- Bitcoin hovers round $84,490, with merchants eyeing a possible rally to $90K relying on the Fed’s stance.

- The Fed is anticipated to maintain charges regular, however hints at future fee cuts may gas a crypto surge.

- XRP jumped 13% after the SEC dropped its lawsuit, including momentum to the already unstable market.

The Federal Open Market Committee (FOMC) assembly is ready for six PM UTC in the present day, and the crypto market is on edge. Main cryptocurrencies, together with Bitcoin (BTC), Ethereum (ETH), and XRP, are anticipated to react strongly to the Fed’s determination on rates of interest and financial coverage.

Bitcoin Eyes $90K as Merchants Await Fed Choice

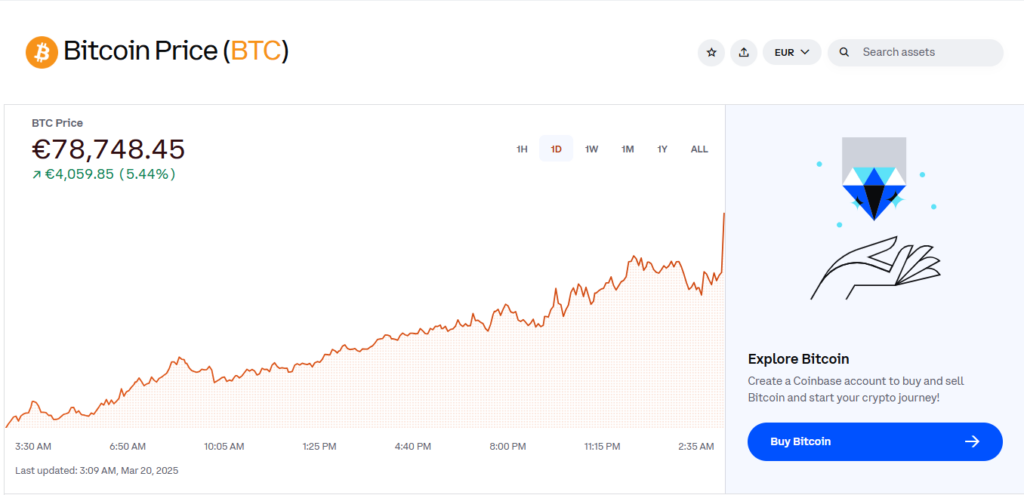

Presently, Bitcoin is hovering round $84,490, with merchants bracing for a possible surge towards $90,000—however all the pieces relies on the Fed’s stance. If the Fed leans dovish, signaling future fee cuts or an finish to quantitative tightening (QT), markets may flip bullish quick. Alternatively, a strict coverage stance may preserve BTC caught and even set off a decline.

Markus Thielen, CEO of 10x Analysis, believes a short-term rally is probably going, stating: “We will see some counter-trend rally as costs are oversold, and there’s a good probability the Fed is mildly dovish.”

Fed’s Stance: What to Anticipate?

Fed Chair Jerome Powell has already prompt that the Fed will “stay on maintain” as a result of ongoing financial uncertainty. The market is nearly sure—99% likelihood based on the CME Group’s FedWatch software—that the Fed will preserve charges regular. Nonetheless, buyers are watching intently for any hints about future fee cuts or a slowdown in QT.

- If the Fed hints at fee cuts, count on crypto costs to rally.

- If the Fed stays agency on tight coverage, Bitcoin and different main cryptos may keep stagnant or drop.

Crypto Market Response So Far

The market has already seen some volatility in anticipation of the Fed’s determination:

- Bitcoin dropped to $81K however has bounced again to $84K.

- Ethereum (ETH) is holding above $2,000, gaining 8% prior to now 24 hours.

- XRP surged 13% after the SEC dropped its lawsuit towards Ripple after 4 years.

Market Sentiment: Worry vs. Greed

Regardless of the current crypto market positive factors, merchants are nonetheless unsure. The Crypto Worry and Greed Index sits at 23, signaling a cautious outlook. Many are ready to see how the Fed’s announcement performs out earlier than making main strikes.

What’s Subsequent?

All eyes are on the Fed’s determination and Powell’s press convention. Whether or not the Fed alerts a pivot or sticks to its strict coverage, count on excessive volatility within the crypto market over the following 24 hours.