Whereas crypto airdrops are all the time anticipated to gas fortunes and adoption, Binance’s newest report exposes deep flaws. Decreased rewards, insider revenue, and bot exploits are more and more impacting group belief in airdrops.

As soon as a development engine, crypto airdrops now danger changing into liabilities. Can the trade repair them earlier than customers lose religion?

Binance’s Evaluation of Current Crypto Airdrops

This report highlights the flawed system that’s turning pleasure into frustration. With this, Binance poses the rhetoric: Are airdrops crypto’s golden ticket or a ticking time bomb?

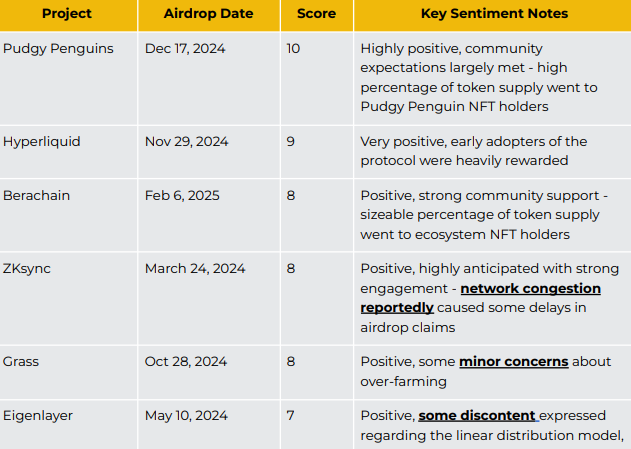

Binance trade’s evaluation provides Pudgy Penguins’ airdrop a near-universal 10/10 acclaim in group sentiment. Hyperliquid adopted intently with a 9/10 score after handsomely rewarding and setting new DeFi requirements.

Nevertheless, the fallout is swift and extreme when airdrops fail to ship. The Binance analysis cites Redstone (RED), which initially pledged 9.5% of its token provide to the group and slashed it to five% on the final second.

This triggered widespread backlash and a dismal 2/10 sentiment rating, in accordance with Binance’s Grok AI evaluation.

It additionally cites Scroll’s October 2024 airdrop as one other catastrophe, highlighting obscure guidelines and an unclear eligibility snapshot resulting in a disappointing 3/10 score.

Equally, in February 2025, Kaito distributed 43.3% of its provide to insiders whereas allocating a mere 10% to the group. The transfer noticed influencers rapidly dump their holdings, eroding belief.

Additional, the report cites Sybil farming, the place bots amass tokens in bulk. Technical failures reminiscent of Magic Eden’s botched declare course of in December 2024 have additional fueled consumer discontent.

Why Most Airdrops Fail to Ship

Past exposing flaws, Binance’s report dissects the mechanics behind these failures—last-minute allocation modifications, like Redstone’s, sign poor planning and injury credibility. Lack of transparency, as seen in Scroll’s unclear eligibility standards, breeds suspicion of favoritism.

Insider-heavy token distributions, reminiscent of Kaito’s, alienate retail contributors. In the meantime, technical inefficiencies, together with Magic Eden’s malfunctioning pockets claims, flip airdrops into irritating consumer experiences.

With billions at stake, these points are now not minor hiccups however existential threats to the legitimacy of the crypto airdrop mannequin.

“Tokens are a brand new asset class….Airdrops are their wild frontier,” wrote Binance macro researcher Joshua Wong.

Regardless of the turmoil, Binance outlines a possible path ahead to revive confidence in crypto airdrops. First, it requires transparency, urging retroactive airdrops to set clear eligibility standards upfront.

In the meantime, engagement-based fashions ought to decide to mounted point-to-token ratios.

Subsequent, initiatives should prioritize real group engagement, treating tokens as extra than simply digital property as instruments for constructing loyal ecosystems.

Lastly, technical options reminiscent of on-chain monitoring and proof-of-humanity instruments, like these employed by LayerZero, may assist fight Sybil farming and improve equity.

Taken collectively, Binance’s report is a wake-up name that whereas crypto airdrops current a singular alternative to democratize wealth and strengthen blockchain communities, in addition they danger collapsing beneath the burden of mismanagement and exploitation.

Disclaimer

In adherence to the Belief Venture pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nevertheless, readers are suggested to confirm info independently and seek the advice of with an expert earlier than making any selections primarily based on this content material. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.