|

Prime Tales of The Week

SEC will drop its attraction towards Ripple, CEO Garlinghouse says

The US Securities and Alternate Fee’s multi-year enforcement motion towards Ripple is lastly coming to an finish, in line with the corporate’s CEO.

“That is it — the second we’ve been ready for. The SEC will drop its attraction — a powerful victory for Ripple, for crypto, each method you have a look at it,” Ripple CEO Brad Garlinghouse wrote on X on March 19.

“I’m lastly in a position to announce that the case has ended; it’s over,” Garlinghouse mentioned within the video hooked up to the X put up.

The top of a long-running authorized battle between Ripple and the SEC comes 4 years after the US securities regulator sued the corporate over an alleged $1.3 billion unregistered securities providing in December 2020.

Trump turns into first US sitting president to talk at a crypto convention

US President Donald Trump is steadily aligning his administration with the crypto business. On March 20, he addressed a neighborhood convention for the primary time since being elected.

Talking at Blockworks’ Digital Asset Summit on March 20 in a pre-recorded assertion, Trump reiterated that the US would take steps to make sure it’s the “crypto capital of the world.”

The president lauded the current regulatory shift within the crypto business over the earlier administration and added:

“Pioneers like it is possible for you to to enhance our banking and cost system and promote higher privateness, security, safety and wealth for American shoppers and companies alike. You’ll unleash an explosion of financial progress.”

Bybit: 89% of stolen $1.4B crypto nonetheless traceable post-hack

The lion’s share of the hacked Bybit funds continues to be traceable after the historic cybertheft, as blockchain investigators proceed their efforts to freeze and get well these funds.

The crypto business was rocked by the biggest hack in historical past on Feb. 21, when Bybit misplaced over $1.4 billion in liquid-staked Ether, Mantle Staked ETH and different digital belongings.

Blockchain safety corporations, together with Arkham Intelligence, have recognized North Korea’s Lazarus Group because the seemingly wrongdoer behind the Bybit exploit, because the attackers have continued swapping the funds in an effort to make them untraceable.

Regardless of the Lazarus Group’s efforts, over 88% of the stolen $1.4 billion stays traceable, in line with Ben Zhou, the co-founder and CEO of Bybit change.

Coinbase turns into Ethereum’s largest node operator with 11% stake

A Coinbase report revealed that the crypto change is the biggest node operator on the Ethereum community, controlling 11.42% of whole staked Ether.

In a efficiency report, Coinbase mentioned it had 3.84 million Ether, value about $6.8 billion, staked to its validators. The change additionally mentioned that, as of March 3, it has 11.42% of whole staked ETH.

Anthony Sassano, host of The Each day Gwei, mentioned that Coinbase’s stake makes the change the “single largest node operator” within the community.

Sassano added that whereas the staking platform Lido is larger as a collective, every node operator has a a lot smaller share share.

Binance CEO reiterates denial of Trump household deal talks

Binance CEO Richard Teng denied reviews that Binance.US was in deal talks with entities affiliated with US President Donald Trump throughout a March 18 panel at Blockworks’ 2025 Digital Asset Summit in New York.

Teng’s assertion reiterated the place taken by Binance’s co-founder, Changpeng “CZ” Zhao, and Trump, each of whom denied the story final week.

Learn additionally

Options

An Funding in Data Pays the Finest Curiosity: The Parlous State of Monetary Schooling

Options

Soulbound Tokens: Social credit score system or spark for international adoption?

On March 13, The Wall Avenue Journal reported that Binance.US, an independently-operated US cryptocurrency change, was discussing promoting an fairness curiosity to Trump-affiliated enterprise entities, together with a attainable cope with World Liberty Monetary, the Trump household’s decentralized finance (DeFi) venture.

“I imagine each World Liberty Monetary in addition to CZ himself have tweeted and denied the reforms, proper? In order that there’s actually nothing else so as to add,” Teng mentioned in the course of the summit, which was attended by Cointelegraph.

Winners and Losers

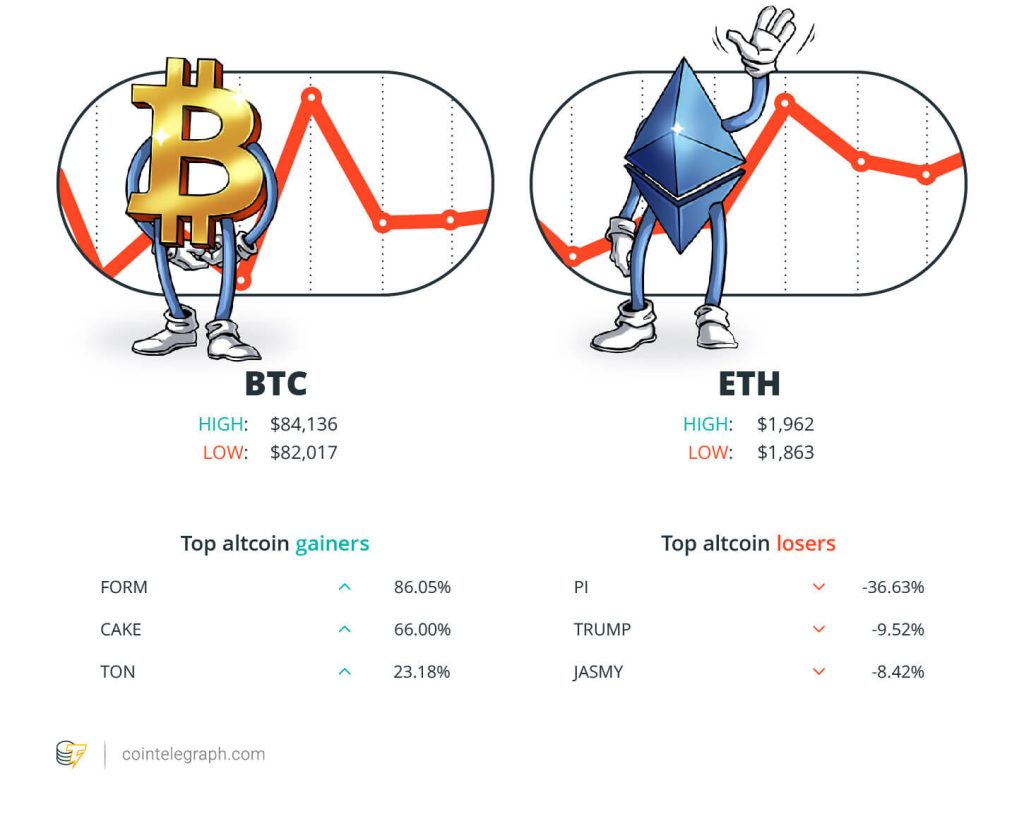

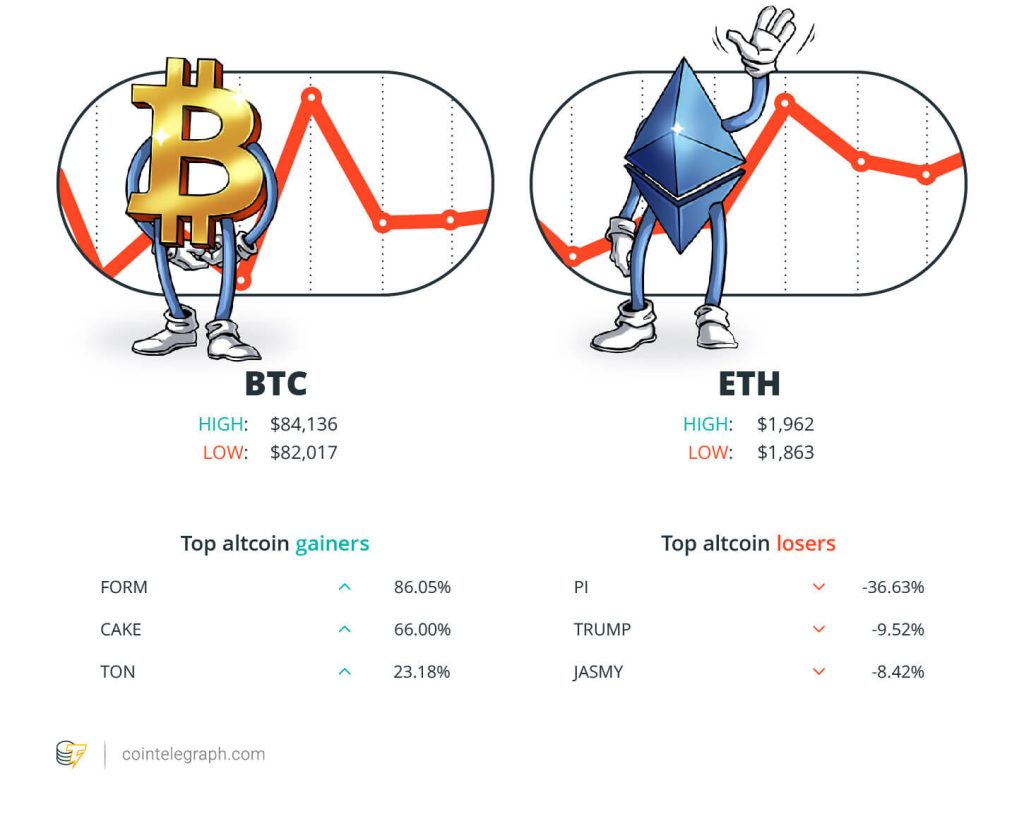

On the finish of the week, Bitcoin (BTC) is at $84,136, Ether (ETH) at $1,962 and XRP at $2.38. The full market cap is at $2.75 trillion, in line with CoinMarketCap.

Among the many largest 100 cryptocurrencies, the highest three altcoin gainers of the week are 4 (FORM) at 86.05%, Pancake Swap (CAKE) at 66.00% and Toncoin (TON) at 23.18%.

The highest three altcoin losers of the week are Pi (PI) at 36.63%, Official Trump (TRUMP) at 9.52% and JasmyCoin (JASMY) at 8.42%. For more information on crypto costs, make certain to learn Cointelegraph’s market evaluation.

Most Memorable Quotations

“I’m ashamed I downplayed it as a substitute of simply calling it what it’s – imply and punching down on a marginalized group.”

Anatoly Yakovenko, co-founder and CEO of Solana Labs

“I imagine each World Liberty Monetary in addition to CZ himself have tweeted and denied the reforms, proper? So there’s actually nothing else so as to add.”

Richard Teng, CEO of Binance

“Was BTC $77k the underside, prob.”

Arthur Hayes, co-founder and former CEO of BitMEX

“Bitcoin bull cycle is over, anticipating 6-12 months of bearish or sideways value motion.”

Ki Younger Ju, CryptoQuant founder and CEO

“I feel what’s taking place, although, is that if we do have a recession, declining GDP, that that is going to present the president and the Fed many extra levels of freedom to do what they need by way of tax cuts and financial coverage.”

Cathie Wooden, CEO of Ark Make investments

“Whereas crypto is the foreign money for AI, not each agent wants its personal token. Brokers can take charges in an current crypto for offering a service.”

Changpeng “CZ” Zhao, co-founder and former CEO of Binance

Prediction of The Week

XRP value chart hints at 75% good points subsequent as SEC ends lawsuit towards Ripple

XRP’s value has recovered by virtually 30% within the final two weeks, led by a crypto market rebound, as Ripple’s long-running authorized battle towards the US Securities and Alternate Fee got here to an finish.

As of March 21, XRP bounced after testing the triangle’s decrease trendline, eyeing an increase towards the higher trendline — across the apex level on the $2.35 stage — by April. The last word goal for this attainable breakout is $4.35 by June, up 75% from the present value ranges.

Conversely, a drop under the decrease trendline may invalidate the bullish setup, setting XRP on the trail towards $1.28. The bearish goal is obtained by subtracting the triangle’s most peak from the potential breakdown level at $2.35.

Prime FUD of The Week

Dangerous information Bitcoin bulls, the long-hoped-for retail is already right here: CryptoQuant

Bitcoin bulls who nonetheless suppose the cycle peak has but to return as retail buyers haven’t piled in but is perhaps utilizing an outdated playbook, in line with a crypto govt.

“The concept that the cycle isn’t over simply because onchain retail exercise is absent wants reconsideration,” CryptoQuant founder and CEO Ki Younger Ju mentioned in a March 19 X put up.

Ju mentioned that these monitoring retail actions utilizing solely onchain metrics won’t have seen the total image.

“Retail is probably going coming into by means of ETFs — the paper Bitcoin layer — which doesn’t present up onchain,” Ju mentioned.

Russian Gotbit founder strikes $23M plea cope with US prosecutors

Aleksei Andriunin, a Russian nationwide charged with manipulating cryptocurrency by means of the Gotbit market maker platform, has reportedly struck a plea cope with prosecutors in america.

Andriunin, the founder and CEO of Gotbit, has agreed to forfeit about $23 million in Tether’s USDt and Circle’s USDC in a plea cope with Massachusetts federal prosecutors, the authorized information service Law360 reported on March 19.

As a part of the plea, Andriunin will plead responsible to 3 counts charging conspiracy to commit wire fraud and market manipulation, in line with the letter signed by the defendant on March 19.

Watch out for ‘cracked’ TradingView — it’s a crypto-stealing trojan

Cybersecurity agency Malwarebytes has warned of a brand new type of crypto-stealing malware hidden inside a “cracked” model of TradingView Premium, software program that gives charting instruments for monetary markets.

The scammers are lurking on crypto subreddits, posting hyperlinks to Home windows and Mac installers for “TradingView Premium Cracked,” which is laced with malware geared toward stealing private knowledge and draining crypto wallets, Jerome Segura, a senior safety researcher at Malwarebytes, mentioned in a March 18 weblog put up.

“We’ve heard of victims whose crypto wallets had been emptied and have been subsequently impersonated by the criminals who despatched phishing hyperlinks to their contacts,” he added.

Learn additionally

Options

Actual AI use instances in crypto: Crypto-based AI markets, and AI monetary evaluation

Options

Is measuring blockchain transactions per second (TPS) silly in 2024? Large Questions

Prime Journal Tales of The Week

Dummies information to native rollups: L2s as safe as Ethereum itself

Customers may really feel as secure and safe preserving $10 million in life financial savings on a Native Rollup as they’d storing it on Ethereum itself.

Meebits and CryptoPunks are like Scorching Wheels for adults: New MeebCo proprietor Sergito

“It was my first time shopping for crypto and my timing was simply notably fortunate. It was that week when Bitcoin went to $3,000 and Ethereum went to love $110,” says MeebCo’s Sergito.

Memecoins are ded — However Solana ‘100x higher’ regardless of income plunge

The memecoin crash has hit Solana’s exercise, charges and value exhausting. However proponents argue the Solana community itself is in higher form than ever earlier than.

Subscribe

Essentially the most partaking reads in blockchain. Delivered as soon as a

week.

Editorial Workers

Cointelegraph Journal writers and reporters contributed to this text.