- Bitcoin’s value has diverged barely from the 2017 bull cycle, however correlation nonetheless holds sturdy at 91%.

- MVRV ratio and market habits counsel BTC is in a correction section much like previous bull markets.

- A 30-day lag evaluation boosts the 2025–2017 cycle correlation to 93%, hinting at a possible rally forward.

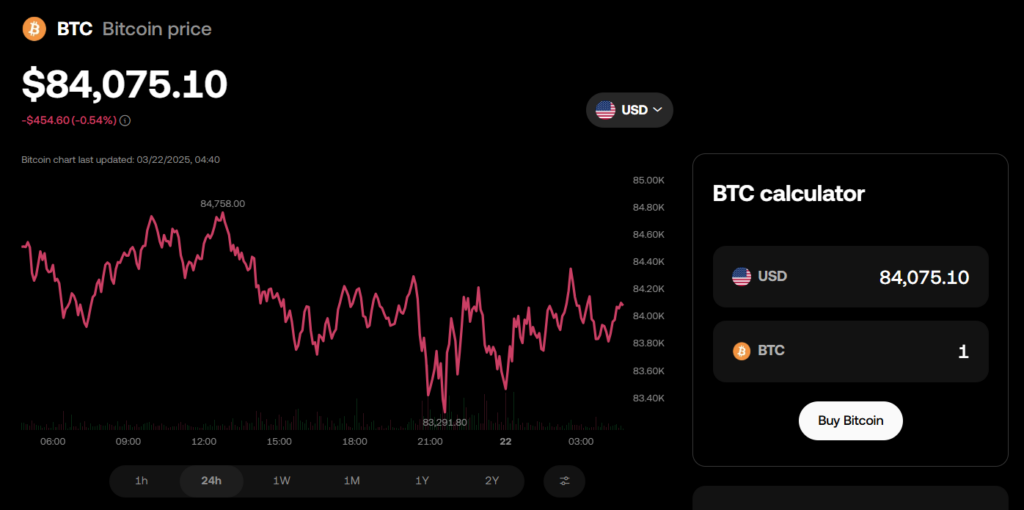

Bitcoin smashed by means of the $100K mark earlier this yr, however these days? It’s been kinda slumping. After hitting that all-time excessive, the worth has slid right into a multi-week downtrend, and naturally, everybody’s questioning: Is BTC nonetheless monitoring prefer it did through the legendary 2017 bull run—or has the sample damaged?

Evaluating Bitcoin in 2025 vs. 2017

In the event you lay the charts side-by-side, BTC’s present run—from the 2022 bear market lows to now—appears eerily just like the 2015–2017 cycle, the one which ended with Bitcoin hitting $20K in December 2017. However now, for the primary time on this cycle, Bitcoin’s latest drop has pulled it off monitor. If it had been nonetheless mimicking 2017, we’d be seeing greater highs, not this sideways chop and slide.

Nonetheless, even with this divergence, the correlation stays excessive. At the beginning of 2025, the present cycle had a 92% match with 2017. That’s slipped barely to 91%—however truthfully, that’s nonetheless freakishly excessive for monetary market patterns.

MVRV Ratio Nonetheless Mirrors 2017

One necessary factor to look at is the MVRV Ratio, which compares present market value to the common value BTC holders paid. When it spikes, it means traders are deep in revenue territory—often simply earlier than issues prime out. When it drops towards the common, it suggests we’re close to a market backside.

Currently, the MVRV ratio has been dropping alongside BTC’s value, which matches how issues performed out in 2017 too. There have been huge rallies, adopted by gut-check corrections. So despite the fact that the worth itself is stumbling, the market psychology nonetheless strains up with 2017. Proper now, MVRV’s correlation with 2017? Nonetheless round 80%.

The Lag Issue: Liquidity and BTC’s Delayed Response

Right here’s the place it will get fascinating. International liquidity (assume: the full cash provide) typically leads Bitcoin’s value—however with a delay. Analysts have discovered it takes about two months for modifications in world liquidity (like M2 cash provide) to ripple into BTC.

Now, apply a 30-day lag to Bitcoin’s present value chart and examine it to 2017—and growth, the correlation shoots as much as 93%. That’s the best match recorded. So what appears like a breakdown may simply be a delay. If that’s the case, BTC might quickly get again on monitor and observe the 2017 sample once more.

So, What’s Subsequent for BTC?

Nobody’s saying 2025 shall be a carbon copy of 2017—however there’s a saying in markets: historical past doesn’t repeat, it rhymes. And to this point, Bitcoin remains to be buzzing a really acquainted tune.

If it retains monitoring with 2017—simply on a little bit delay—we is perhaps a pointy restoration and a possible rally within the not-too-distant future. Maintain tight, watch the charts, and don’t rely BTC out simply but.