Hyperliquid (HYPE) is displaying sturdy technical alerts throughout a number of indicators, with the token surging greater than 15% within the final 24 hours. The platform continues to show spectacular market efficiency, producing $47 million in charges over the previous 30 days and outperforming main blockchain networks like Ethereum and Solana.

Technical indicators counsel a possible golden cross formation, that means HYPE may check $21 and even $25.80 within the coming interval.

Hyperliquid Income Locations It Amongst Prime Protocols In Crypto

Hyperliquid is at present one of the profitable protocols in crypto. Over the previous 30 days, it has generated a formidable $47 million in charges and not too long ago reached $1 trillion in perps quantity.

Whereas this locations it behind main gamers akin to Jito, Pumpfun, and PancakeSwap when it comes to month-to-month income, Hyperliquid has surpassed vital blockchain apps and chains, together with Solana, Ethereum, Raydium, and Phantom.

What makes Hyperliquid’s success notably exceptional is that, not like most different high-performing protocols that function on established blockchain networks akin to BNB, Solana, or Ethereum, Hyperliquid features as its personal impartial chain.

Excluding Tron, nearly all different main protocols depend on dad or mum blockchains, whereas Hyperliquid has achieved its substantial income figures as a standalone entity.

Regardless of this spectacular efficiency and distinctive positioning, HYPE has skilled appreciable downward value strain not too long ago, buying and selling beneath the $20 threshold for sixteen consecutive days, making a notable disconnect between the protocol’s operational success and its market valuation.

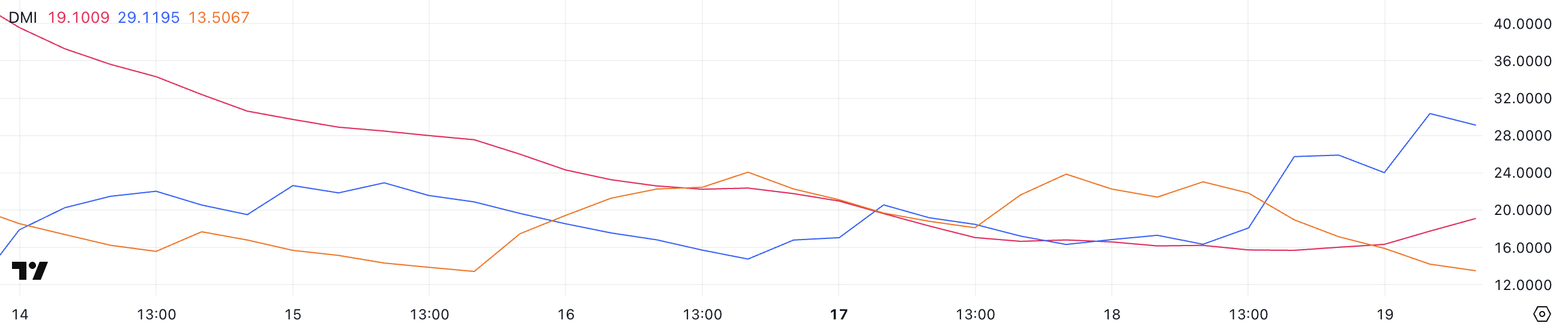

HYPE DMI Exhibits Patrons Are In Management

The HYPE DMI (Directional Motion Index) chart exhibits promising momentum shifts, with the ADX (Common Directional Index) rising from 15.7 to 19, suggesting a strengthening pattern conviction.

Extra considerably, the +DI (Constructive Directional Indicator) has surged from 18 to 29.1, whereas the -DI (Detrimental Directional Indicator) has declined from 21.8 to 13.5. This crossover sample, the place +DI rises above -DI, sometimes alerts a possible bullish reversal.

The rising unfold between these indicators and the rising ADX suggests that purchasing strain is overcoming promoting strain, doubtlessly setting the stage for HYPE to interrupt above its latest sub-$20 buying and selling vary.

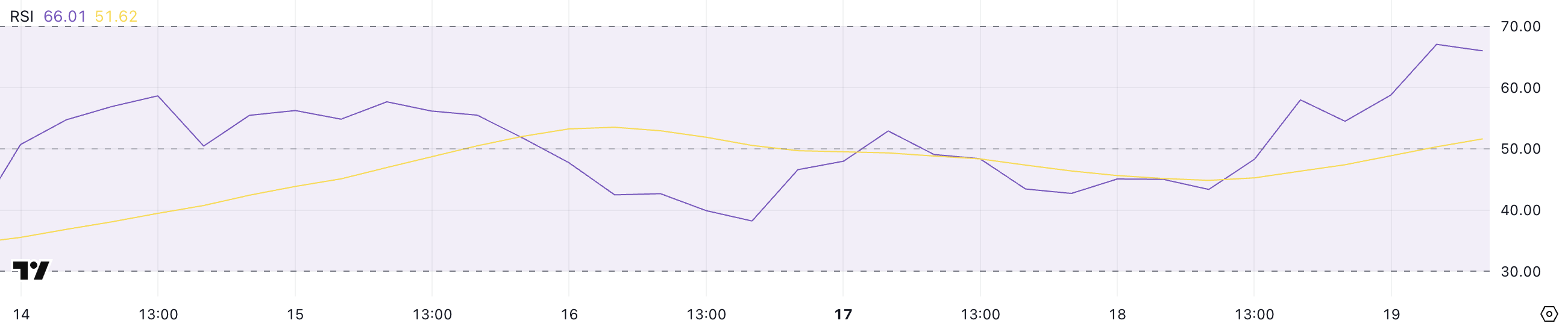

The Relative Energy Index (RSI) is a momentum oscillator that measures the pace and alter of value actions. Readings above 70 are sometimes thought-about overbought, and beneath 30 are thought-about oversold.

HYPE’s RSI climbing from 54.5 to 66 signifies rising bullish momentum that hasn’t but reached excessive ranges. This uptick suggests strengthening purchaser curiosity whereas remaining beneath the overbought threshold of 70.

The truth that HYPE hasn’t reached overbought ranges since December 2024 implies there should still be room for value appreciation earlier than any potential pullback.

Along with the DMI indicators, this RSI studying reinforces the opportunity of continued upward motion in HYPE’s value within the close to time period.

Will Hyperliquid Rise Above $20 This Week?

The HYPE Exponential Transferring Common (EMA) strains are converging towards a possible golden cross formation, which happens when a shorter-term transferring common crosses above a longer-term one.

This technical sample sometimes alerts a powerful bullish momentum shift that might propel HYPE to check its speedy resistance degree at $17. Ought to consumers efficiently break by way of this threshold, the trail would open for HYPE to climb towards the $21 mark.

In eventualities the place distinctive shopping for strain materializes, Hyperliquid may lengthen its beneficial properties to problem the numerous resistance degree at $25.80, representing a considerable restoration from its latest sub-$20 buying and selling vary.

Conversely, if the anticipated uptrend fails to materialize and bearish sentiment prevails, HYPE may expertise renewed downward strain, forcing it to check the crucial assist degree at $12.43.

The significance of this assist can’t be overstated, as a breach beneath this ground may set off accelerated promoting, doubtlessly pushing HYPE below the psychologically vital $12 degree for the primary time since December 2024.

Disclaimer

In step with the Belief Mission tips, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. All the time conduct your individual analysis and seek the advice of with an expert earlier than making any monetary choices. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.