- BlackRock’s Robbie Mitchnick says Ethereum criticism is overblown and sees sturdy potential forward.

- ETHA, BlackRock’s Ethereum ETF, pulled in $6B in six months—regardless of market skepticism.

- Mitchnick believes including staking to ETFs may unlock main worth for Ether buyers.

Whereas Ethereum hasn’t precisely been lighting up the charts these days—particularly in comparison with Bitcoin—Robbie Mitchnick, head of digital belongings at BlackRock, thinks the concern is overblown.

Positive, Ether didn’t hit a brand new all-time excessive after Trump’s return to the White Home despatched crypto markets flying. However in line with Mitchnick, the negativity round Ethereum is “a bit overdone.”

Talking at Blockworks’ Digital Asset Summit in New York on Thursday, Mitchnick stated there’s nonetheless “so much to be optimistic about.”

Why Ethereum Nonetheless Issues to BlackRock

Mitchnick pointed to BUIDL, BlackRock’s tokenized treasuries product constructed on Ethereum, which simply crossed $1 billion in belongings underneath administration. “There was no query the blockchain we’d use was Ethereum,” he stated.

BlackRock’s Ethereum ETF, ETHA, additionally launched final 12 months, shortly after its wildly profitable Bitcoin ETF rollout in January. That fund, IBIT, has already grown to greater than $51 billion in web belongings, redefining what crypto ETFs may be.

Whilst Ethereum struggles, BlackRock is doubling down. CEO Larry Fink has brazenly supported tokenization—bringing conventional belongings like bonds and shares on-chain. Ethereum, being the most-used sensible contract platform, stays central to that imaginative and prescient.

Ethereum’s Tough Patch

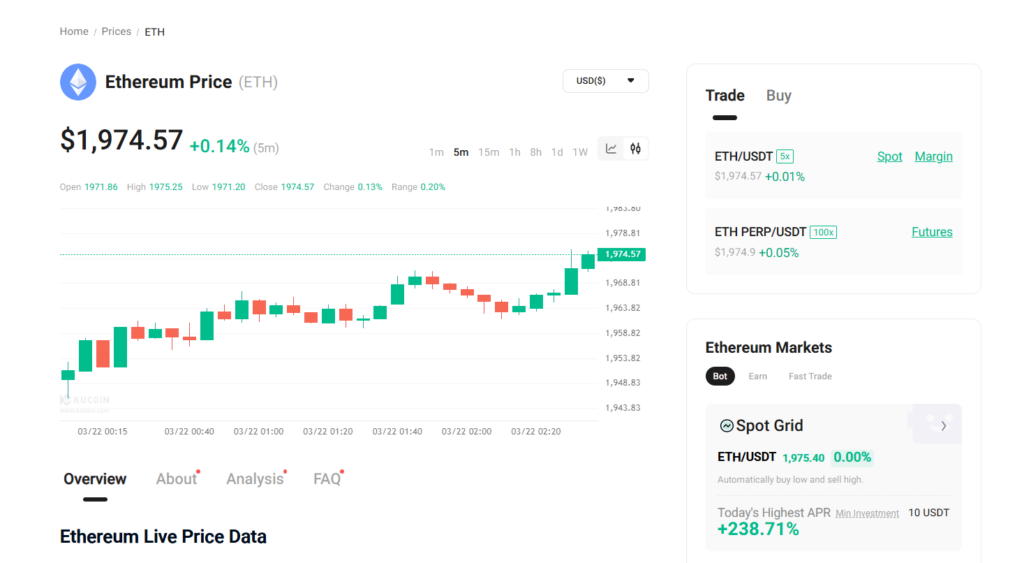

Let’s be actual although—Ethereum’s had a tough few months. Ether dropped under $2,000 for the primary time since November 2023, falling tougher than Bitcoin as markets reacted to Trump’s on-again, off-again tariff insurance policies.

That droop stirred up some drama within the Ethereum neighborhood. There have been calls to restructure the Ethereum Basis, and even Vitalik Buterin has confronted criticism.

Mitchnick, nevertheless, continues to be bullish—particularly if regulators give the inexperienced mild to staking inside ETFs.

The “Meh” False impression

Regardless of what individuals suppose, Ethereum ETFs haven’t flopped, Mitchnick stated. “There’s a little bit of a false impression on the market that ETH ETFs have been meh.” ETHA, for instance, noticed $6 billion in inflows in its first six months.

That will not stack as much as Bitcoin’s numbers—however in comparison with most ETFs? It’s an elite efficiency.

Why Staking Issues

Nonetheless, Mitchnick admits Ethereum ETFs are “much less good” with out staking. Staking, the place Ether holders earn yield by serving to safe the community, is a key a part of Ethereum’s funding attraction. And proper now, ETH held in ETFs simply… sits there.

A proposed rule change from NYSE Arca may change that. If permitted, ETFs like Grayscale’s ETHE and EZET may begin staking Ether—and return that worth to buyers.

Advocates, together with Jito Labs and Multicoin Capital, say this is able to higher mirror Ethereum’s native advantages and even assist assist the community.

“There’s clearly a subsequent part within the potential evolution of this,” Mitchnick stated. “Staking yield is a significant a part of how one can generate funding return on this house.”

Backside line: Ethereum may not be on prime proper now, however BlackRock appears to suppose it’s removed from accomplished.