After 5 weeks of consecutive outflows, US spot Bitcoin ETFs have rebounded with $744 million in internet inflows this week. On Monday, March 17, ETFs noticed a $274 million influx, which was the best day by day determine in over a month.

This rebound means that institutional buyers are coming again to the Bitcoin market as macroeconomic elements have priced in. Nonetheless, BTC nonetheless stays under the $90,000 threshold.

Bitcoin ETFs Begin Recovering from a $5 Billion Loss

US Bitcoin ETFs misplaced over $5.3 billion because the second week of February. The month was notably brutal for ETFs, with a record-breaking $3.5 billion in outflows.

The sharp sell-off was attributed to institutional buyers liquidating their holdings amid market volatility and shifting macroeconomic situations. Nonetheless, March has signaled a turnaround, with inflows steadily rising over the previous week.

With macroeconomic considerations easing, institutional buyers look like regaining confidence available in the market. The week started on a robust observe, with Bitcoin ETFs recording $274 million in inflows on Monday.

The optimistic momentum endured, culminating in six straight days of internet inflows. On March 21 alone, the ETFs noticed a complete internet influx of $83.09 million.

BlackRock’s IBIT led the way in which, recording as much as $150 million in optimistic flows on Friday. In the meantime, all different issuers remained stagnant. The one outlier was Grayscale’s GBTC, which continued its pattern of outflows, shedding $21.9 million that day.

This shift means that institutional gamers could also be positioning themselves for a possible market restoration. Crypto influencer and Open4Profit founder Zia ul Haque pointed to this resurgence, questioning whether or not institutional buyers are performing on inside information.

“Institutes began Accumulating Once more: Do they know one thing?! Bitcoin ETF noticed a optimistic influx for the final consecutive 5 days! That is the most important consecutive influx this month. From the start of March, giants bought BTC closely which created a large panic and value dump available in the market. However in the previous few days, they’re accumulating once more. This might be a very good signal for the market,” ul Haque wrote.

His commentary aligns with the regular restoration in ETF inflows and Bitcoin’s value motion, which continues to defend in opposition to additional draw back.

Nonetheless, regardless of the optimistic ETF flows, not everybody shares the bullish outlook and optimism for Bitcoin’s value restoration. Some analysts suppose that Bitcoin ETF inflows don’t clearly mirror resuming purchaser curiosity.

Institutional buying and selling methods are doubtlessly experiencing structural shifts. Hedge funds typically leverage a low-risk arbitrage technique involving Bitcoin spot ETFs and CME futures.

“The ETF ‘demand’ was actual, however a few of it was purely for arbitrage. There was a real demand for proudly owning BTC, simply not as a lot as we had been led to imagine. Till actual patrons step in, this chop & volatility will proceed,” common analyst Kyle Chasse defined.

If this structural shift continues, it may affect market stability regardless of the current return of ETF inflows.

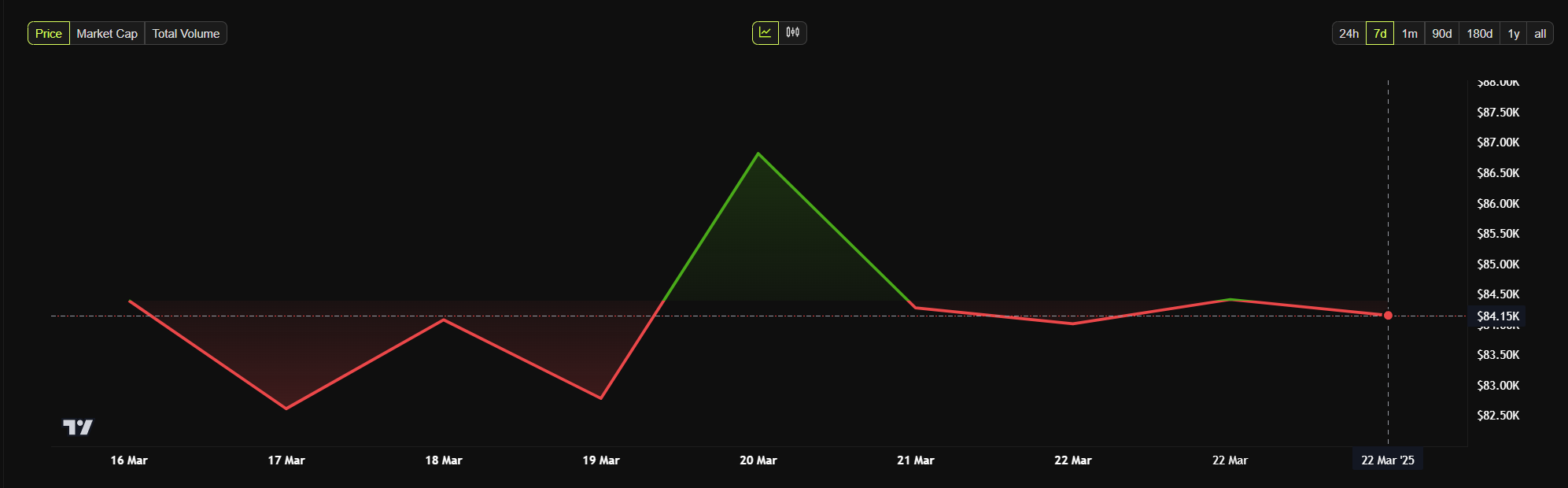

As of this writing, Bitcoin is buying and selling at round $84,148. It’s down by a modest 0.46% within the final 24 hours, failing to mirror optimism amid the current uptick in Bitcoin ETF investments.

In the meantime, Ethereum ETFs proceed to submit detrimental flows, with internet inflows in 12 consecutive buying and selling days (over two weeks).

Disclaimer

In adherence to the Belief Mission tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nonetheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any selections based mostly on this content material. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.