Ethereum (ETH) continues to be struggling beneath the $2,000 mark after briefly hitting the brink following the current FOMC assembly. The bullish momentum has shortly light, and ETH is once more displaying indicators of weak point.

Technical indicators, together with RSI and DMI, point out rising bearish strain within the quick time period. Merchants are actually monitoring key help and resistance ranges to see whether or not ETH will proceed its correction or try a restoration.

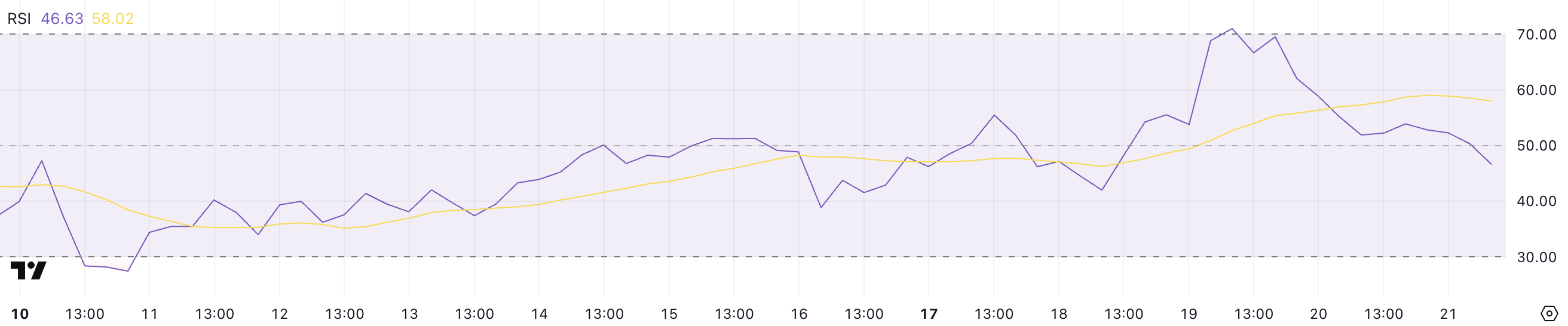

Ethereum RSI Is Down After Touching Overbought Ranges

Ethereum’s RSI has dropped sharply to 46.63 from 71 simply two days in the past, signaling a shift in momentum.

The Relative Power Index (RSI) is a momentum oscillator that measures the pace and alter of worth actions, usually on a scale of 0 to 100. Readings above 70 counsel an asset is overbought, whereas ranges beneath 30 point out it could be oversold.

With ETH’s RSI now sitting close to 46, it has entered impartial territory, displaying that the current bullish momentum has light. This might suggest a interval of consolidation or additional draw back danger if sellers preserve management.

Merchants might now count on ETH to stabilize and bounce if demand returns or proceed its correction if bearish strain grows stronger.

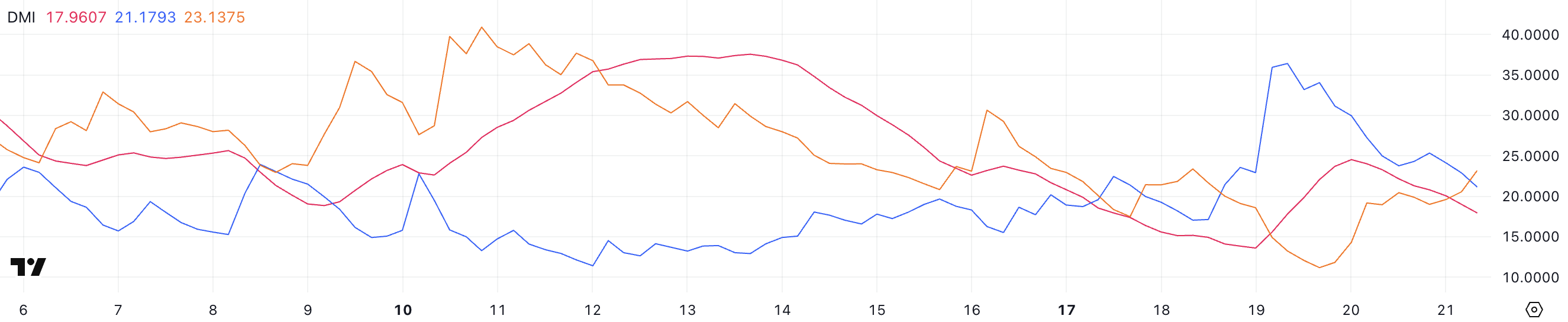

ETH DMI Exhibits Sellers Are Once more In Management

Ethereum’s DMI chart exhibits that the ADX has dropped to 17.96 from 24.5 yesterday, indicating weakening development energy.

The Common Directional Index (ADX) measures the energy of a development, with values above 25 suggesting a robust development and values beneath 20 pointing to a weak or ranging market.

On the identical time, ETH’s +DI has fallen to 21.17 from 34, signaling that bullish momentum is fading. In the meantime, the -DI has climbed to 23.12 from 11.17, suggesting rising bearish strain.

With ADX dropping and -DI crossing above +DI, Ethereum may face additional draw back or enter a consolidation section as sellers acquire extra affect over worth motion.

Can Ethereum Surge 30% Quickly?

Ethereum worth is presently in a corrective section, and if this development continues, it may take a look at key help ranges at $1,867 and $1,823.

A break beneath these zones may open the door for a deeper decline towards $1,759, with the danger of ETH falling beneath $1,700 for the primary time since October 2023.

Nonetheless, if Ethereum manages to reverse the present downtrend and regain bullish momentum, it may push towards resistance at $2,106.

A stronger rally may see ETH aiming for $2,320 and even $2,546, providing a possible upside of round 30% from present ranges.

Disclaimer

Consistent with the Belief Mission pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. All the time conduct your personal analysis and seek the advice of with an expert earlier than making any monetary selections. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.