Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

The analytics agency Glassnode has revealed the Solana worth ranges that may very well be essential to observe, based mostly on on-chain accumulation information.

Solana Value Foundation Distribution Reveals The place Provide Is Most Concentrated

In a brand new put up on X, Glassnode has mentioned concerning the UTXO Realized Value Distribution (URPD) of Solana. The URPD is an indicator that principally tells us about how a lot of the SOL provide was bought at which worth ranges. Naturally, the metric makes use of the final transaction worth of any token in circulation as its value foundation.

Associated Studying

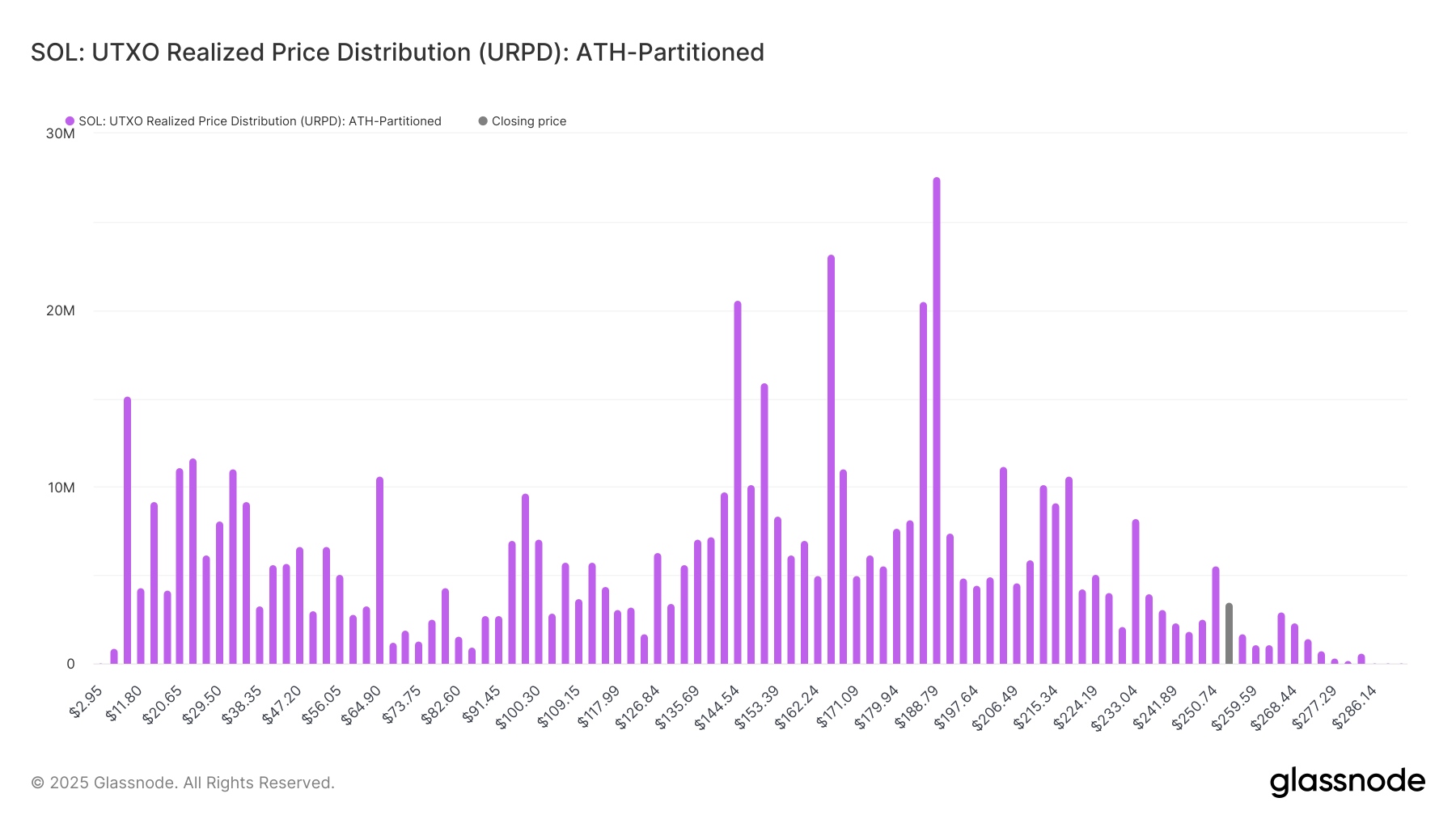

First, right here is how the URPD appeared when the cryptocurrency set its new all-time excessive (ATH) again in January:

From the graph, it’s obvious that a couple of worth ranges like $144 stood out by way of the quantity of provide that they hosted. On the worth ranges nearer to the brand new ATH, nonetheless, provide was fairly skinny, that means not many cash modified fingers there.

In on-chain evaluation, the potential of any stage to behave as assist or resistance is measured by way of the quantity of provide that it hosts. Which means ranges which have a big cluster round them on the URPD are those of significance to the asset.

As for why that is so, the reply lies in investor psychology: holders are delicate to retests of their value foundation. At any time when the value touches a big value foundation cluster, the traders who’re holding these cash might reply by making some panic strikes.

These strikes can have a tendency towards shopping for if the retest is occurring from above, as traders might wish to defend their profit-loss boundary. In retests taking place from beneath, nonetheless, the merchants may react by promoting as an alternative, as they could search to exit at their break-even.

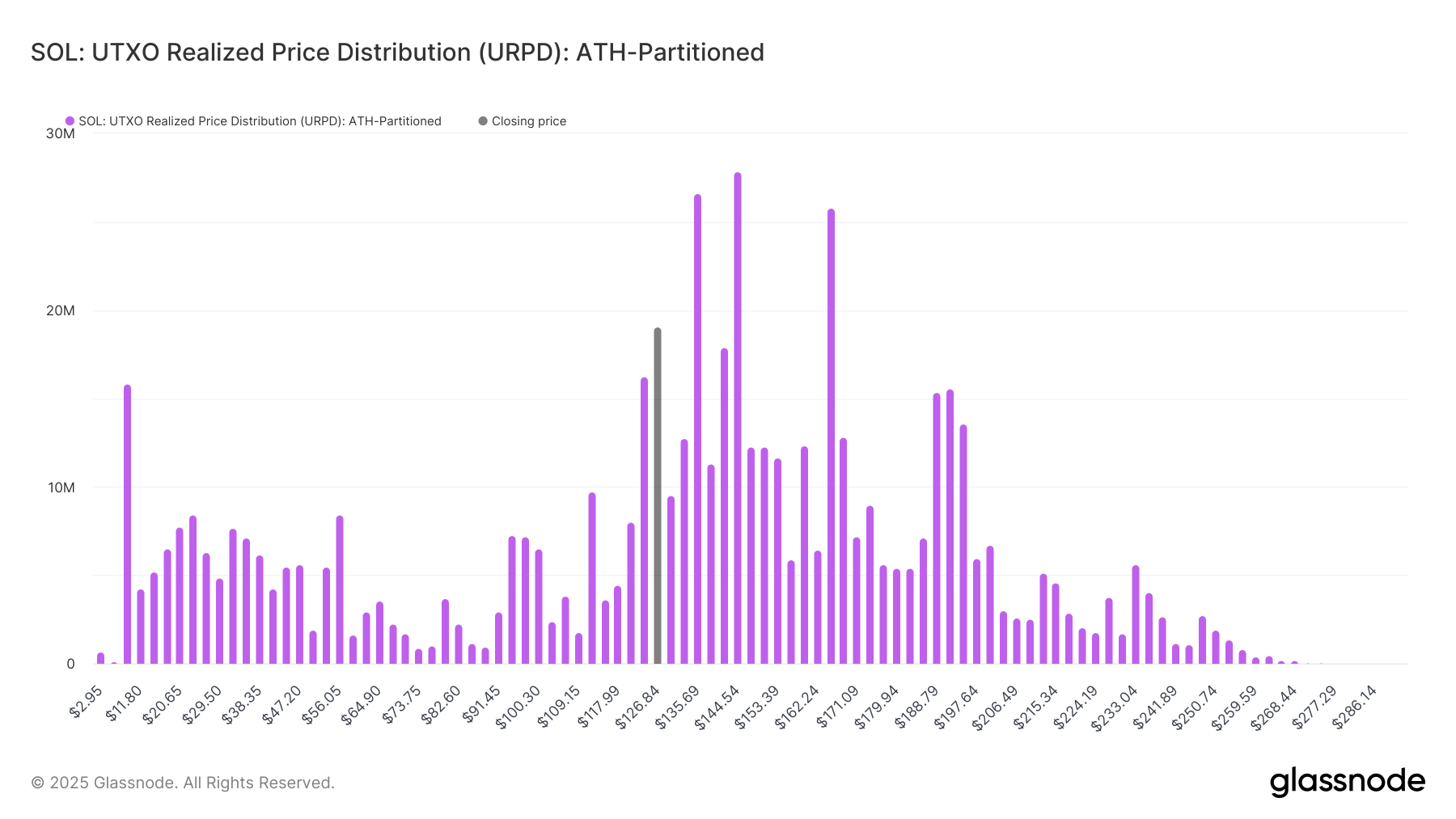

When SOL reached its ATH, there was a scarcity of assist close by. This can be why the asset ended up falling into the cluster that did carry a major quantity of provide. Under is a chart that exhibits how the URPD has modified following the value drawdown.

From the graph, it’s seen that if SOL continues its downtrend, it might have to finish up counting on the freshly grown $112 stage. In January, this stage hosted the fee foundation of 4 million tokens, however at this time, the determine has grown to 9.7 million, equal to 1.67% of your entire provide.

Past this stage, Glassnode notes, “$94, $97, and $100 collectively maintain almost 21M SOL (3.5% of provide).” Within the situation that these assist ranges fail, Solana might discover itself in hassle, as there aren’t any main provide clusters till $53.

Associated Studying

By way of the degrees above, the $135 and $144 ranges stand out, as they maintain the acquisition stage of 26.6 million and 27 million cash, respectively. These ranges may act as main obstacles in SOL’s restoration.

SOL Value

Solana has jumped greater than 5% over the past 24 hours to recuperate to the $130 stage.

Featured picture from Shutterstock.com, Glassnode.com, chart from TradingView.com