Bitcoin’s latest worth motion has stored merchants on edge, hovering between $81,000 and $86,000 and not using a clear course.

Whereas some indicators trace at bearish momentum, contemporary knowledge means that the market should have room to push larger.

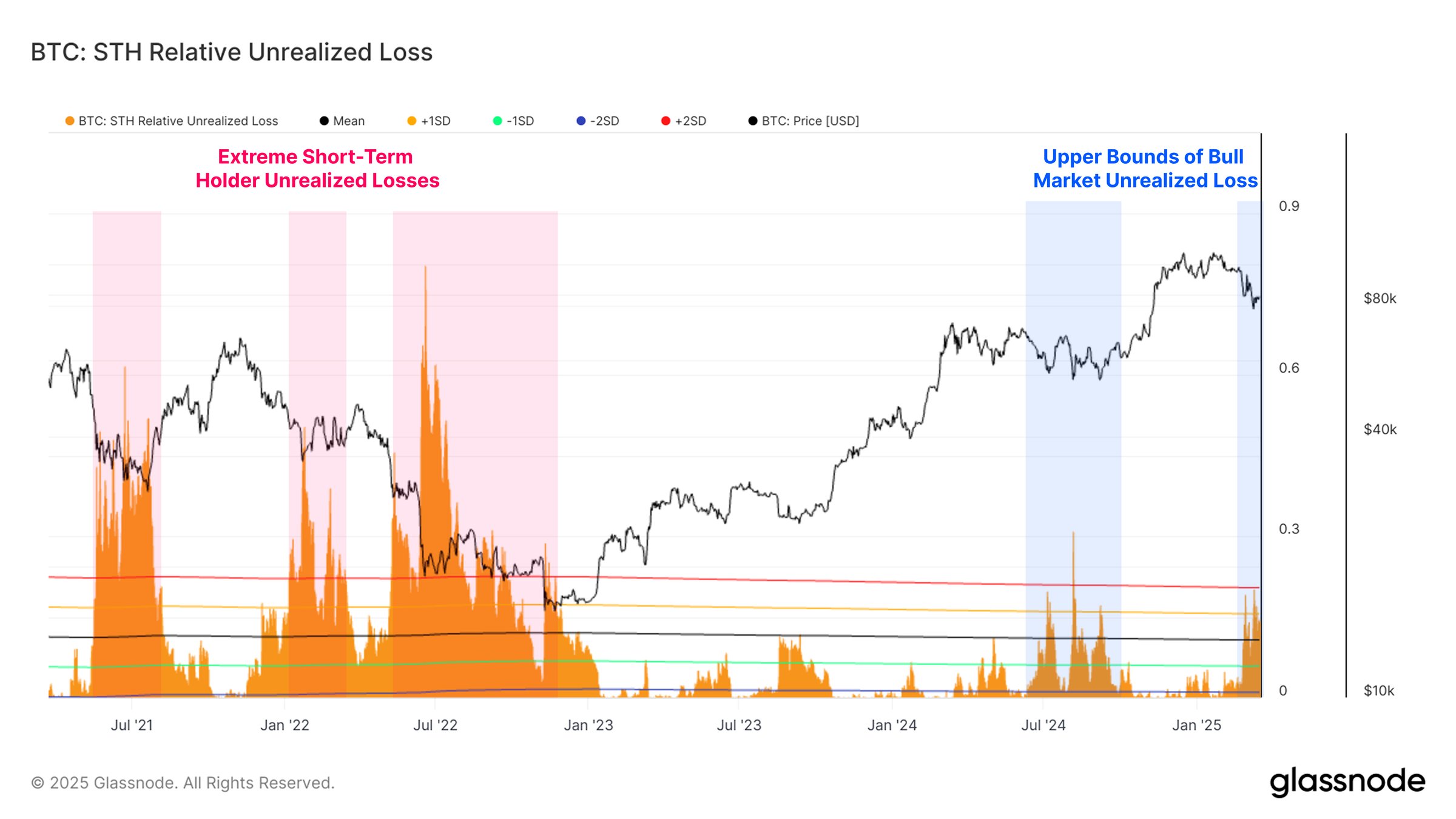

Blockchain analytics agency Glassnode has highlighted rising stress on short-term Bitcoin holders, who at the moment are going through vital unrealized losses. These losses, which exist solely on paper till property are offered, have reached ranges that previously have signaled elevated promoting exercise.

Regardless of this, Glassnode factors out that the magnitude of those losses remains to be inside the vary usually seen in bullish phases. In comparison with the heavy sell-offs of 2021, the present downturn seems far much less extreme, indicating that the broader market pattern could not have totally reversed.

Losses Are Rising, However Not Like Earlier than

Over the previous month, realized losses amongst short-term Bitcoin traders have surged previous $7 billion—making it essentially the most extended loss occasion of this cycle. Nonetheless, this determine stays nicely beneath earlier market collapses.

For context, Bitcoin sell-offs in 2021 and 2022 noticed realized losses climb as excessive as $19.8 billion and $20.7 billion, respectively. For the reason that present losses don’t match these excessive ranges, widespread panic could not have set in but.

What’s Subsequent for Bitcoin?

With uncertainty nonetheless looming, Bitcoin’s subsequent main transfer stays unclear. If promoting accelerates, a deeper decline might comply with. Nonetheless, if historical past is any indication, the market is probably not accomplished rallying simply but.