The current Bitcoin rally has sparked anticipation for brand spanking new peak values, driving traders towards safe storage choices. The rising institutional involvement and mainstream adoption are rising demand for dependable crypto wallets.

Non-custodial options, like Finest Pockets, have gotten most popular because of their user-controlled, verification-free mannequin. With Bitcoin’s bullish trajectory, the significance of protected and handy storage is paramount.

Bitcoin’s Newest Worth Motion: A Step Towards Six Figures?

Bitcoin has captured the highlight as soon as once more, surging previous $87,000 earlier than a slight pullback. The rally comes amid rising institutional curiosity, renewed state-level adoption discussions, and rising hypothesis concerning the four-year Bitcoin cycle.

Supply – 99Bitcoins YouTube Channel

Analysts are divided—some see Bitcoin in an accumulation section, whereas others predict an prolonged bull run. With liquidity challenges persisting and main gamers like MicroStrategy and BlackRock making strategic strikes, the market stands at an important turning level.

Bitcoin’s leap to $87,000 earlier than correcting to $84,000 has reignited enthusiasm within the crypto area. Whereas the every day acquire could appear modest, Bitcoin has remained comparatively flat over the previous week, contrasting with the broader bullish sentiment.

Nonetheless, a 13% month-to-month decline highlights the market’s ongoing volatility. Altcoins have adopted Bitcoin’s value motion, with Ethereum briefly reclaiming $2,000 earlier than settling at $1,987.

XRP led the good points with a 7% improve, reaching $2.56 earlier than pulling again to $2.40. Whereas the value motion indicators renewed investor confidence, issues about market liquidity and macroeconomic pressures persist.

Institutional Gamers Fueling Bitcoin’s Ascent

The surge in Bitcoin’s value coincides with main developments from institutional traders. BlackRock’s iShares Bitcoin Belief has witnessed substantial inflows, signaling heightened demand for Bitcoin ETFs.

On the identical time, MicroStrategy, led by Michael Saylor, introduced plans to amass an extra $500 million price of Bitcoin. These strikes reveal rising institutional conviction in Bitcoin’s long-term potential.

Nonetheless, regardless of the rising involvement of large-scale traders, Bitcoin’s liquidity stays a problem. The market is experiencing diminished investor participation and leverage buying and selling, compounded by institutional outflows and geopolitical uncertainties.

These elements carry into query the energy of Bitcoin’s present rally and the potential for additional good points.

U.S. States Exploring Bitcoin as a Strategic Asset

A number of U.S. states are making important strikes towards Bitcoin adoption. North Carolina is contemplating allocating 10% of its basic fund to Bitcoin as a strategic reserve, reflecting a rising development amongst states evaluating cryptocurrency as an funding asset.

Minnesota has proposed integrating Bitcoin into its funding, tax, and retirement frameworks, becoming a member of states like Texas in exploring using crypto belongings for monetary planning.

Such developments point out a broader institutional and governmental shift towards Bitcoin, reinforcing the narrative that digital belongings are more and more being seen as viable monetary devices relatively than speculative belongings.

Is the Crypto Market Experiencing a Bull Run or Simply an Prolonged Uptrend?

Market sentiment stays divided on whether or not Bitcoin has formally entered a bull market. Some analysts argue that the 2023-2024 uptrend resembles previous cycles, whereas others imagine the standard four-year cycle could also be breaking down.

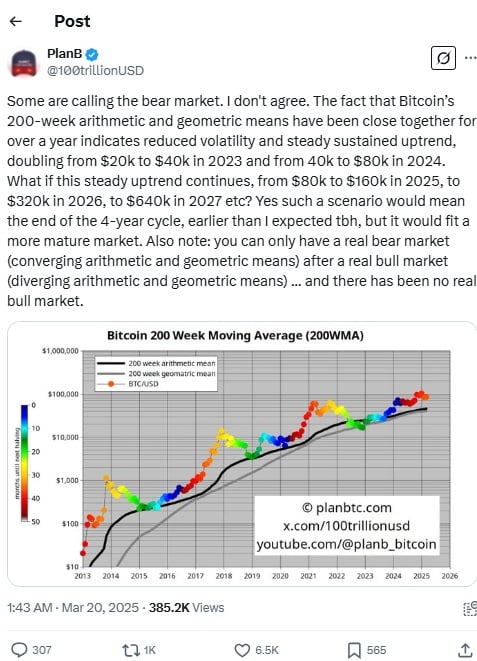

A well known crypto analyst on X, PlanB, means that Bitcoin’s 200-week arithmetic and geometric means staying shut for over a 12 months sign decrease volatility and a gradual uptrend.

His mannequin predicts a possible doubling in Bitcoin’s value annually, suggesting a trajectory from $80,000 in 2024 to $160,000 in 2025 and probably reaching $640,000 by 2027. If this development holds, it may mark a elementary shift in how Bitcoin’s value cycles evolve.

Nonetheless, he additionally notes {that a} true bear market can solely happen after an actual bull market, and by his metrics, Bitcoin has but to expertise a full-scale bull rally.

The approaching months shall be essential in figuring out whether or not Bitcoin is within the early levels of a chronic bull market or whether it is merely experiencing one other cyclical uptrend.

Finest Pockets: The Final Non-KYC Crypto Buying and selling Answer

As Bitcoin continues to dominate headlines, retail traders are in search of safe and handy methods to commerce and retailer their belongings.

Finest Pockets has emerged as one of many fastest-growing crypto wallets, providing a seamless, safe, and user-friendly expertise with out requiring KYC verification.

Supply – Finest Pockets Twitter

Finest Pockets helps over 60 blockchains, enabling customers to purchase, promote, stake, and swap cryptocurrencies with ease.

Whether or not an investor is seeking to retailer Bitcoin, Ethereum, or different altcoins, Finest Pockets gives a safe atmosphere with out the effort of identification verification. This makes it a lovely choice for many who prioritize privateness and effectivity.

Conclusion

Pleasure is constructing within the crypto market as Bitcoin’s value motion good points momentum, fueled by rising institutional assist and state-level curiosity.

Whereas some query whether or not the four-year cycle nonetheless holds, there’s little question that Bitcoin stays a significant pressure in world finance.

With regulatory shifts and liquidity issues in play, extra traders are turning to safe choices like Finest Pockets to handle their belongings. Whether or not Bitcoin climbs to new highs or experiences a pullback, the best instruments and information stay important for navigating the market.

Go to Finest Pockets