BlackRock’s tokenized US Treasury fund, BUIDL, has seen a pointy rise in adoption, with the fund’s belongings below administration (AUM) surging previous the $1 billion milestone this month.

This progress highlights a robust shift towards real-world asset (RWA) tokenization, whilst broader crypto markets face headwinds.

BlackRock’s BUIDL Leads the RWA Sector

Based on knowledge from RWA. XYZ, BUIDL’s AUM, has elevated by virtually 129% during the last 30 days, bringing it to $1.4 billion.

This milestone implies that it took just one yr for the fund, which launched on the Securitize platform in March 2024, to cross the $1 billion mark.

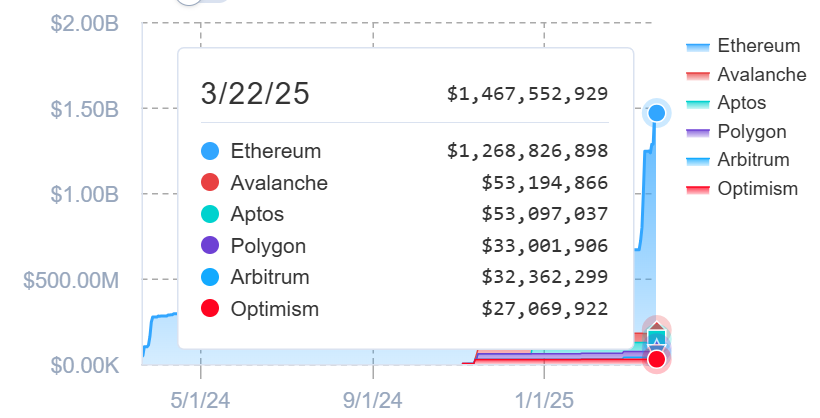

Whereas BUIDL has expanded to a number of blockchains, nearly all of its provide—over $1 billion, or 86.46%—stays on Ethereum. This means sturdy minting exercise on the community.

Different chains, akin to Avalanche and Aptos, every maintain about $56 million of the fund’s provide, or roughly 3.6%. Ethereum Layer-2 networks like Polygon, Arbitrum, and Optimism host the remaining.

In the meantime, investor participation has additionally grown. Up to now month, the variety of holders rose by 19%, bringing the overall to 62.

Market observers identified that these numbers spotlight the rising belief in blockchain-based monetary merchandise and the rising institutional curiosity in tokenizing bonds and credit score.

Constancy Joins the Tokenization Race

BUIDL’s milestone comes as asset administration agency Constancy additionally strikes into the tokenization area.

Over the previous week, the agency filed with the US Securities and Change Fee (SEC) to launch a blockchain-based model of its Treasury cash market fund. The brand new share class, named “OnChain,” will function utilizing blockchain as a switch agent and settlement layer.

“The OnChain class of the fund at the moment makes use of the Ethereum community as the general public blockchain. Sooner or later, the fund could use different public blockchain networks, topic to eligibility and different necessities that the fund could impose,” the submitting added.

Constancy’s transfer mirrors a broader pattern. Monetary establishments are turning to blockchain to tokenize bonds, funds, and credit score devices. This shift gives improved effectivity, round the clock settlement, and higher transparency.

In the meantime, the submitting comes as institutional curiosity in RWAs continues to rise, regardless of a sluggish crypto market. Whereas Bitcoin is down 11% year-to-date, RWA tokens have seen sustainable progress in 2025.

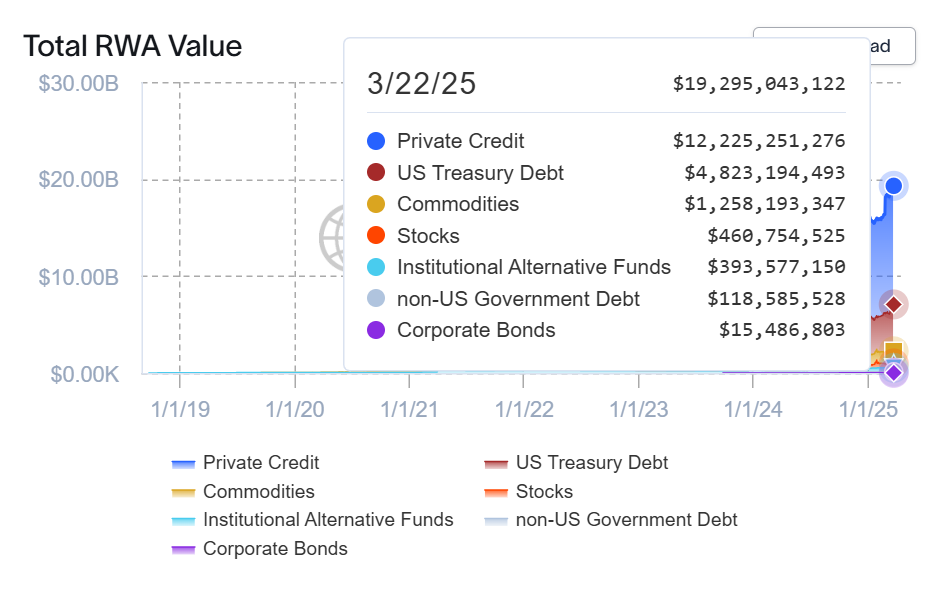

On-chain knowledge exhibits the overall RWA market has grown 18.29% up to now 30 days, reaching $19.23 billion. The variety of RWA holders additionally elevated by 5%, now nearing 91,000.

BlackRock’s BUIDL leads the RWA area by market cap. It’s adopted by Hashnote’s USDY at $784 million and Tether Gold (XAUT) at $752 million.

In the meantime, US Treasuries make up $4.76 billion of the overall, whereas personal credit score dominates with $12.2 billion.

Disclaimer

In adherence to the Belief Mission pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nonetheless, readers are suggested to confirm details independently and seek the advice of with knowledgeable earlier than making any choices based mostly on this content material. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.