After the FOMC (Federal Open Market Committee) minutes and the digital asset summit on Wednesday and Thursday, respectively, roughly $2.09 billion in Bitcoin (BTC) and Ethereum (ETH) choices expire right now.

The expiration might affect market situations, with buyers monitoring potential shifts.

Over $2 Billion in Choices Expiry Right this moment

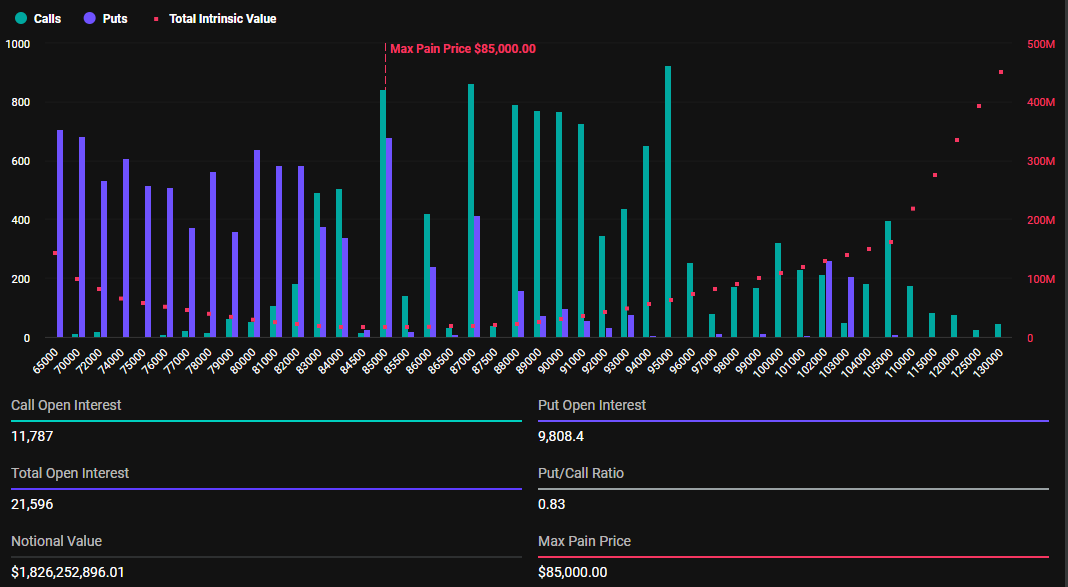

In response to Deribit, $1.826 billion in Bitcoin choices expire right now. The utmost ache level of those contracts stands at $85,000.

These choices embrace 21,596 contracts, barely fewer than final week’s 35,176. Regardless of current volatility, the put-to-call ratio of 0.83 signifies a normal bullish sentiment.

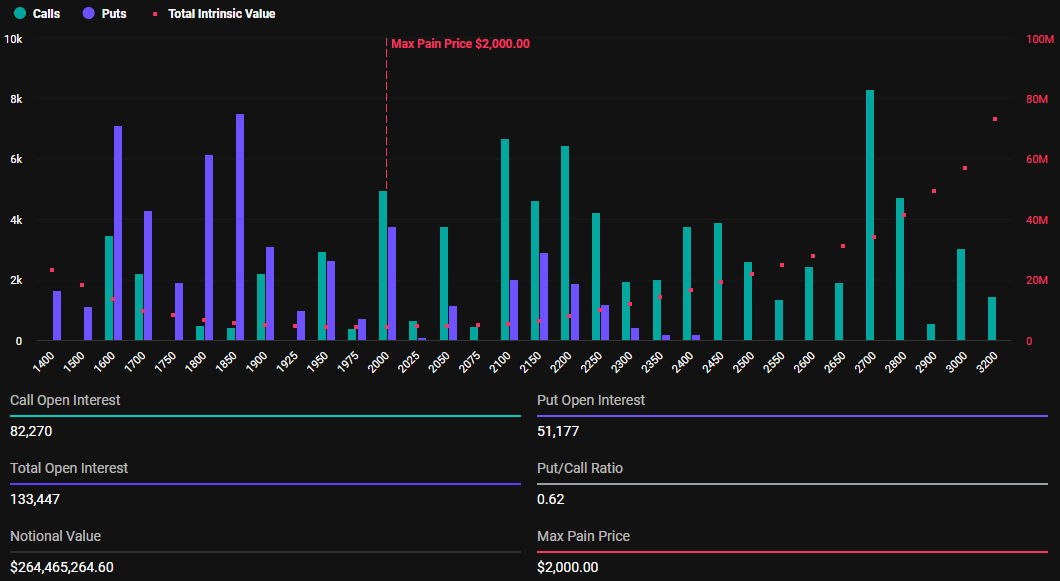

Ethereum has $264.46 million in choices expiring, involving 133,447 contracts. This determine can be decrease than the earlier week’s 223,395 contracts. The utmost ache level for these choices is $2,000, and the put-to-call ratio is 0.62.

Because the choices contracts close to expiration at 8:00 UTC right now, Bitcoin and Ethereum costs are anticipated to strategy their respective most ache factors. In response to BeInCrypto information, BTC traded for $84,414, whereas ETH exchanged fingers for $1,977.

This means a modest upside for Bitcoin and Ethereum in direction of the $85,000 and $2,000 strike costs, respectively. This surge is believable given sensible cash’s Technique in choices buying and selling, pushing costs towards the “max ache” degree. Right here, the best variety of contracts, each calls and places, expire nugatory.

“Will we see a volatility squeeze or a sluggish unwind?” Deribit posed in a publish on X (Twitter).

Primarily based on Bitcoin and Ethereum’s put-to-call ratios, each beneath 1, name choices (purchases) have a better prevalence than put choices (gross sales).

Market Sentiment Forward of Right this moment’s Choices Expiry

Analysts from crypto choices buying and selling device Greeks.dwell supplied insights on the present market sentiment, highlighting a divided dealer group. On the one hand, some anticipate a worth drop after the FOMC assembly, as policymakers rejected additional rate of interest cuts, successfully disappointing the crypto market.

Alternatively, some anticipate a brief rise earlier than uneven situations. With this, the analysts word the vary between $83,000 and $85,000 as the world of curiosity, with anticipated volatility round President Trump-related developments and potential MicroStrategy (now Technique) purchases.

“Count on chop and drift decrease earlier than heading larger once more on Monday, regardless of the present pump not being considered as sustainable,” Greeks.dwell analysts noticed.

Elsewhere, BeInCrypto reported that Bitget change CEO Gracy Chen is assured BTC will maintain above the $73,000 to $78,000 vary, paving the way in which for a possible rally to $200,000. She attaches her optimism to the US strategic Bitcoin reserve’s potential to drive institutional legitimacy and long-term worth stability.

Whilst Bitget’s Chen stays optimistic, merchants and buyers ought to brace for short-term volatility. Traditionally, choices expirations are likely to trigger non permanent worth actions. Nevertheless, the market often stabilizes shortly after.

This requires vigilance and evaluation of technical indicators and market sentiment to handle potential volatility successfully.

Disclaimer

In adherence to the Belief Venture pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nevertheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any selections primarily based on this content material. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.