Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Over the previous few weeks, the Bitcoin value has not been capable of maintain any significant momentum within the journey to get well its six-figure valuation. After falling to only above $81,000 on Tuesday, March 18, the flagship cryptocurrency pushed for the $87,000 mark earlier than going through a big stage.

Under is why the $87,000 stage might show pivotal to the long-term well being of the Bitcoin value.

5.58 Million BTC Addresses ‘Sitting On A Sizzling Potato’

In a March 21 submit on the X platform, in style crypto analyst Maartunn mentioned the importance of $87,000 as a vital stage for the long run trajectory of the Bitcoin value. The reasoning behind this particular evaluation is the common on-chain value foundation of a number of BTC traders.

Associated Studying

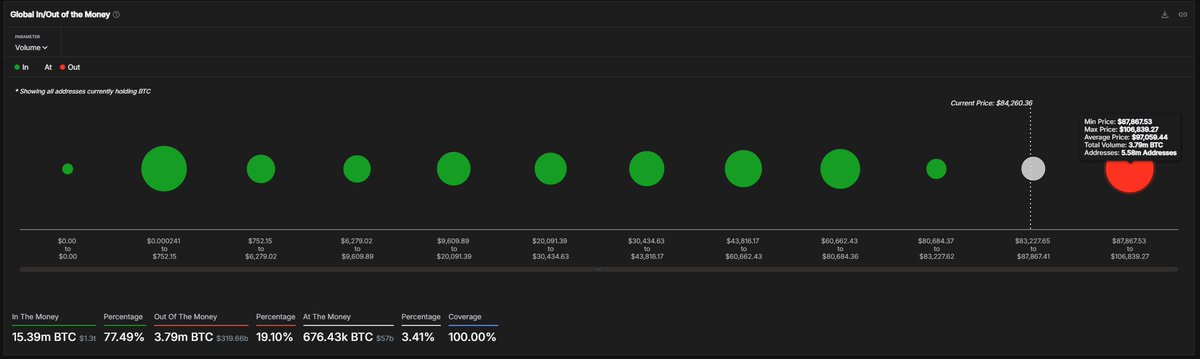

Value-basis evaluation includes evaluating the capability of a value stage to behave as both resistance or assist primarily based on the whole quantity of cash bought in or round it. As noticed within the chart under, the dimensions of the dot displays the variety of cash purchased inside a selected value bracket. (therefore the power of the assist or resistance space).

In line with Maartunn, about 5.58 million addresses acquired 3.79 million BTC (price $367 billion at a median value of $97,059) between the $87,867 – $106,839 area. The analyst famous that the traders listed below are “sitting on a sizzling potato” and within the crimson, as all of them purchased at costs properly above the present value.

Sometimes, this $87,867 – $106,839 area serves as a vital resistance space, as traders are prone to promote their belongings ought to the Bitcoin value return to their value foundation. This promoting exercise would put some downward stress on the premier cryptocurrency, hindering the additional upward value motion.

Moreover, Maartunn recognized the traders throughout the $87,867 – $106,839 area as short-term holders, a category of traders identified to be “fragile” and extra reactive to slight market actions. Therefore, the analyst famous that this may not be a really perfect state of affairs, particularly if the market sees one other wave of bearish stress.

Quick-term holders have been related to vital sell-off occasions (in response to cost fluctuations). In the end, this means that the Bitcoin market might expertise a extreme capitulation occasion if the short-term traders within the $87,867 – $106,839 area are pressured to comprehend their losses.

Bitcoin Value At A Look

As of this writing, the worth of BTC is hovering across the $84,000 mark, reflecting no vital change previously 24 hours.

Associated Studying

Featured picture from iStock, chart from TradingView