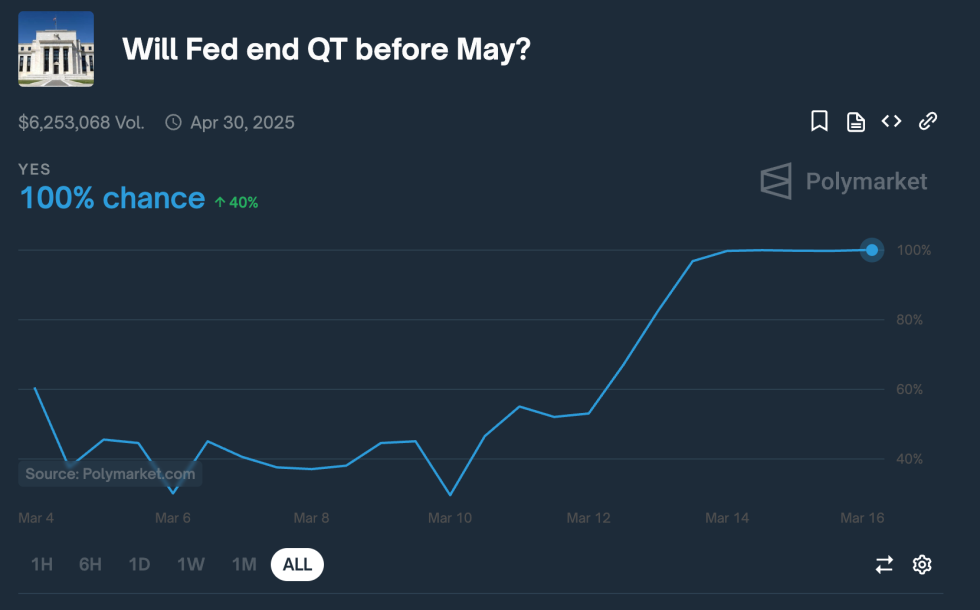

Bitcoin (BTC) may quickly see a pattern reversal as main prediction market platform Polymarket forecasts the US Federal Reserve (Fed) ending quantitative tightening (QT) by April 30. An finish to restrictive financial coverage may present a much-needed increase for risk-on property like BTC.

Fed Seemingly To Finish QT Earlier than Might

Bitcoin has dropped almost 13% over the previous month as a consequence of a mixture of unfavorable elements, together with US President Donald Trump’s commerce tariffs and the Fed’s restrictive financial stance.

Over the previous two months, the main digital asset has tumbled from an all-time excessive (ATH) of $109,588 on January 19 to buying and selling within the low $80,000 vary on the time of writing – wiping out greater than $400 billion from its market cap.

Nevertheless, the tide could quickly flip for the flagship cryptocurrency. Main prediction market platform Polymarket now tasks a 100% probability that the Fed will finish its restrictive financial coverage – QT – earlier than Might. Such a shift is anticipated to profit risk-on property, together with cryptocurrencies.

For the uninitiated, QT is a financial coverage the place the central financial institution reduces its steadiness sheet by promoting authorities bonds or letting them mature with out reinvesting, successfully pulling liquidity out of the financial system. For Bitcoin, this usually results in decrease costs as a result of much less liquidity means much less money accessible for riskier property like crypto.

QT is without doubt one of the key financial instruments the Fed makes use of to limit liquidity within the financial system. The opposite major software is elevating short-term rates of interest, which discourages borrowing and funding in riskier property, usually main to cost corrections in each shares and cryptocurrencies.

The Fed started its present QT cycle in June 2022, aiming to tighten market liquidity and fight rising inflation – a byproduct of pandemic-era stimulus measures. The February Shopper Value Index (CPI) report reveals inflation has cooled to 2.8%, nearing the Fed’s long-run inflation goal of two%, suggesting that QT could have achieved its supposed impact.

Q2 2025 To Be Bullish For Bitcoin?

If Polymarket’s predictions show correct and the Fed halts QT earlier than Might, Q2 2025 may flip bullish for Bitcoin and different cryptocurrencies. Benjamin Cowen, CEO of Into The Cryptoverse, echoed this sentiment, just lately stating that an finish to QT would possible set off a market rally.

Current pro-Bitcoin remarks from Fed Chair Jerome Powell have added additional optimism in regards to the cryptocurrency’s restoration potential. Nevertheless, considerations persist over Bitcoin’s continued habits as a speculative asset moderately than a steady retailer of worth.

Regardless of this, institutional confidence stays robust. Asset administration agency ARK Make investments just lately invested one other $80 million in BTC, reinforcing religion within the digital asset’s long-term potential. At press time, BTC trades at $83,707, up 1.2% up to now 24 hours.

Featured Picture from Unsplash.com, charts from Polymarket and TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our group of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.