Onyxcoin (XCN) has been underneath important promoting strain, correcting by 9.4% over the past seven days and plunging by 43% up to now 30 days.

The downtrend has left XCN struggling to regain its footing as technical indicators proceed to level towards a bearish market construction. Regardless of short-lived makes an attempt at restoration, the asset has remained weighed down by persistent bearish momentum.

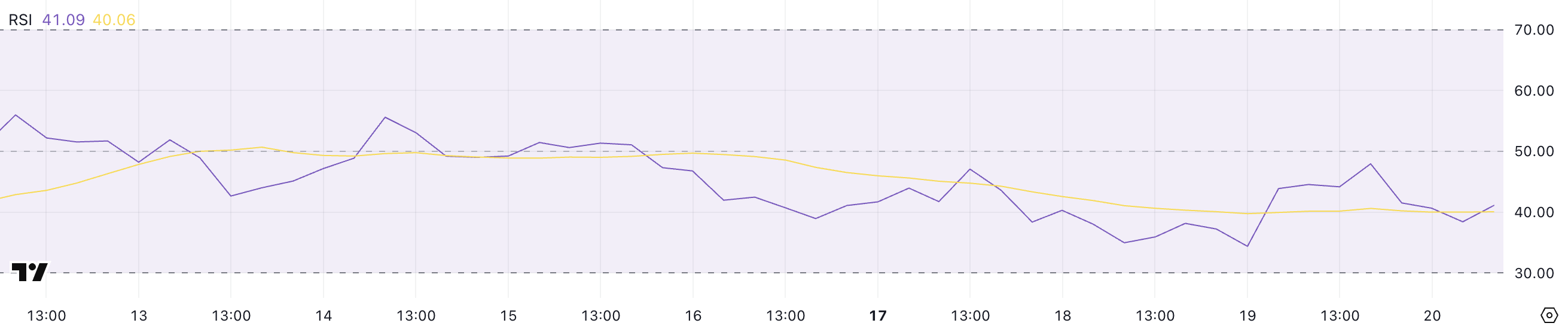

Onyxcoin RSI Has Been Under 50 For Virtually 5 Days

Onyxcoin RSI is at the moment sitting at 41.09, marking a decline from yesterday’s stage of 47.95. This drop signifies that bearish momentum has been gaining floor over the previous 24 hours, pushing the RSI additional away from the impartial 50 mark.

Since March 15, XCN’s RSI has remained persistently beneath 50, signaling that the asset has been underneath persistent promoting strain.

The continued weak point mirrored within the RSI means that bulls are struggling to regain management, holding the worth in a bearish or consolidative part.

The RSI (Relative Energy Index) is a momentum oscillator that measures the pace and magnitude of current worth modifications to judge overbought or oversold circumstances.

Usually, an RSI above 70 alerts that an asset is perhaps overbought and due for a pullback, whereas an RSI beneath 30 signifies that the asset may very well be oversold and may see a bounce. With XCN’s RSI at 41.09 and caught beneath 50 for a number of days, it suggests the market stays tilted towards bearish sentiment.

Whereas it’s not but in oversold territory, the continued sub-50 readings spotlight the dearth of bullish momentum and will suggest continued sideways or downward motion until consumers step in to reverse the pattern.

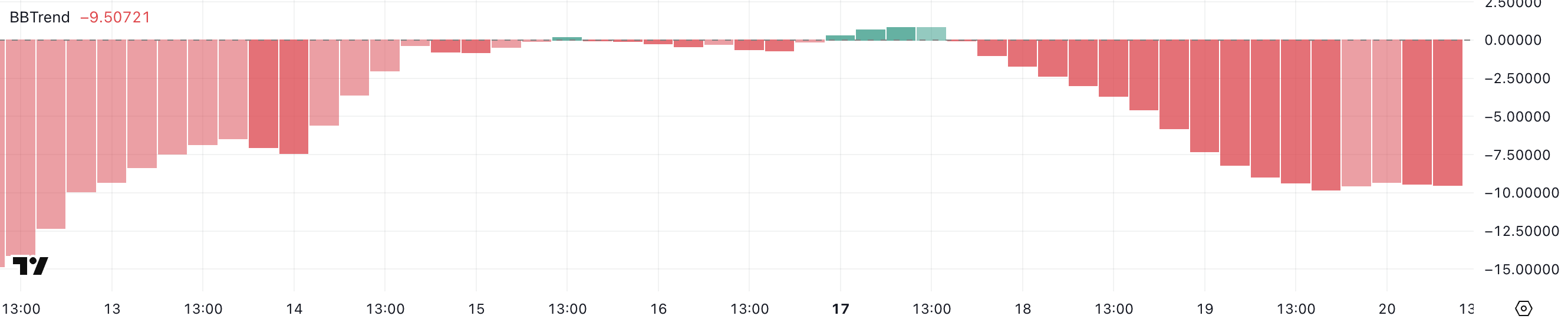

XCN BBTrend Exhibits Promoting Strain Is Nonetheless Right here

Onyxcoin BBTrend is at the moment at -9.5 and has remained in detrimental territory for the previous two days, signaling a bearish setting.

Earlier, on March 17, BBTrend briefly turned optimistic at 0.83 however didn’t maintain upward momentum, rapidly reverting again beneath zero. This incapability to take care of optimistic readings means that bullish makes an attempt have been weak and short-lived, reinforcing the notion that sellers proceed to dominate the market.

The deepening detrimental worth of the BBTrend displays ongoing strain on XCN’s worth, holding it underneath pressure.

The BBTrend, or Bollinger Band Pattern indicator, measures worth tendencies based mostly on the positioning of worth motion relative to the Bollinger Bands.

When BBTrend values are above zero, it signifies that the worth is buying and selling above the midline (usually the 20-period transferring common), suggesting bullish momentum. Conversely, detrimental values level to costs trending beneath the midline, indicating bearish momentum.

With XCN’s BBTrend at -9.5 and struggling to determine optimistic values, it alerts that the asset continues to lack sturdy bullish strain, leaving the worth susceptible to additional draw back or extended consolidation.

Will Onyxcoin Fall Under $0.010 In March?

Onyxcoin EMA traces are displaying a bearish configuration, with short-term transferring averages positioned beneath the long-term ones.

This alignment means that downward momentum is prevailing, growing the probability of additional worth declines. If XCN continues to pattern decrease, it might fall beneath the important thing assist at $0.010, a stage not seen since January 17.

Nevertheless, if Onyxcoin manages to regain the sturdy bullish momentum it demonstrated on the finish of January – when it grew to become one of many best-performing altcoins available in the market – it might reverse this setup.

In that case, XCN may problem resistance ranges at $0.014 and $0.020, with the potential to climb as excessive as $0.026 if consumers step in aggressively.

Disclaimer

Consistent with the Belief Mission pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. At all times conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.