Because the week wraps up, we get that acquainted second of market reflection – Bitcoin’s weekly candle closing. It’s the type of checkpoint that doesn’t simply summarize the final seven days but additionally units the stage for what’s to come back. A rejection, a continuation or perhaps the start of one thing solely totally different – it’s all as much as how that last candle prints.

However numbers alone don’t inform the complete story, and that’s the place the Bollinger Bands are available.

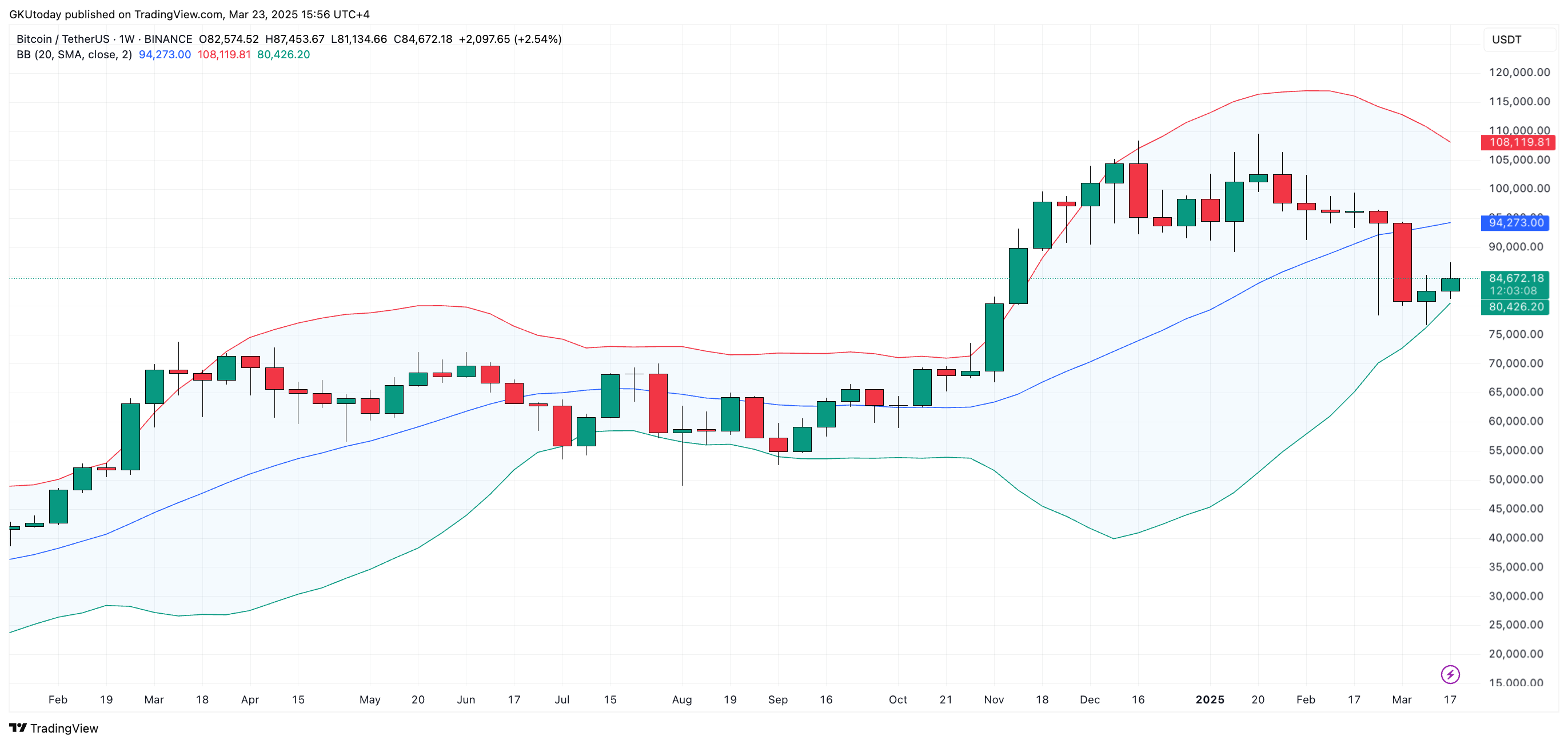

Consider them much less as indicators and extra as versatile boundaries that continually adapt to cost habits. The center band, a transferring common, acts as a gravitational pull, whereas the outer bands increase and contract with volatility, giving merchants a way of when the worth is likely to be stretching too far in a single path.

For the second week in a row, Bitcoin (BTC) has been hanging out close to the decrease Bollinger Band, not breaking by however bouncing off it – twice now. And that’s not only a random transfer.

Often, when the worth finds assist at this decrease degree and holds, it’s a signal that there’s no less than a short lived flooring, an space the place promoting strain fades and patrons begin stepping in. If this sample retains up, the following factor to observe is the center band at round $94,300, which is about 11.25% greater than the place it’s now.

None of this implies a fast breakout. That’s simply how the weekly time-frame works.

Candles there transfer slowly, and their indicators are inclined to play out over weeks, not days. So, whereas this isn’t a short-term name to motion, it’s a midterm nod to the concept Bitcoin is likely to be constructing a base right here, a basis for one thing greater.