Hedera (HBAR) has been buying and selling beneath the $0.20 mark for the previous week. The persistent downtrend has saved the token beneath stress, as each technical indicators and value motion recommend a cautious market atmosphere.

Latest alerts from each the DMI and Ichimoku Cloud spotlight rising bearish sentiment, with sellers beginning to achieve floor. The query now could be whether or not HBAR can preserve its footing above essential help or if additional draw back is on the horizon.

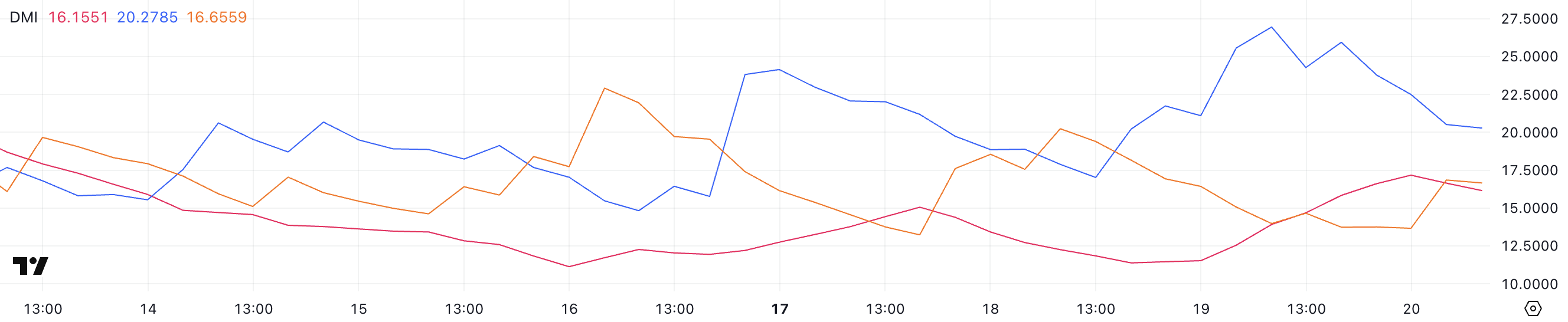

Hedera DMI Reveals Patrons Are Nonetheless In Management, However Sellers Are Rising

Hedera ADX, which measures pattern energy, is presently at 16.15, up from 11.5 yesterday. Earlier as we speak, it briefly reached as excessive as 17.16. Whereas this can be a modest uptick, it signifies that the pattern is slowly gaining some momentum.

Alongside this, the +DI line, which tracks bullish stress, has declined from 26.95 yesterday to twenty.27, suggesting weakening shopping for energy.

On the flip facet, the -DI line, representing bearish stress, has elevated from 13.97 to 16.65, indicating that sellers have gotten extra energetic.

The ADX (Common Directional Index) gauges the energy of a pattern no matter its route. Usually, an ADX studying beneath 20 alerts a weak or non-existent pattern, between 20 and 40 suggests a growing or average pattern, and above 40 signifies a powerful pattern.

With Hedera’s ADX nonetheless beneath 20, the pattern stays weak, however the latest uptick may trace at strengthening within the close to future. Nevertheless, with +DI declining and -DI rising, this shift means that bearish momentum is beginning to outweigh bullish forces.

Despite the fact that the pattern energy continues to be gentle, this sample may imply that HBAR could proceed its downtrend until shopping for stress returns to overpower the sellers.

HBAR Ichimoku Cloud Reveals a Bearish Setup After Key Resistance Wasn’t Damaged

The Ichimoku Cloud chart for Hedera exhibits that the value continues to be struggling beneath the Kumo (cloud), which reinforces the prevailing bearish pattern.

The value is presently buying and selling just below each the Tenkan-sen (conversion line) and the Kijun-sen (bottom line). This means an absence of bullish momentum and confirms indecision within the brief time period.

The cloud forward is crimson and thick, indicating sturdy overhead resistance. Till the value can decisively break above this resistance space, the bearish bias is prone to persist.

The Ichimoku Cloud system gives a holistic view of help, resistance, pattern route, and momentum. When the value is beneath the cloud, as HBAR is now, the asset is taken into account to be in a downtrend.

The Tenkan-sen and Kijun-sen traces present shorter-term alerts. The Tenkan-sen’s slight beneath the Kijun-sen is a refined bearish sign, although their proximity additionally displays a weak pattern and potential consolidation.

Provided that the value is beneath each traces and the cloud is appearing as resistance above, HBAR is prone to stay beneath stress within the brief time period until shopping for quantity will increase sufficient to push it again above the cloud and set off a pattern reversal.

Can Hedera Fall Under $0.17 Quickly?

Hedera value is presently buying and selling inside a decent vary, caught between a resistance stage at $0.195 and a key help stage at $0.184.

The value motion means that if the $0.184 help is retested and fails to carry, HBAR may shortly transfer decrease to check the subsequent vital help at $0.178.

A lack of that stage may open the door for additional draw back, doubtlessly driving the value beneath $0.17.

Nevertheless, if HBAR manages to reverse this downtrend, the primary hurdle would be the $0.195 resistance—an space it tried to interrupt above yesterday however failed.

A profitable breakout above $0.195 may shift the momentum again in favor of the bulls and doubtlessly set off a transfer towards the subsequent resistance at $0.21.

If bullish momentum strengthens past that, the value may goal greater ranges at $0.258 and $0.287, with a attainable retest of $0.30 – the extent HBAR hasn’t touched since January 31.

Disclaimer

In step with the Belief Venture tips, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. At all times conduct your personal analysis and seek the advice of with an expert earlier than making any monetary selections. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.