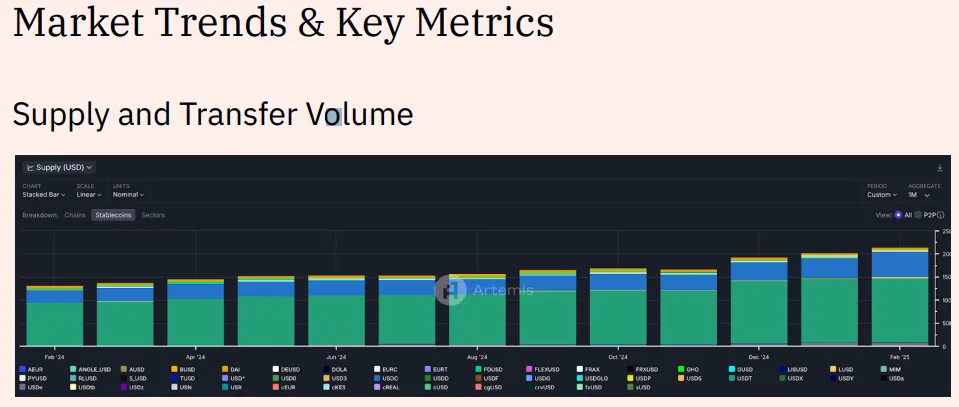

Stablecoins are reshaping digital finance, providing a quick and accessible option to transfer cash throughout borders. With a complete provide of $214 billion and $35 trillion in transfers over the previous 12 months, they’re now not only a area of interest crypto software—they’re a rising monetary powerhouse.

Nonetheless, an excessive amount of transparency is now presenting as a serious drawback that might impede their wider adoption.

Stablecoins and Transparency: A Hurdle for Mass Adoption

Artemis and Dune Analytics carried out a report on the State of Stablecoins in 2025, exploring provide, adoption, and market traits. Primarily based on the findings, the overall stablecoin provide has reached $214 billion, with as much as $35 trillion in transfers over the previous 12 months.

Their transaction quantity has surpassed main cost networks like Visa and Mastercard, proving their rising affect.

Nonetheless, regardless of their fast adoption, transparency presents a key hurdle for stablecoins. Whereas the blockchain’s openness is nice for safety and belief, it’s not all the time very best for on a regular basis funds.

“Crypto funds failed for one small cause that wants fixing: When sending USDC, let the recipient see the transaction however not your handle. No person desires to disclose their pockets for a ten USDC beer cost,” DeFi researcher Ignas remarked.

One other consumer likened it to exposing your financial institution stability everytime you break up a invoice with pals. In the identical method, the dominance of USDT and USDC stablecoins is obvious. Tether’s USDT and Circle’s USDC management many of the market.

Jean Rausis, co-founder of the DeFi platform SMARDEX, finds this regarding.

“The surge in stablecoin wallets exhibits that buyers belief them throughout market volatility. However most of this progress is occurring with centralized stablecoins that carry the identical counterparty dangers as conventional banks,” Rausis instructed BeInCrypto.

The crypto government believes the long run lies in decentralized stablecoins backed by property like Ethereum (ETH) and that includes automated yield mechanisms.

Banks Are Paying Consideration to Rising Stablecoin Regulation

The Artemis and Dune report additionally exhibits that stablecoins have already surpassed Visa and Mastercard in transaction quantity. This traction has successfully attracted the eye of conventional monetary establishments.

In opposition to this backdrop, stablecoins are now not only for crypto merchants. Institutional curiosity is surging, with US banks now allowed to supply stablecoin providers. The Financial institution of America (BoA) is contemplating launching its stablecoin, which is pending regulatory approval.

Nonetheless, with higher adoption comes elevated scrutiny. Privateness-focused cryptocurrencies like Monero (XMR), which clear up the transparency subject by hiding transaction particulars, have confronted authorized roadblocks resulting from issues over cash laundering.

Regardless of transparency issues, stablecoins are thriving in international locations battling inflation. In locations like Nigeria, they’re turning into a dependable various to unstable native currencies. On the similar time, competitors is heating up, with new gamers trying to problem Tether and Circle’s dominance.

For stablecoins to really go mainstream, they need to stability transparency with privateness. Whereas regulators demand oversight, on a regular basis customers don’t wish to broadcast their monetary historical past. Applied sciences like zero-knowledge proofs and selective disclosure might supply options, permitting customers to manage what info they share.

Disclaimer

In adherence to the Belief Venture tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nonetheless, readers are suggested to confirm info independently and seek the advice of with knowledgeable earlier than making any selections based mostly on this content material. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.