- Bitcoin’s Coinbase premium hit its highest degree since February 20, signaling sturdy U.S. investor accumulation.

- BTC reclaimed its 200-day EMA, with analysts eyeing a possible retest of $90,000 if $85,000 holds as help.

- Some merchants stay cautious, warning that Bitcoin might nonetheless right to $73,000 if resistance at $90,000 persists.

Bitcoin’s (BTC) Coinbase premium index has surged to its highest degree since February 20, following a robust 5% rally on March 19. This spike suggests rising accumulation, presumably led by U.S. establishments and whales.

Rising Coinbase Premium Indicators Institutional Accumulation

The Coinbase premium index tracks the worth distinction between BTC pairs on Coinbase and Binance. A better worth signifies stronger shopping for strain from U.S. buyers, signaling potential accumulation. CryptoQuant analyst Woonminkyu famous that the 30-day exponential shifting common (EMA) of the index has crossed above the 100-day EMA—an indication typically related to giant institutional gamers coming into the market.

“Previous developments present that when this indicator rises, BTC bull markets are likely to proceed. Excessive probability of an accumulation section, making it a key second to observe BTC’s momentum,” the analyst defined.

Since Coinbase Professional was built-in into Coinbase Superior in early 2024—a platform utilized by main corporations like Technique and Tesla—the Coinbase premium could more and more mirror U.S. institutional curiosity in Bitcoin.

Will Bitcoin Reclaim $90K Quickly?

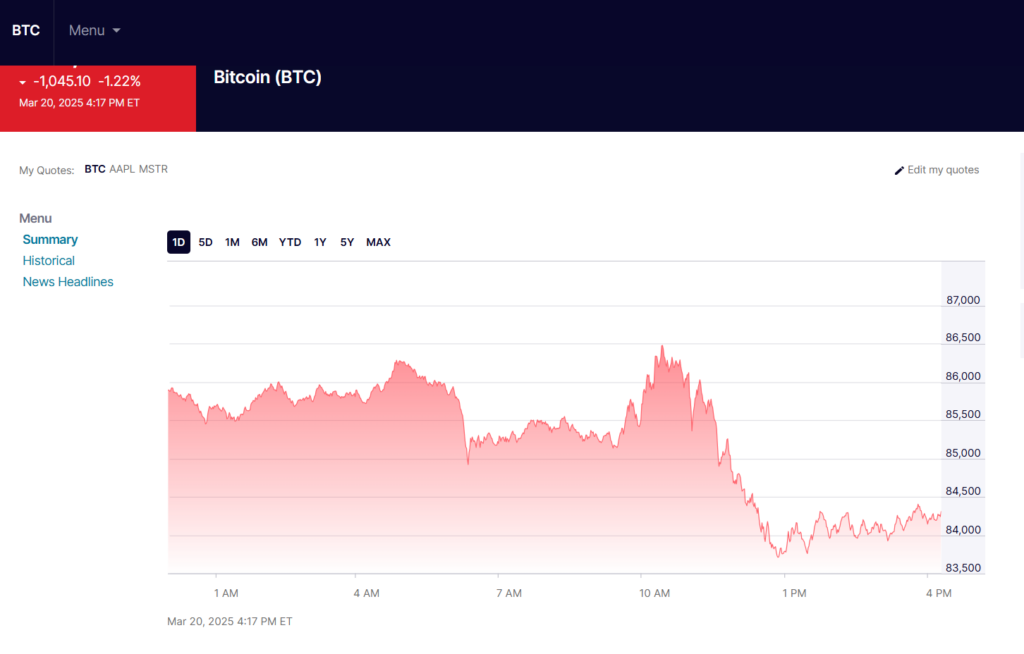

On the day by day chart, Bitcoin has reclaimed its 200-day EMA (orange line), a key technical degree that traditionally strengthens the likelihood of an uptrend. BTC additionally bounced from the decrease vary of the Bollinger Bands (BB), with the BB’s shifting common hovering above $90,000.

A profitable breakout above $85,000 resistance, now become help, improves the probability of BTC retesting $90,000 within the coming days. Michael Van de Poppe, founding father of MN Consultancy, stays bullish, predicting a push towards $90K within the close to future.

Nevertheless, not all analysts share the identical confidence. Max, the founding father of BecauseBitcoin, believes BTC nonetheless has “a little bit extra work to do.” He identified that EMA cloud indicators proceed to suppress Bitcoin beneath the $88,000–$90,000 vary.

Crypto dealer Koroush AK additionally urged warning, warning that Bitcoin’s construction stays unsure. “BTC is at a vital degree beneath $90,000; a correction to $73,000 stays a chance,” he instructed.

Key Ranges to Watch

- Bullish case: Holding above $85,000 strengthens possibilities of a $90K retest.

- Bearish case: A day by day shut beneath $85,000 might invalidate the bullish construction.

With volatility rising, all eyes are on BTC’s subsequent transfer—can it break previous resistance, or is a deeper pullback on the horizon?