperienced areas): Market sensitivity:

- Bitcoin correlation with macro and on-chain exercise.

- Community exercise: community development and community liquidity.

- Threat off sign: danger sign or at 0. Indicating falling or small likelihood of capitulation.”

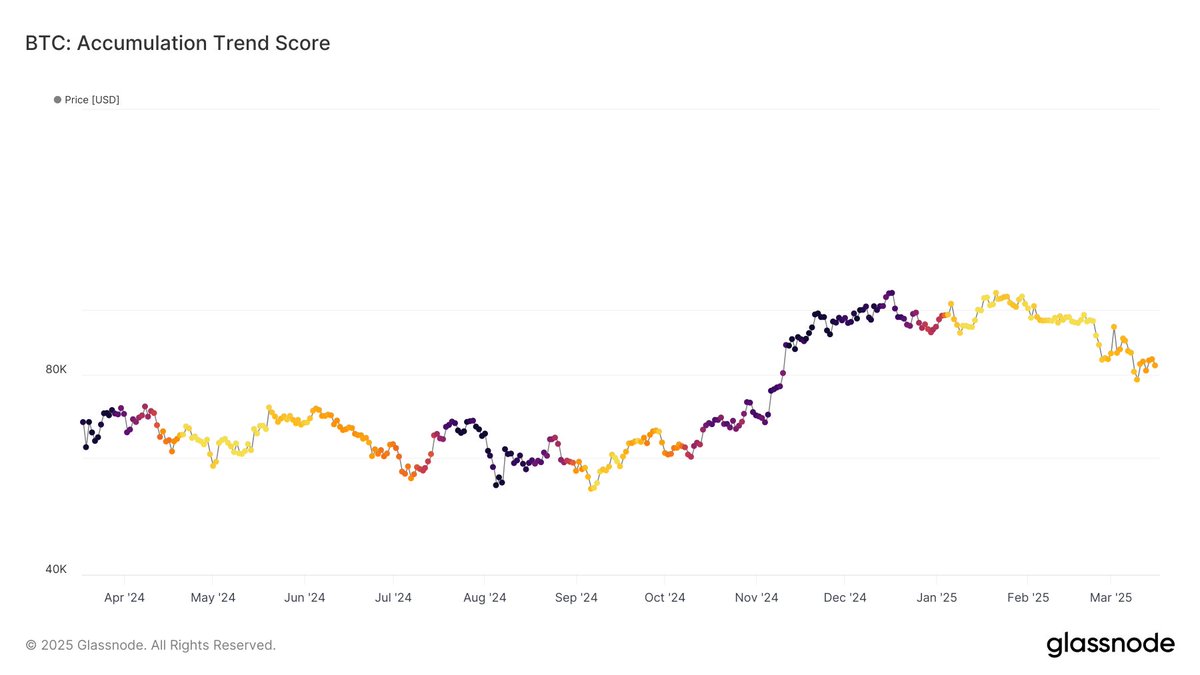

Allemann and Happel’s crypto agency Glassnode says that one other key metric suggests accumulation of Bitcoin is beginning to emerge as a market development.

“Since March eleventh, Bitcoin’s Accumulation Pattern Rating has risen above 0.1, indicating some shopping for through the latest downtrend. Whereas distribution stays dominant, this shift suggests early indicators of accumulation.”

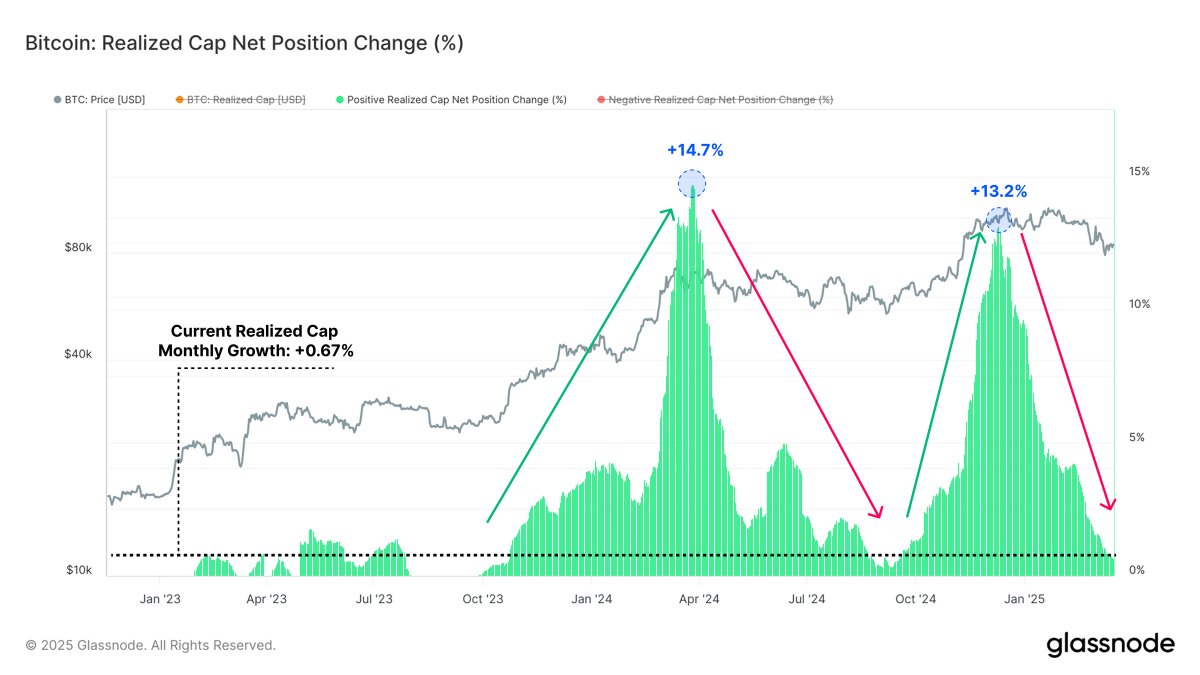

Glassnode additionally says that Bitcoin’s realized cap internet place change is suggesting that profit-taking and capital inflows are slowing.

The realized cap internet place change tracks an asset’s capital inflows and outflows with constructive values indicating accumulation.

“The Bitcoin market continues to regulate to its new value vary after experiencing a -30% correction. Liquidity circumstances are additionally contracting in each on-chain and futures markets.”

Taking a look at Glassnode’s chart, the agency appears to recommend that Bitcoin’s realized cap internet place change is up 0.67%. In Bitcoin’s present context, it would point out a market restoration.

Bitcoin is buying and selling for $86,272 at time of writing, up 3.6% within the final 24 hours.

Comply with us on X, Fb and Telegram

Do not Miss a Beat – Subscribe to get e mail alerts delivered on to your inbox

Verify Value Motion

Surf The Day by day Hodl Combine

Disclaimer: Opinions expressed at The Day by day Hodl are usually not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your individual danger, and any losses you might incur are your accountability. The Day by day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital property, neither is The Day by day Hodl an funding advisor. Please notice that The Day by day Hodl participates in internet affiliate marketing.

Generated Picture: Midjourney