The worth motion of Solana was fairly underwhelming over the previous week, mirroring the worsening local weather of the altcoin market. Apparently, the launch of the SOL futures exchange-traded funds (ETFs) throughout the week did little or no to jolt the altcoin’s value again to life.

Following the extreme value downturn that hit the market, together with the Solana token, traders have been left questioning when it was finest to “purchase the dip.” The most recent on-chain remark means that it would lastly be time for traders to get again into the SOL market.

SOL Lengthy-Time period Buyers Fearful – A Purchase Sign?

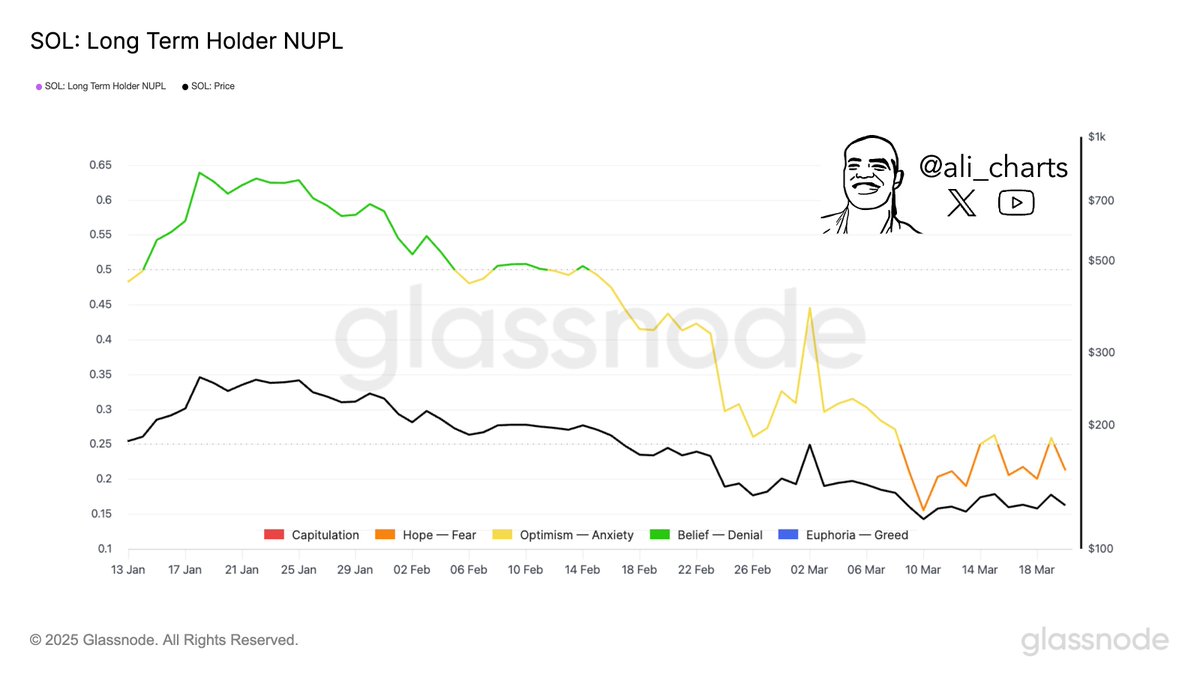

In a March 21 publish on the X platform, outstanding crypto analyst Ali Martinez stated long-term SOL holders are actually in concern. The related on-chain indicator right here is the “Lengthy-Time period Holder Web Unrealized Revenue/Loss (NUPL)” metric, which measures the distinction between market cap and realized cap divided by market cap.

This NUPL indicator supplies perception into the ratio of long-term traders in revenue at each given time. When this metric’s worth is over zero, it signifies that extra traders are in revenue; whereas a less-than-zero worth for the NUPL indicator implies that extra traders are within the purple than these in revenue.

Though an upward pattern for the metric means that extra cash are starting to enter revenue, it additionally implies that extra traders are inclined to take revenue — resulting in elevated bearish strain. Alternatively, a falling NUPL worth signifies traders’ decreased willingness to understand loss, leading to decreased promoting strain.

Supply: @ali_charts on X

As proven within the chart above, long-term Solana traders are actually in concern, because the NUPL metric slipped beneath the 0.25 mark. Based on earlier logic, this class of SOL holders is much less more likely to promote their belongings and notice their losses, signaling much less bearish strain for the altcoin.

Furthermore, Martinez famous that “sensible cash” traders have at all times proven a willingness to enter the market in periods like this. “Be grasping when others are fearful,” the analyst stated concerning the technique.

Traditionally, the crypto market tends to maneuver within the crowd’s other way. Therefore, it may be time to “purchase the dip,” particularly with the long-term traders at present skeptical concerning the promise of the Solana token.

Solana Worth At A Look

As of this writing, the worth of SOL sits simply beneath the $130 degree, reflecting a 0.4% decline prior to now 24 hours. Based on CoinGecko information, the altcoin’s worth has dropped by nearly 5% prior to now week.

The worth of SOL on the day by day timeframe | Supply: SOLUSDT chart on TradingView

Featured picture from Aivaras Sakurovas | Dreamstime.com, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our group of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.