Cardano has traded inside a good vary over the previous week because the broader crypto market makes an attempt a restoration. It has confronted resistance at $0.75 and located assist at $0.69.

Regardless of the value consolidation, on-chain knowledge reveals a strengthening bullish bias that might pave the best way for an upward breakout.

Cardano Caught in a Vary—HODLing Factors to a Potential Breakout

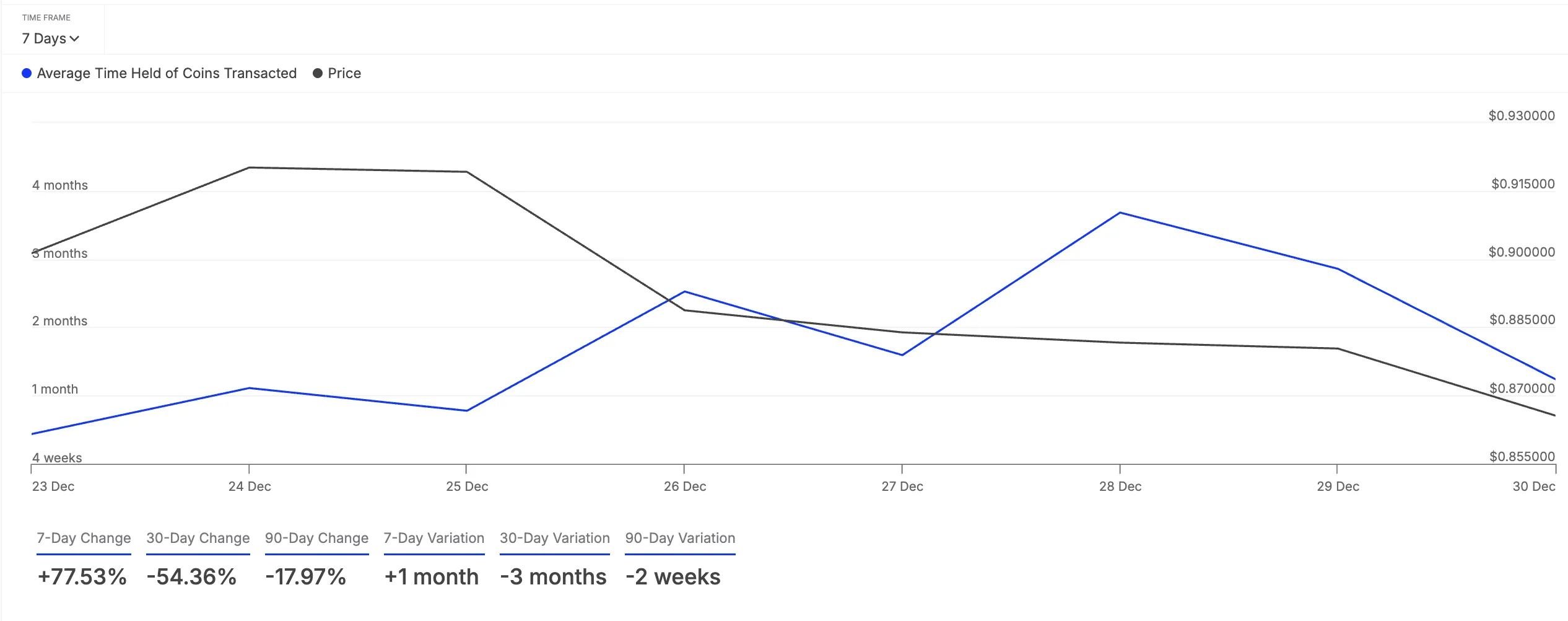

Amid ADA’s sideways value actions over the previous week, traders have elevated their holding instances. In line with IntoTheBlock, holding time has elevated by 77% through the overview interval.

This development alerts a choice for hodling reasonably than short-term promoting.

An asset’s coin holding time is a metric that tracks the common length of time its tokens are held in pockets addresses earlier than being bought or transferred.

As this time spikes, it alerts Cardano holders are opting to carry onto their belongings reasonably than promote. This implies rising confidence within the asset’s long-term potential. If the development persists, it may scale back promoting strain and trigger ADA to try a break above the resistance at $0.75.

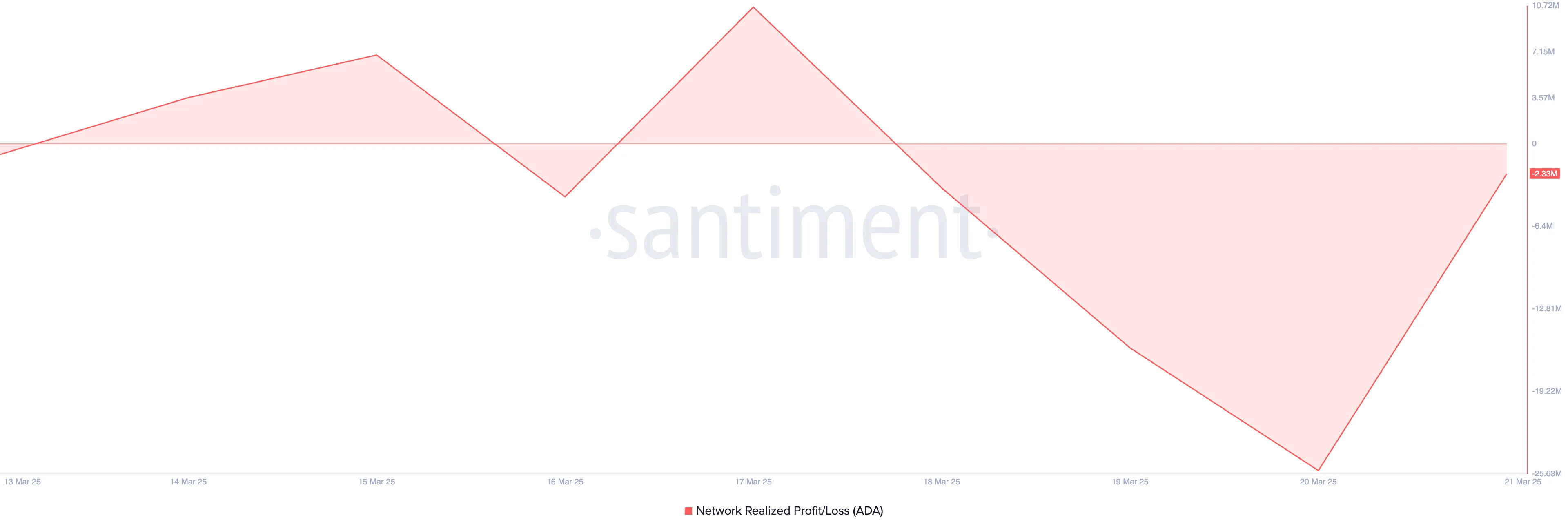

Moreover, ADA’s Community Realized Revenue/Loss (NPL) stays unfavorable, that means most Cardano holders would incur losses in the event that they bought now. At press time, this indicator stands at -2.33 million.

This metric measures the overall revenue or loss realized by traders once they transfer their cash on-chain, indicating total market sentiment. When NPL is unfavorable, extra traders are at a loss, decreasing the motivation to promote.

This is able to assist scale back promoting strain within the ADA market and enhance the probability of a possible rebound as extra traders maintain onto their belongings as an alternative of realizing losses.

ADA’s Subsequent Transfer: Break Above $0.75 or Drop to $0.65?

At press time, ADA trades at $0.71. The horizontal development of its Relative Energy Index (RSI) on the day by day chart confirms the coin’s sideways actions.

The RSI indicator measures an asset’s oversold and overbought market circumstances. When it’s flat, as with ADA, it signifies a steadiness between shopping for and promoting strain, that means there is no such thing as a clear momentum in both route. This implies market consolidation, the place the asset trades inside a spread with out sturdy bullish or bearish dominance.

Nevertheless, with the regular uptick in ADA accumulation, a break above the resistance at $0.75 may very well be on the horizon. If profitable, ADA may rally towards $0.77.

However, a breakdown under the $0.69 assist may set off a decline to $0.65.

Disclaimer

In keeping with the Belief Undertaking tips, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. All the time conduct your personal analysis and seek the advice of with an expert earlier than making any monetary selections. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.