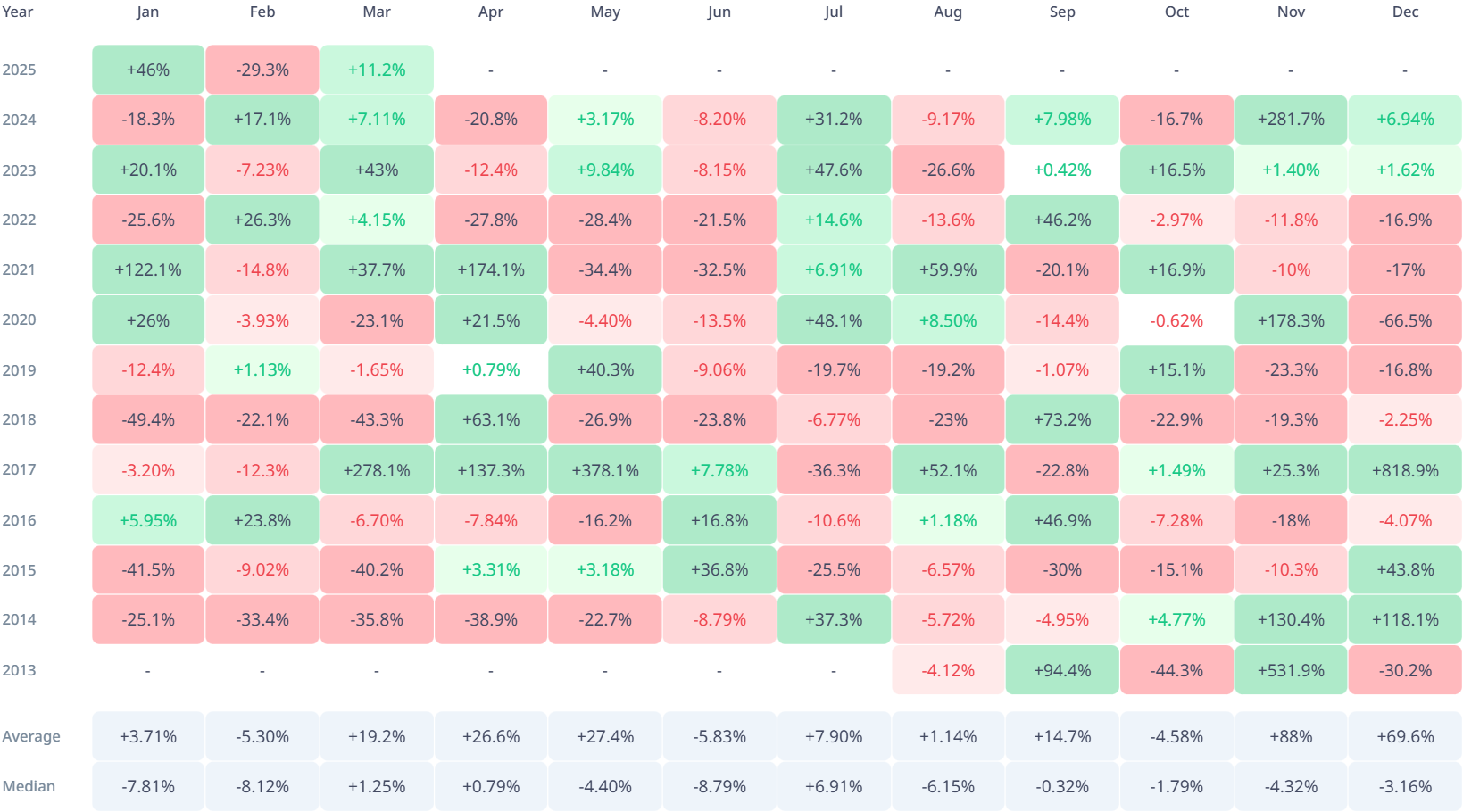

Traditionally, XRP has maintained a median progress charge of 19.2% in March for the previous 11 years. As per Cryptorank information, XRP’s progress is at the moment at 11.6% because the month eyes its final buying and selling week.

XRP outlook and projected increase

Nonetheless, analysts predict that XRP might nonetheless rise and shut the roughly 8% hole in progress figures and estimates. XRP has posted within the inexperienced for 4 consecutive years and closed in March 2023 at a 43% excessive.

If XRP maintains an upward trajectory, it might hit $3 earlier than the tip of the month. Nonetheless, such a progress trajectory might solely come if XRP surges previous its month-to-month common of 19%.

As of this writing, XRP has rallied by 0.11% to commerce at $2.39 throughout the final 24 hours. Nonetheless, the coin has not risen additional as a consequence of buyers’ capital pullback within the asset.

In the identical timeframe, buying and selling quantity declined 40.41% to $2.5 billion. Nonetheless, specialists insist that XRP has what it takes to soar greater, given the constructive sentiment that adopted the Securities and Trade Fee’s (SEC) dropping the Ripple lawsuit enchantment.

XRP proponents consider that, given the authorized uncertainty surrounding XRP, institutional buyers might now really feel comfy committing funds to it.

The pending XRP ETF filings can also obtain regulatory approval, additional rising the coin’s long-term worth.

XRP’s technical indicators level to power

In the meantime, XRP’s technical indicators sign a golden cross supported by its 23-day transferring common crossing above the 50-day curve from under. This growth usually signifies an upward pattern and a trigger for optimism.

Whereas market observers stay cautious of their optimism, XRP has remained resilient within the crypto house over the past 30 days of the market downturn. The asset might additional push boundaries to reclaim $3.