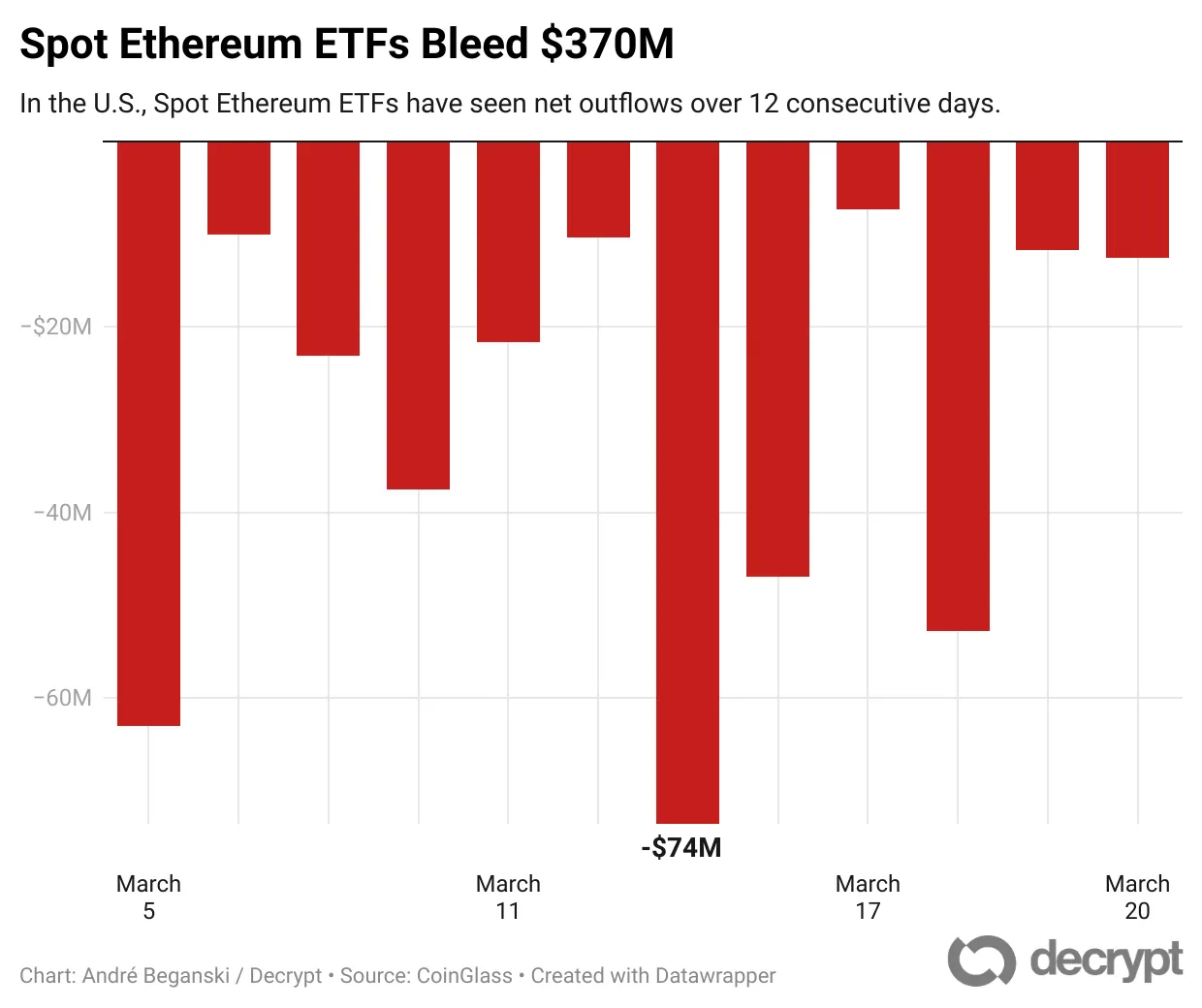

Spot Ethereum exchange-traded funds have shed $370 million in property over the previous 12 buying and selling days, notching their longest shedding streak but, as the worth of the underlying asset has struggled.

Amongst funds, which started buying and selling final yr, outflows from the iShares Ethereum Belief (ETHE) and the Grayscale Ethereum Belief (ETHE) totaled $146 million and $106 million, essentially the most over this era, in keeping with crypto information supplier CoinGlass.

The outflows have dovetailed with Ethereum’s tumble to its present degree of round $1,950 from $2,200 on March 5, in keeping with the crypto information supplier CoinGecko. The asset has swooned in current months amid buyers doubts about its pace and effectivity in comparison with blockchain rivals and a wider fall-off in crypto and different risk-on property prompted by macroeconomic angst.

Spot Bitcoin ETFs have attracted $660 million this week, regaining a small quantity of floor misplaced in their very own current downturn.

In an interview on Thursday on the Digital Asset Summit in New York, Robert Mitchnick, BlackRock’s head of digital property, mentioned that the Ethereum ETFs’ lackluster debut got here partly as a result of they don’t allow staking.

NYSE Arca filed for simply that on behalf of Bitwise this week, whereas Grayscale, 21Shares and Constancy have additionally filed for rule modifications on their funds to allow staking.

The SEC has acknowledged the NYSE and Grayscale filings, and earlier this month, the Fee met with Coinbase to debate how sure liquidity dangers might be mitigated for spot Ethereum ETFs relying on the quantity of ETH withheld from staking.

“A staking yield is a significant a part of how one can generate funding return on this area,” Mitchnick mentioned.

Staking rewards are issued to Ethereum buyers that lock up their capital and take part within the strategy of validating transactions.

The quantity of Ethereum being staked has in the meantime elevated to 33.8 million ETH, in keeping with information from testnet block explorer beaconcha.in. That represents a 0.5% enhance from the 33.6 million Ethereum staked on March 5, when spot Ethereum ETFs started their current bleed.

Spot Ethereum funds have generated $2.45 billion in internet inflows since their debut final July, with BlackRock’s spot Ethereum ETF garnering $587 million. Analysts take into account their launch profitable, though their efficiency is dwarfed by spot Bitcoin ETFs which have acquired greater than $35 billion in internet inflows, in keeping with U.Ok. asset supervisor Farside Traders.

“This highlights a rising institutional threat urge for food for BTC, whereas ETH’s restoration stays sluggish as buyers anticipate stronger catalysts,” the crypto analysis agency BRN mentioned on X (previously often known as Twitter) on Friday.

Edited by James Rubin

Each day Debrief E-newsletter

Begin each day with the highest information tales proper now, plus unique options, a podcast, movies and extra.