Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

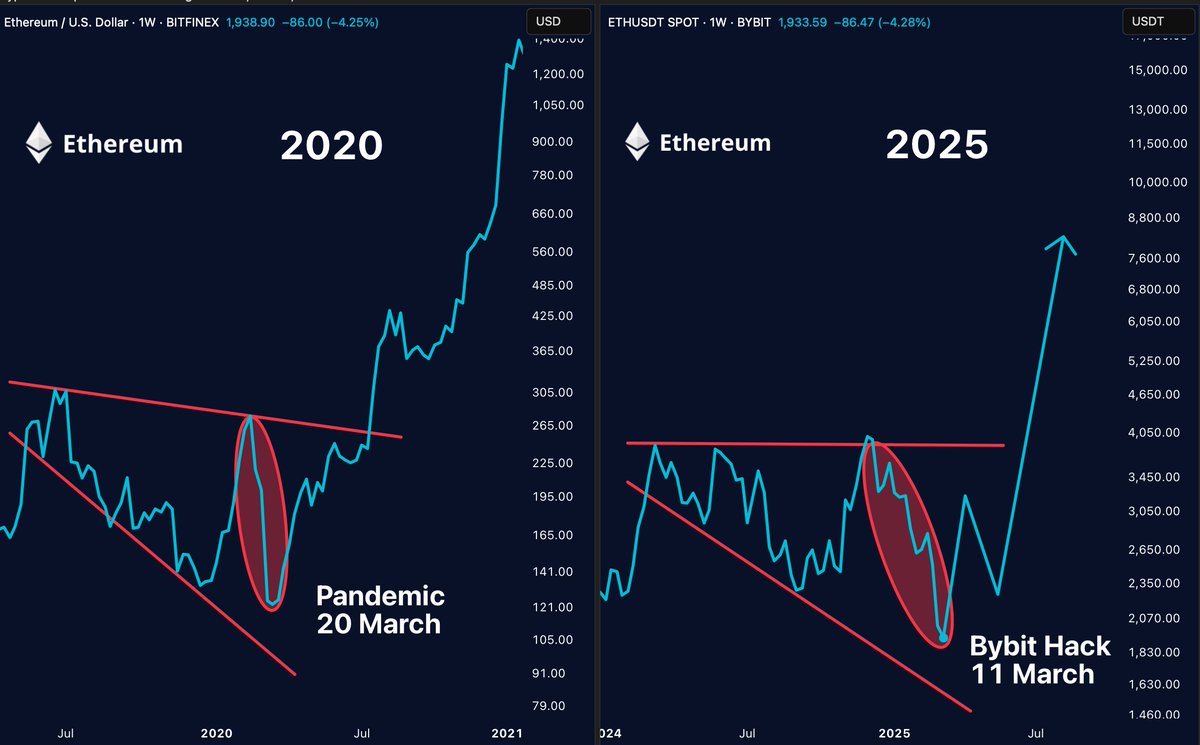

In response to an X submit by crypto analyst CryptoGoos, Ethereum (ETH) could also be nearing the top of a bear entice. The analyst predicts that the cryptocurrency might surge previous its latest vary excessive of $4,000, doubtlessly eyeing a brand new all-time excessive (ATH) of $10,000.

Ethereum Breaking Out Of The Bear Entice?

Ethereum seems poised to interrupt free from a possible bear entice, because the second-largest cryptocurrency by market cap continues to commerce within the low $2,000 vary after enduring a robust sell-off since December 2024.

Associated Studying

For the uninitiated, a bear entice refers to a false sign that makes it appear to be an asset’s value is continuous to fall, tempting merchants to quick it – just for the value to instantly reverse and rise, inflicting these quick positions to get liquidated.

In a latest X submit, CryptoGoos emphasised that ETH could also be nearing the top of such a entice. The analyst shared an ETH weekly chart illustrating how the cryptocurrency may very well be on the brink of a pattern reversal after months of relentless sell-offs.

Fellow crypto analyst Merlijn The Dealer echoed CryptoGoos’ sentiment, highlighting similarities between ETH’s present value motion and patterns seen in 2020. He famous that the final time this setup emerged, “panic changed into a historic rally.”

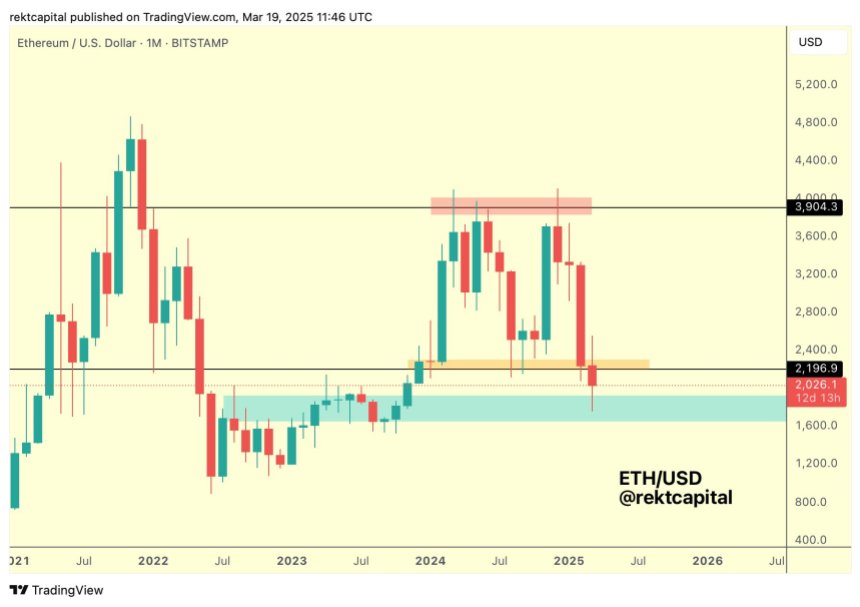

Crypto investor Rekt Capital additionally weighed in, declaring that Ethereum is buying and selling inside a “historic demand space.” The investor acknowledged:

If value can generate a robust sufficient response right here, then #ETH will have the ability to reclaim the $2196-$3900 Macro Vary (black). If ETH does this earlier than the March Month-to-month Shut, then this whole sub-$2200 draw back would find yourself as a draw back wick.

ETH About To Exit Accumulation Part

Seasoned crypto commentator Ted shared a chart indicating that ETH has damaged out of its short-term accumulation section. He defined that the digital asset has been in accumulation since its drop from $3,000 to $1,800. Ted added that sustained value motion above $2,000 might ignite a major value rally.

Famous analyst Daan Crypto Trades revealed that he not too long ago transformed a few of his long-term Bitcoin (BTC) holdings into ETH for the “first time in years.” He cited the present ETH/BTC buying and selling pair as presenting a pretty threat/reward setup.

Associated Studying

Past bullish value motion, a number of technical indicators are signaling a possible ETH rally within the close to time period. Notably, ETH’s weekly Relative Power Index (RSI) not too long ago hit a multi-year low – an indication {that a} pattern reversal may very well be imminent.

Nonetheless, rising ETH reserves on crypto exchanges stay a degree of warning, as they may suppress bullish momentum if traders decide to promote. At press time, ETH trades at $2,029, up 7.8% previously 24 hours.

Featured picture from Unsplash, charts from X and Tradingview.com