The Uniswap (UNI) group has voted in favor of two important governance proposals, allocating $165.5 million to the Uniswap Basis to stimulate ecosystem improvement.

This transfer follows the launch of Uniswap v4 and Unichain earlier this 12 months and has led to an uptick in UNI’s worth.

Uniswap Secures Funding Approval for Development and DeFi Innovation

In a latest submit on X, the Uniswap Basis celebrated the approval of two proposals launched on February 14 as a part of the “Uniswap Unleashed” initiative.

“This marks the start of our group’s subsequent period: one which unlocks new alternatives to construct, develop and to create and seize worth,” the submit learn.

Some of the important points of the governance choice is that it lays the groundwork for activating the much-anticipated “payment swap.” This mechanism enhances the protocol’s sustainability and rewards UNI token holders. Furthermore, it alerts a shift towards a extra sustainable and rewarding ecosystem.

“These campaigns will result in different advantages for the Uniswap group. For instance, 65% of Unichain web chain income is about to be earned by UVN validators and stakers, as soon as the UVN launches,” the proposal famous.

The primary proposal outlines the Uniswap Basis’s strategic priorities for 2025 and past. It focuses on 4 key areas. The primary is scaling community provide by optimizing liquidity throughout lively Ethereum Digital Machine (EVM) chains.

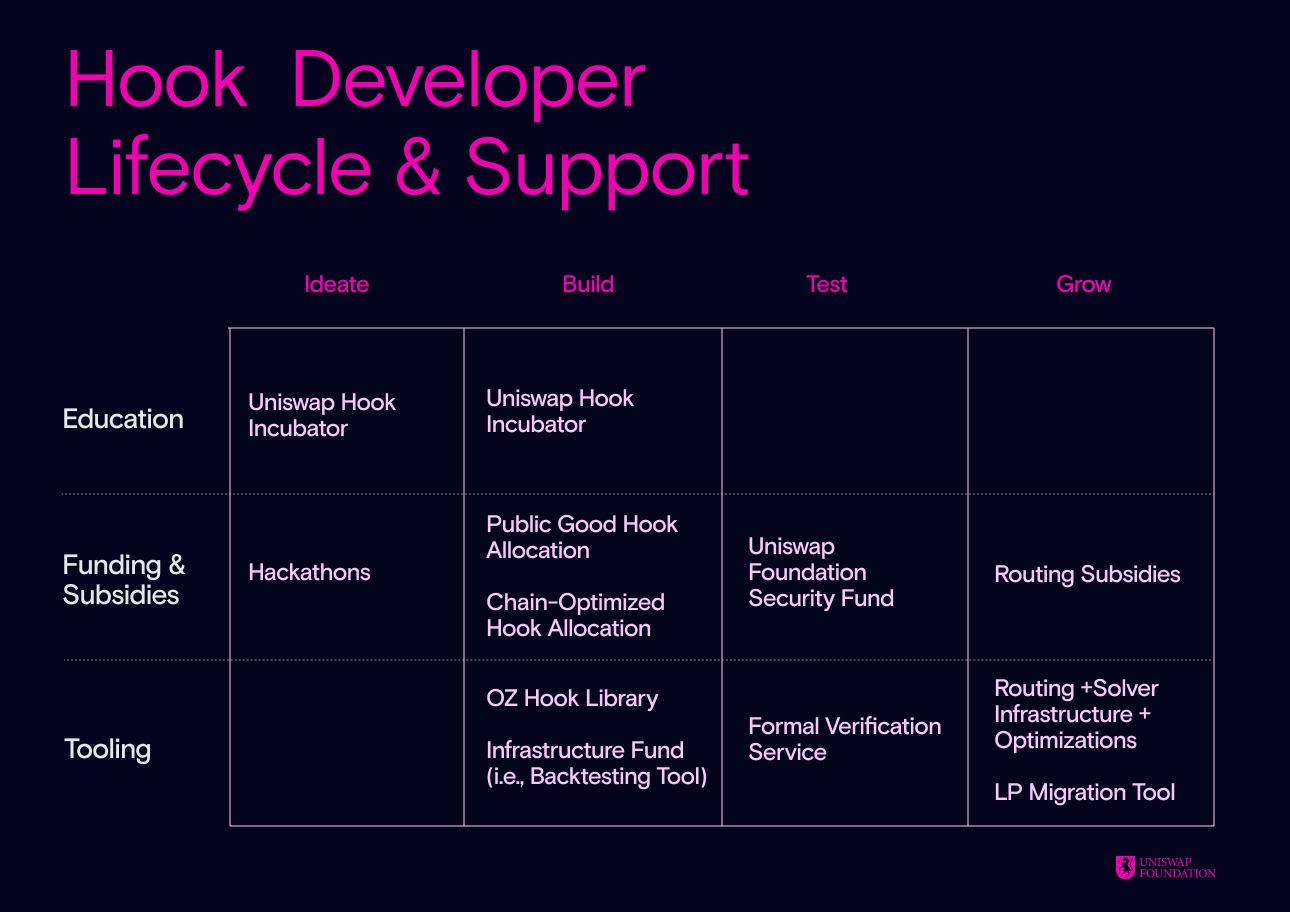

The second precedence is scaling community demand by growing platforms that encourage DeFi innovation and appeal to builders. This contains initiatives equivalent to funding packages, infrastructure improvement, and academic assets. These intention to help builders all through the hook improvement lifecycle.

As well as, the third precedence is strengthening governance by activating income sources and onboarding new protocol contributors. It emphasizes distributing a portion of Unichain’s web chain income to validators and stakers and exploring the creation of a authorized entity for governance functions.

Lastly, the proposal goals to determine a Core Contributor Program. This program will create incentive-aligned improvement groups to advance the protocol and ecosystem.

The proposal additionally features a whole funding of $120.5 million, with $95.4 million allotted to the muse’s grant finances and $25.1 million designated for operational prices.

“It displays an funding into the success of the Uniswap Protocol and Unichain, and into worth for the Uniswap group, and will likely be backstopped by best-in-industry transparency reporting and an unrelenting drive to create worth,” the proposal learn.

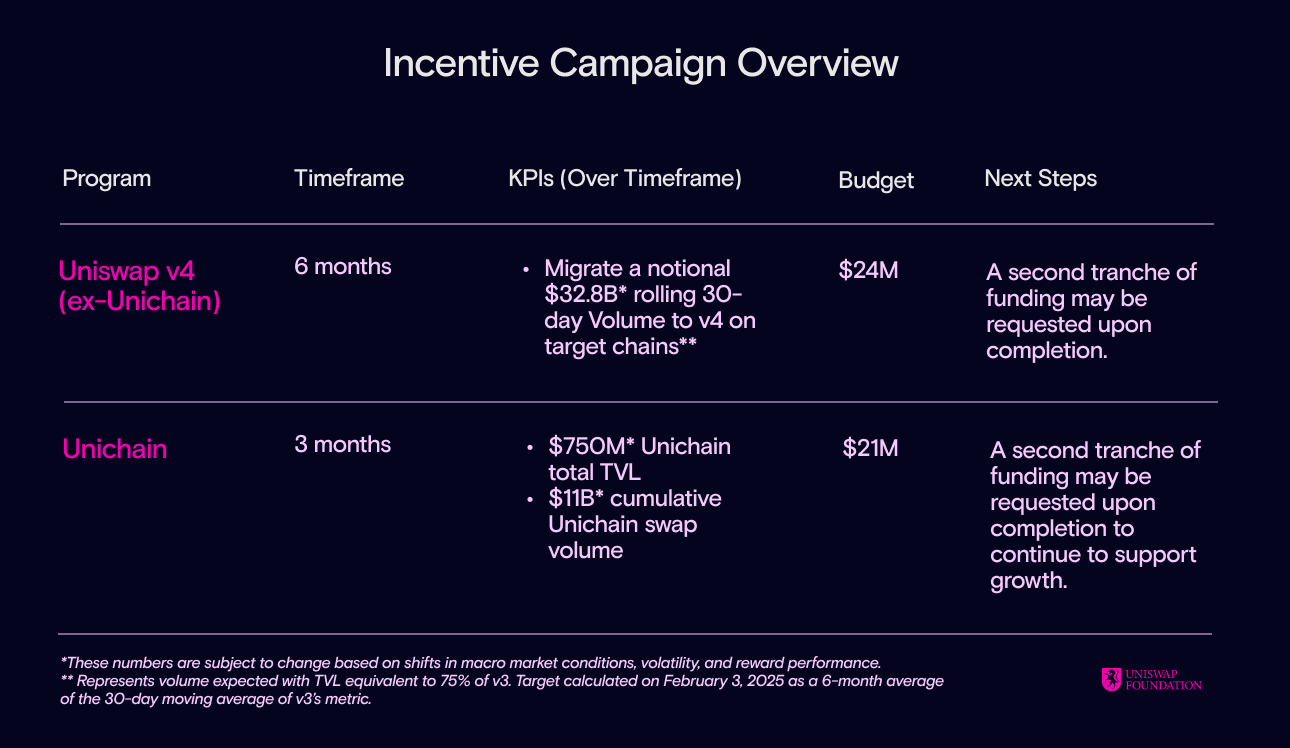

The second proposal, which included enter from Gauntlet, focuses on funding two liquidity incentive packages to drive progress for Uniswap v4 and Unichain. Thus, the first goal is to draw liquidity suppliers (LPs), swappers, and builders to those platforms, which is able to play key roles in DeFi’s future. The Uniswap Basis requested a $45 million finances to help these liquidity incentives.

The Aera platform will likely be used to make sure full governance management over the funds. This platform will enable Uniswap Governance to recall unused funds if essential. Gauntlet has already arrange an Aera vault on the Ethereum (ETH) mainnet.

Moreover, with the proposal’s approval, the vault will likely be resumed. A complete of seven,588,532 UNI tokens will likely be deposited to fund ongoing liquidity incentives.

In the meantime, UNI reacted positively to the information. In line with information from BeInCrypto, its worth surged by 7.5% over the previous 24 hours.

At press time, UNI was buying and selling at $6.8. Moreover, buying and selling quantity noticed a exceptional 207.9% spike, additional highlighting a considerable improve in exercise.

Disclaimer

In adherence to the Belief Undertaking pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nevertheless, readers are suggested to confirm info independently and seek the advice of with an expert earlier than making any choices primarily based on this content material. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.